Shocking: Here Is Why The Stock Market Is Rallying

2/25/2016 – A positive day with the Dow Jones up 213 points (+1.29%) and the Nasdaq up 39 points (+0.87%)

I don’t remember the last time when financial media sentiment has been so bearish. Maybe in early 2009? It is a complete reversal from our May 2015 top, a time when you couldn’t find a single bearish article even if your life dependent on it.

Simply put, everyone now believes that financial Armageddon is just around the corner. Here is just a small sample from today.

- Here’s Why Oil Could Be Headed to $0

- This is why you can expect another global stock market meltdown

- ‘Smart-beta’ investing guru is now warning of a crash

- 5 things to do as we near a bear market in stocks

- It’s not going to get better for the rest of the year: Portfolio manager

My God!!!…..no wonder the market is rallying here. In other words, if you are a bear, you should be very concerned. There are just too many people jumping on the bearish bandwagon at the present moment.

Luckily, I then saw this ray of hope Historical pattern says the risk of a 2016 bear market is zero

Every single time the S&P 500 gained more than 1.5% a day for three consecutive days, it traded higher a year later.

The S&P 500 violated the low set prior to the kickoff move only twice (1987, 2000). Both times it bounced back quickly.

In 2016, the S&P 500 closed at a 52-week low before its kickoff rally. In 1970, 1987 and 2011, the S&P 500 also closed at a 52-week just before soaring higher.

Obviously, kickoff rallies like this are not the only factor driving stocks, but this particular pattern confirms the six reasons for a stock market rally listed by the February 11 Profit Radar Report (all six reasons are available here).

The Feb. 11 Profit Radar Report recommended buying the S&P 500 at 1,828 (after it fell as low as 1,810) in anticipation of a sizeable rally.

As compelling as this historic pattern may be, tunnel vision is a luxury investors can’t afford. It’s worth noting that the 2016 kickoff is weaker (in terms of consecutive percentage gains) than prior kickoff rallies, and our major-market-top liquidity indicator raised a caution flag in May 2015.

The scope of this rally has yet to be revealed, and a break below the February low is still possible (like in 1987 and 2002).

Regardless of the S&P’s near-term path, history says we shouldn’t under estimate this kickoff rally. Acting on the sentiment-based buy signal at S&P 1,828 provided a low-risk entry point and insurance against a runaway rally.

Ummm…so let me get this straight. The market has rallied 3 days in the row and now there is ZERO chance of 2016 being negative? Only an idiot would follow this line of thinking. This reminds me of “Years ending in 5 are always positive” myth propagated last year. At least it was until both the S&P and the Dow finished the year in the negative territory. And there went that 120+ year myth.

In reality, we are dealing with a very complex market environment.

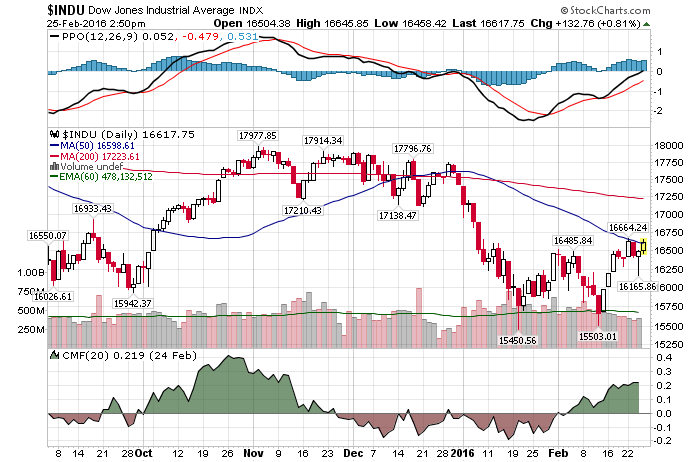

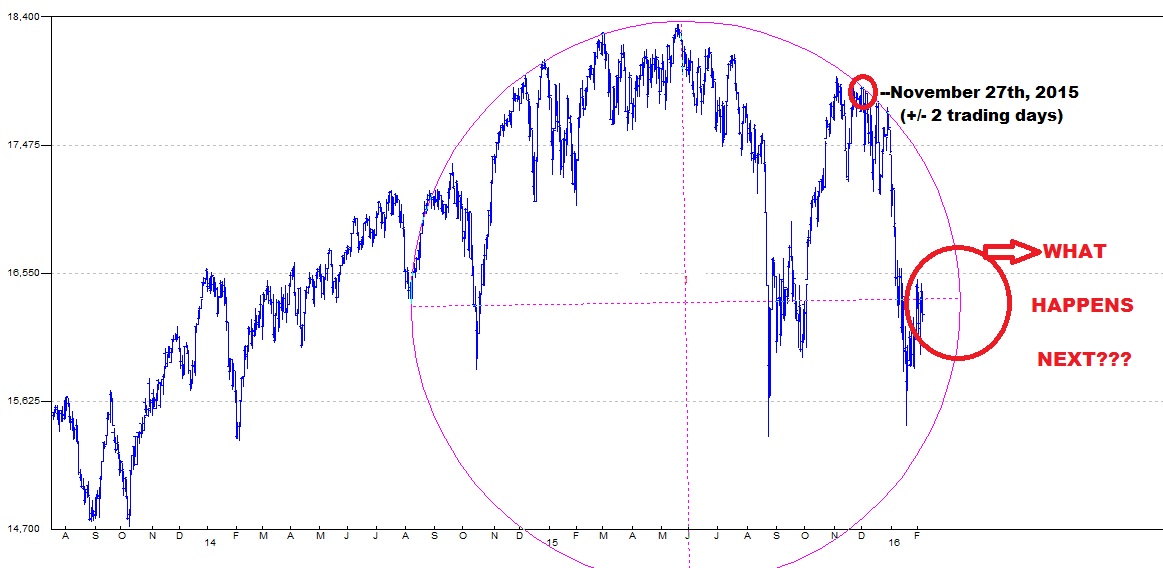

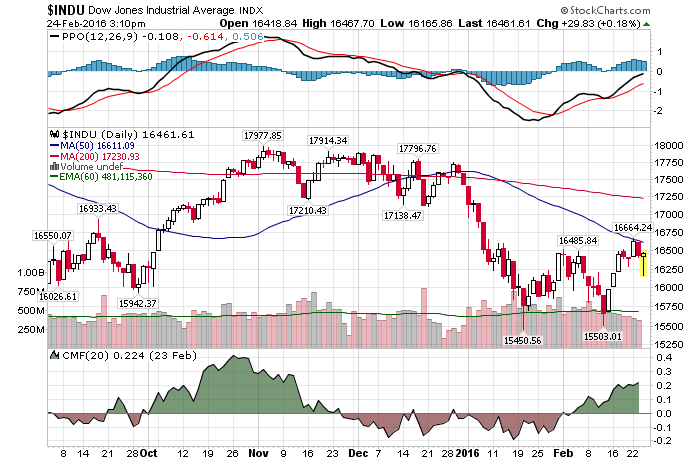

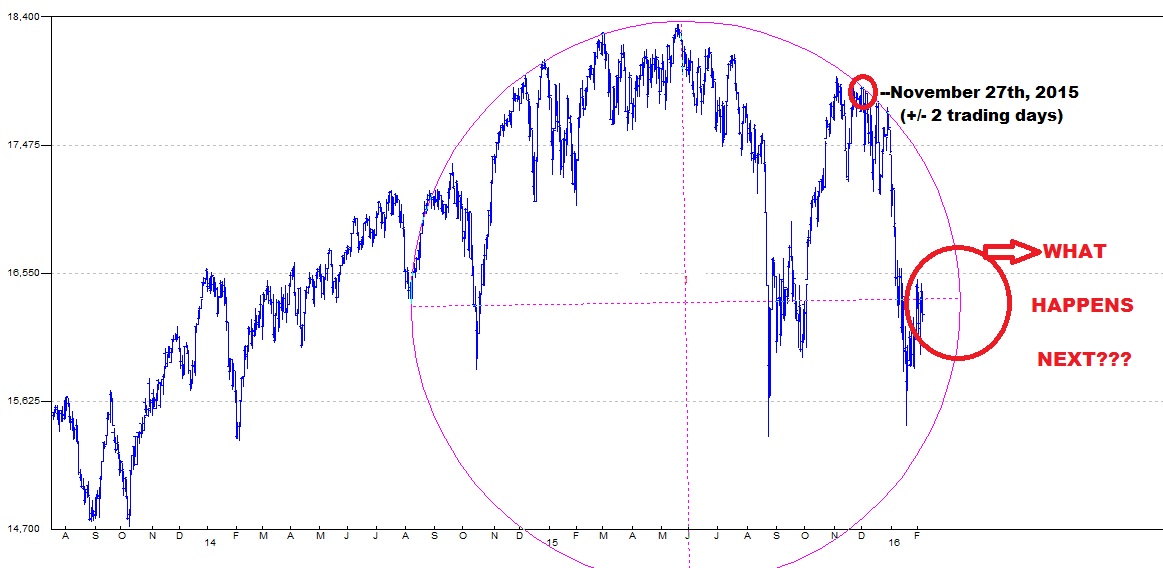

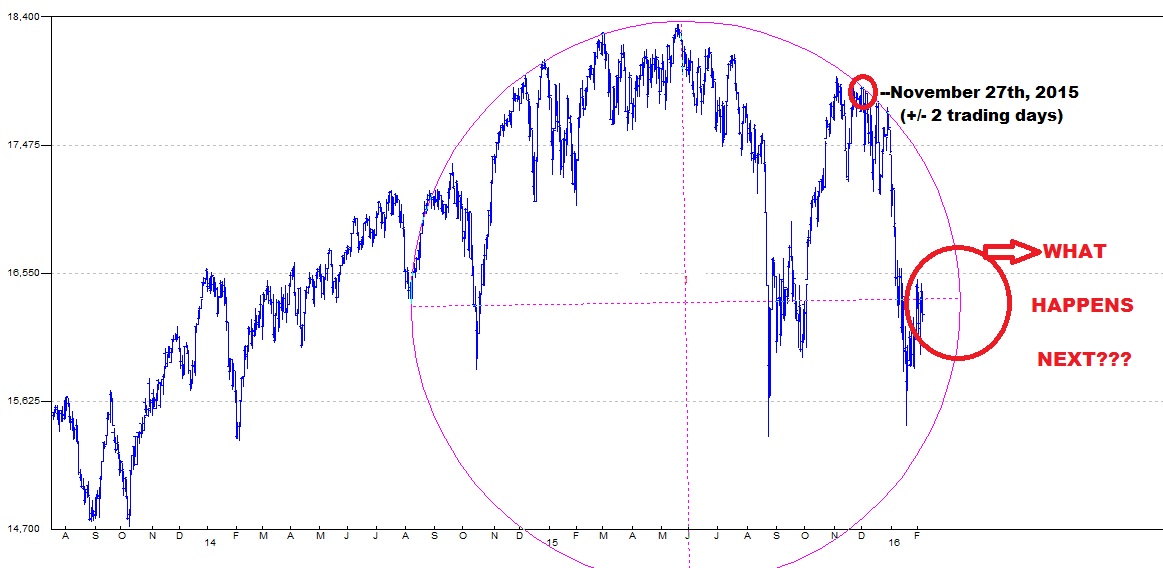

That is exactly what I proposed on this free blog forum 2-3 weeks ago. After presenting the chart below and suggesting that the current market will drive both bulls and bears up the wall over the next few weeks. And that is exactly what has been happening.

That is, until we reach a certain point in both Time and Price. Most importantly TIME. When we do, the market will deliver a jaw dropping move. It could be up or it could be down. I am simply not willing to release that information here. However, if you wish to know the timing and the direction, please Click Here.

his conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 25th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Investment Grin Of The Day

Jim Rogers: The Best Long-Term Investments Now Are Sugar & Russian Ruble – Really?

As always, this interview is a must watch if you participate in financial markets. Jim discusses today’s market environment, why we will crash and why this crash will be bigger, what central bankers are thinking, where he is investing, Gold, cashless society, Donald Trump, China, etc….. Definitely worth a few minutes of your time.

Jim Rogers: The Best Long Term Investment Now Is Sugar & Russian Ruble – Really? Google

What You Ought To Know About Today’s Volatility Patterns

2/24/2016 – A positive day with the Dow Jones up 53 points (+0.32%) and the Nasdaq up 39 points (+0.87%)

2/24/2016 – A positive day with the Dow Jones up 53 points (+0.32%) and the Nasdaq up 39 points (+0.87%)

Over the last few weeks I have suggested that the market will drive both bulls and bears up the wall. Today is a prime example. Just as the bears got excited after a two day 500 point drop on the Dow, the market promptly turned around to crash all Armageddon dreams with a quick 300+ point rally.

This will continue until a certain Time/Price point is reached in the future. If you would like to find out where that point is and where the market will go after we get there, please Click Here.

At least for now, negative headlines continue to dominate the news. Here is just a small sample from today.

- It is worse than anyone thought on Wall Street

- BlackRock Warns Bond Traders They’re Underestimating the Fed

- Hedge funds are getting ready for Armageddon

- Guy Hands: ‘Very, Very Scary Market’ for Investors

- Indicator has a big warning for the market

Let’s look at the last bit….

“We’re probably going to have a pretty volatile 2016,” Rhoads added. The second piece of the puzzle, found in the options market, may signal the direction of that move. Sadly for bulls, it could be to the downside. Rhoads notes that options traders have been buying twice as many upside bets compared to downside protection on the VIX this year. This positioning shows the market is biased toward a higher VIX, which comes when there’s a view that the stock market will drop.

If I was a bear (and I might be) I would be concerned with so much negativity out there.

On the flip side and fundamentally speaking, the market has detached from any sort of reasonable reality quite a long time ago. Suggesting that a rather violent correction might lie ahead. Just as VIX/VXX volatility patterns suggest. I wrote about it before What You Ought To Know About Today’s Fundamental Picture

Which scenario is the correct one?

Only TIMING and cyclical analysis can answer that question. And that is exactly what I talk about in this week’s premium update. Clearly outlining what will happen as soon as the chart below complete. Click Here to learn more.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 24th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Investment Grin Of The Day

Why Syrian War Will Be Remembered As One Of The Most Shameful Episodes In The History Of The American Press

Despite recent proposed truce in Syria, it is unlikely to hold. There are just too many self interests at the table.

With that in mind, I am happy to see some in the mainstream America finally wake up to an outright lie being propagated throughout western media. Something I have been saying here for months, if not years. With Boston Globe delivering an honest punch for a change.

The media are misleading the public on Syria

Unfortunately, for all of us, especially if Hillary Clinton wins the White House, the drums of war continue to grow ever so loud. Here is the latest as the world rearms itself for the next and final conflict…..

- Great Power Pivot: U.S. Shifts Focus to War With China and Russia

- Saudi Arabia official: If all else fails, remove Syria’s Assad by force

- Start Preparing for the Collapse of the Saudi Kingdom

- Mounting Evidence Putin Will Ignite WWIII

- Russia’s Military Is More Advanced Than You Might Think

- Russia’s nuclear hunter of aircraft carriers to get hypersonic cruise missiles by 2022

At some point future generations will look back and wonder if we were all clinically insane. Maybe not individually, but it appears the whole world has indeed gone topsy-turvy. Why?

We now live in the world where the US/NATO bombs the entire Middle East back into the stone age and then has the audacity to blame Russia for it with a straight face. Setting up a clear precedent for the next war. I have outlined the time frame for this war, based on my stock market TIMING work, many times before. If you haven’t read it, Click Here to see it.

Investment Wisdom Of The Day

I’ll Give You My Cash When You Pry It From My Cold, Dead Hands.

Over the last few years I have searched for a worthy cause to get behind. A cause that doesn’t involve politics, religion, etc…..I might have finally found one.

The war on cash has officially started.

Bloomberg: Both Sides Can Declare Victory in the War on Cash

While the article above comes to an idiotic conclusion, it is worth reviewing in order to understand the scope of the issue. When I wrote about the subject matter for the first time exactly a year ago (see below), I didn’t think this would be possible. Yet, with central bankers around the world hell bent on destroying all remaining sound financial principals, it is time to fight back.

Personally, I find this outrageous and I am seriously considering launching an official campaign against this. I will keep you posted. The fight is just starting and it will be a tough one. Europeans Say ‘Hands Off Our Cash’ as Interest Rates Go Negative

Previously published explanation – last year . It is as applicable today as it was back than and it is scary how fast things are progressing

Is The FED Planning To Abolish Cash? .

In an attempt to gain complete control of our financial system the FED needs an additional tool. The ability to set negative interest rates in order to tax the currency. We might as well be a stone throws away from someone at the FED actually proposing this notion as CITI’s own economist believe it’s a splendid idea.

Citi Economist Says It Might Be Time to Abolish Cash

Their plan entails…..

- Abolishing currency.

- Taxing currency.

- Removing the fixed exchange rate between currency and central bank reserves/deposits.

I am truly speechless here. Apparently it is not enough that we are already suffering through the worst FED induced Ponzi Scheme in human history. They now want the FED to abolish cash in order to induce negative interest rates. To fight deflation, to induce even larger asset bubbles, to gain full control control of the population, etc…

Just imagine how high the stock market will go if the fools above are able to set interest rates at, let’s say, -6%. Yet, as we are about to find out, the bigger the bubbles the bigger the eventual consequences will be. You cannot rewrite the laws of physics and that is precisely what they are trying to do here.

Perhaps I will end this with the following statement, echoing the NRA. I just hope that most Americans are smart enough to realize the same.

I’ll give you my cash when you pry it from my cold, dead hands.

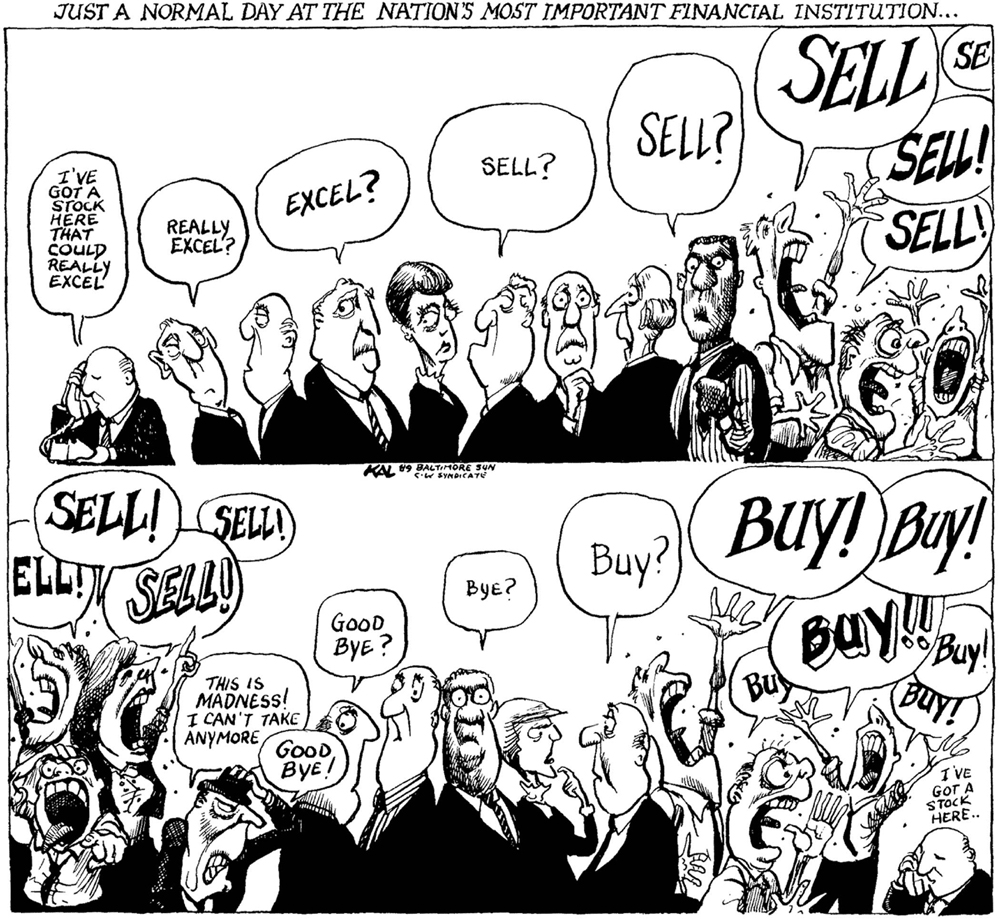

Market Confusion Index Hits An All Time High

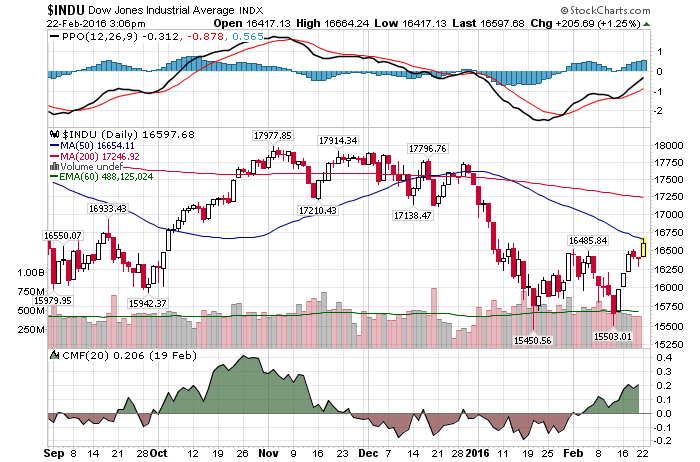

2/22/2016 – A positive day with the Dow Jones up 225 points (+1.37%) and the Nasdaq up 66 points (+1.47%)

Make any sort of a declaration or a market statement today, and chances are, you can make a nearly bulletproof case that you are right. Let me show you what I mean…..

- Has The Market Crash Only Just Begun?

- Is it possible the correction is over?

- HARRY DENT: The recession isn’t coming — it already started

- Marriage of crude-oil prices, stocks at historic level

- Look out below? Options price in scary S&P swoon

- ‘It is a time of opportunities

And that’s just a small sample from today.

In other words, if your Charles Schwab financial adviser is telling you that he knows where the market is going, well, he is probably lying through his teeth.

That is why fundamental analysis becomes absolutely worthless in a complex market environment we are experiencing today. And even though both bulls and bears might eventually be right, it is the sequence of events that will determine what the market will do next. A better approach is needed.

A TIMING approach. I have been publishing the chart below over the last few weeks with the following explanation.

We remain in a very complex market environment. Here is the chart I presented to you almost two weeks ago. Suggesting at the time that the market will remain within a certain trading range until the structure below (sphere) completes itself on a certain date and price. When it does, a powerful directional move will start. If you would like to find out when that PRICE/TIME arrives (to the day) and where the market will push next, please Click Here.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. February 22th, 2016 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!