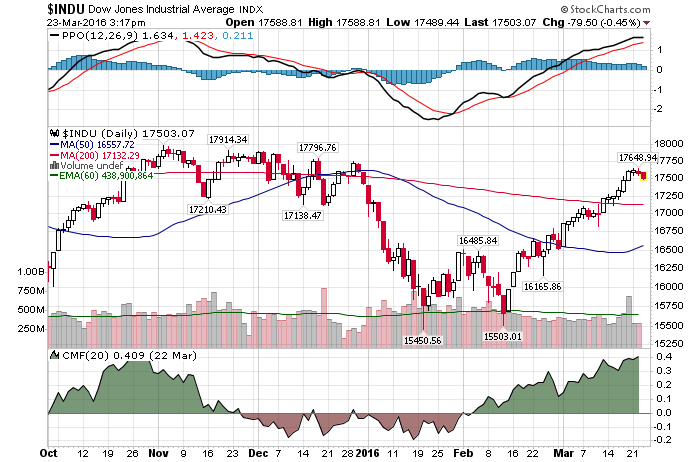

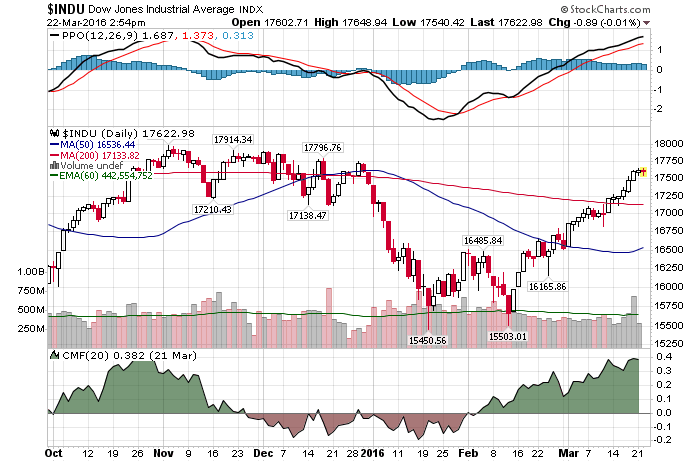

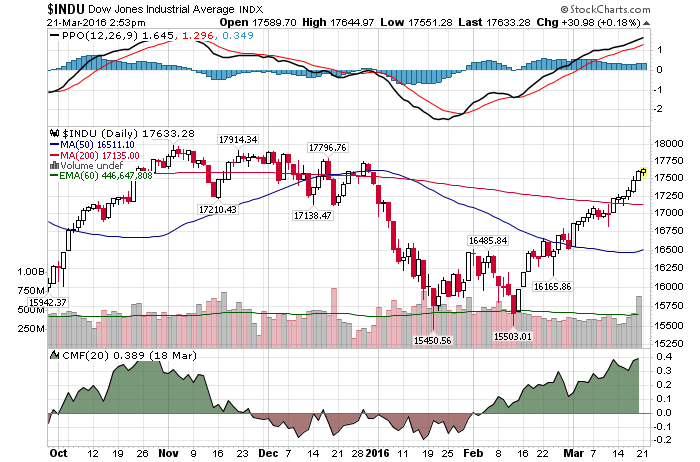

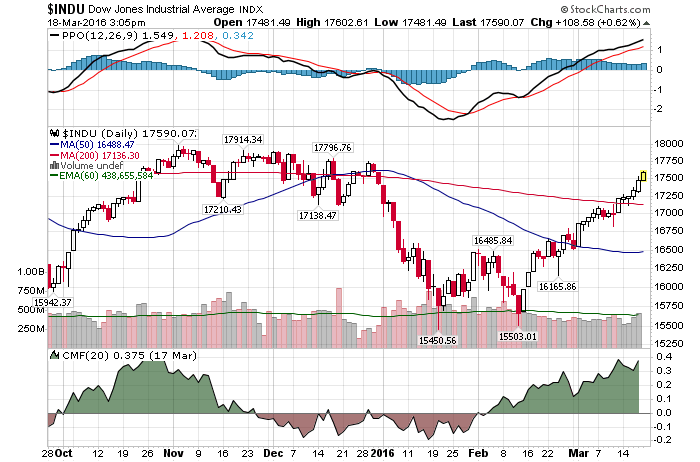

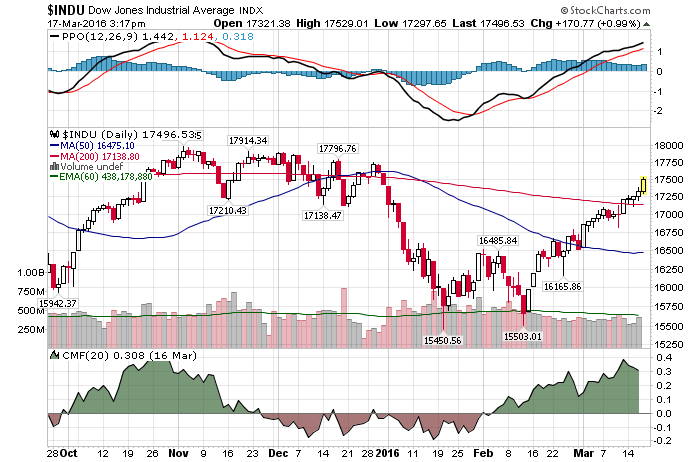

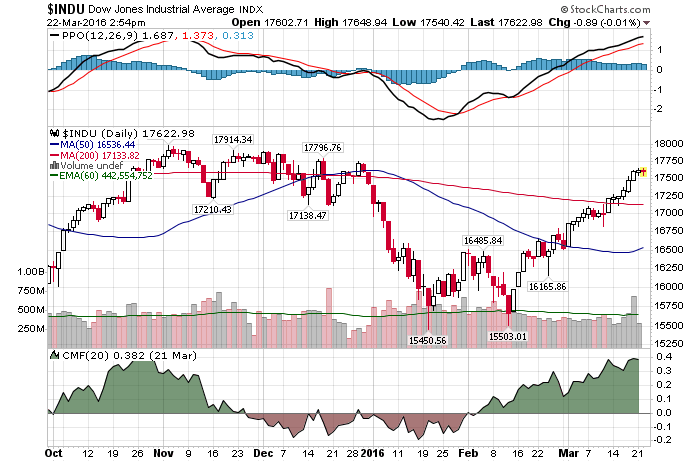

3/22/2016 – A mixed day with the Dow Jones down 41 points (-0.23%) and the Nasdaq up 13 points (+0.27%)

The bulls are back. As confident as ever……

Investors are getting caught paddling upstream, and as they turn their bearish boats around, the tide will continue to rise for stocks, argues Tom Lee of Fundstrat Global Advisors.

“Economic indicators this week may show the U.S. economy experienced a mild slowdown but is not headed for a recession,” Richard Turnill, the global chief investment strategist, wrote in a report Monday on the company’s website. Investors should have an “underweight” position in Treasuries, according to the report. New York-based BlackRock manages $4.6 trillion

But not everyone thinks that way.

I wouldn’t necessarily say “Untradeable”. We need a longer-term perspective here.

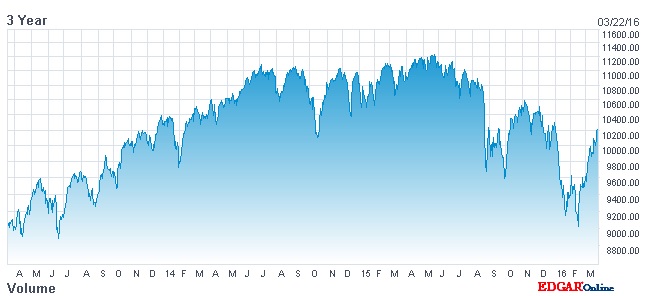

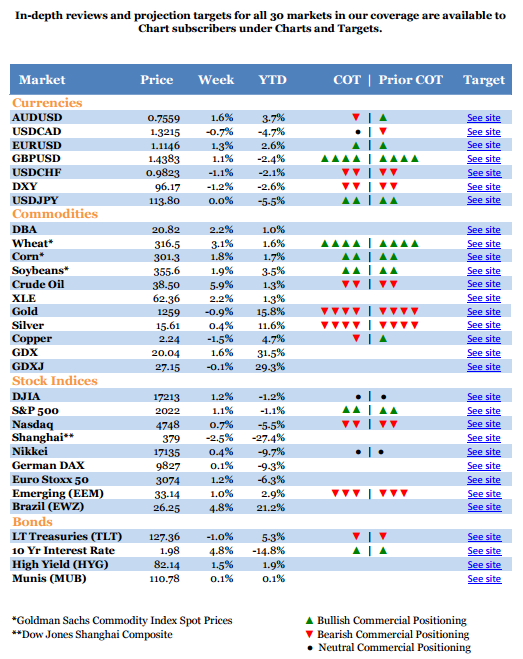

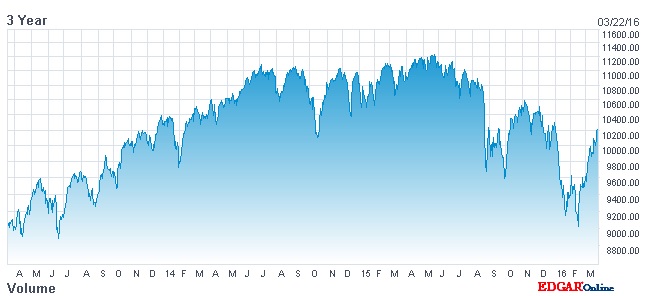

NYSE is the largest index by capitalization. One can argue that the index topped out in June of 2014. Exactly 5.25 years after an important March 2009 bottom. Or right on schedule as per my 5 year cycle forecast.

Throughout last year I told your that the NYSE was either distributing or consolidating. Hinting at distribution due to slowing economy, overvaluations, the end of QE, higher interest rates, etc….. It is now clearly evident that the index was indeed distributing throughout 2014 and 2015.

Today’s question is……..is the bottom in?

My answer is simple. Why would it be? If anything, things are worst now then they were 6-24 months ago. Particularly if you take today’s valuation levels into consideration.

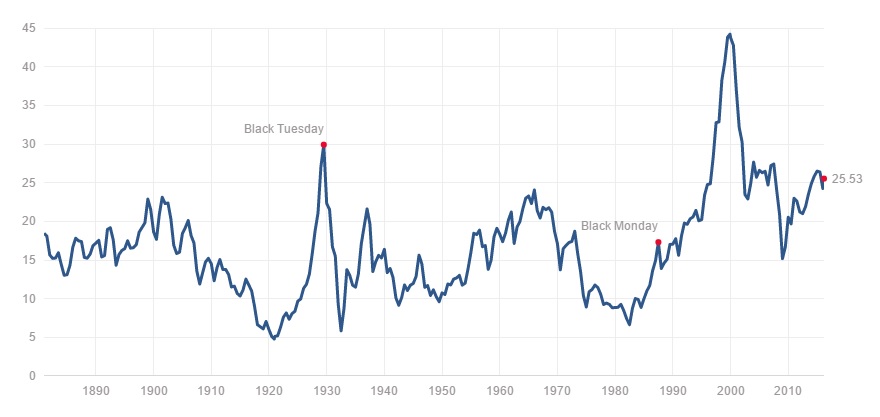

GAAP earnings are down 18% year over year. More worrisome, many expect this trend to accelerate. Shiller’s Adjusted S&P P/E ratio is close to 26. The 3rd highest level in history of the stock market.

So, unless the US Economy stages some sort of miraculous double digit growth recovery here, I think the answer fairly clear.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 22nd, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!