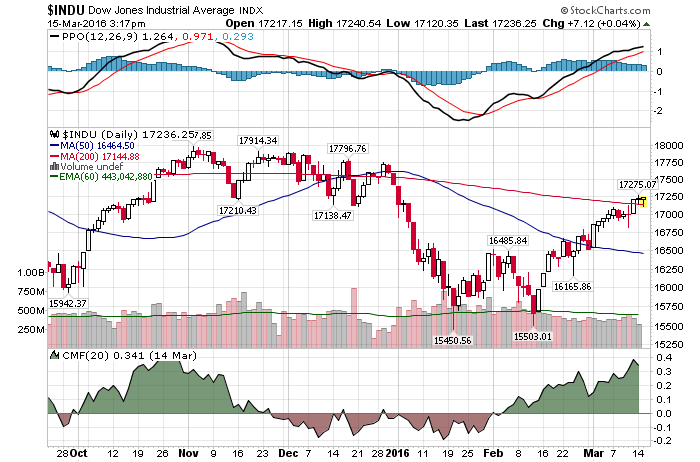

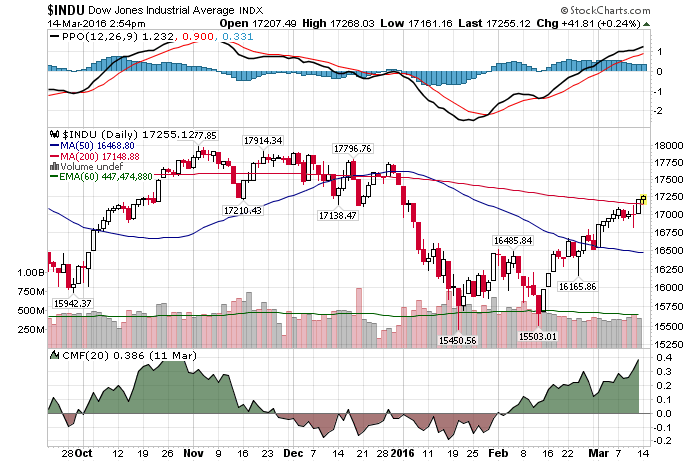

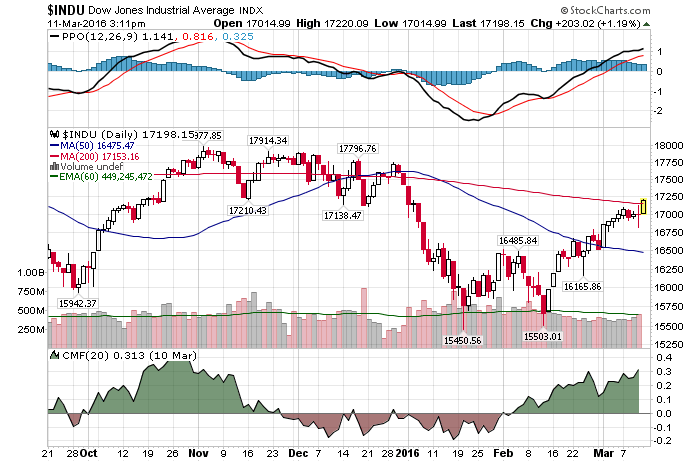

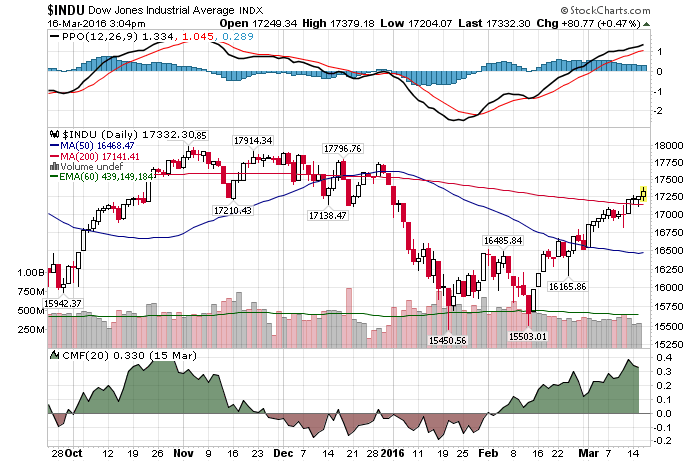

3/16/2016 – A positive day with the Dow Jones up 78 points (+0.45%) and the Nasdaq up 35 points (+0.75%)

Well, the FED has chickened out once again. That shouldn’t come as a surprise.

I will simply repeat what I have said here 8 months ago. And since that forecast appears to be dead on, there is no need to change anything.

Here is the original from August of 2015. Why The FED Will Not Raise Interest Rates

I am 75% confident that the FED will not raise interest rates at all and 100% confident that they will not raise it in any meaningful way. What is meaningful? Even 8 separate hikes at 25 bps each would be laughable here. And while anything above that will matter, I am extremely confident that we will not even get close to that over the next 2-5 years.

Here is why…….

- China has launched an official currency war by devaluing the Yuan 6 times (thus far) over the last few months. Japan is trying to do the same and the EU is now implementing further easing and QE. In this ocean of devaluation, the US cannot afford to have a strong currency.

- Plus, the US Economy is rolling over into a recession. Some of today’s official numbers are starting to reflect that.

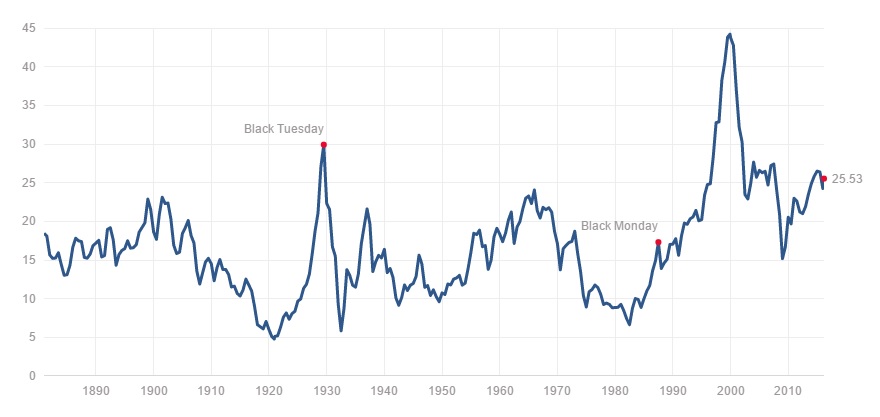

- We are on the verge of a massive down leg in our equity markets. At least based on my mathematical and timing work. The stock market is extremely overpriced.

- Commodities have collapsed.

- Deflationary forces are reappearing throughout the economy.

- Etc….

As I have mentioned before, this is the worst case scenario for the FED. They are already TOO LATE. Now they are stuck in a situation where our economy and capital markets collapse while they are rendered powerless. As soon as other investors realize that……well…….watch out below.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. March 16th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!