Investment Wisdom Of The Day

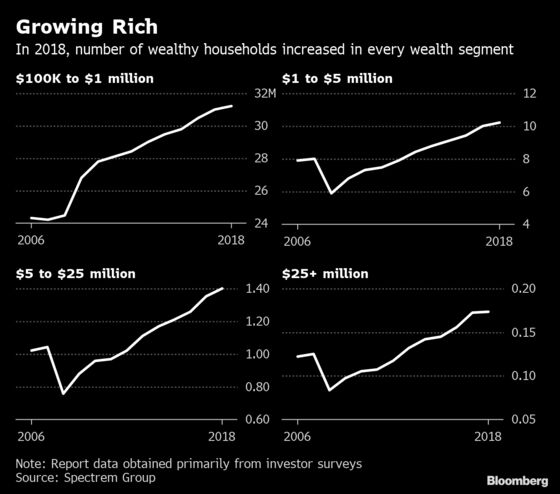

The U.S. Now Has More Millionaires Than……….

3/14/2019 – A mixed day with the Dow Jones up 7 points (+0.03%) and the Nasdaq down 12 points (-0.16%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

We have some wonderful news for a change. Something Mr. Trump is surely to take credit for……

The number of wealthy households in the U.S. reached a new high last year, roughly equivalent to the entire population of Sweden or Portugal. More than 10.2 million households had a net worth of $1 million to $5 million, not including the value of their primary residence, according to a survey by the Spectrem Group. That’s up 2.5 percent from 2017.

Even as the ranks of the mass affluent grew, the pace slowed because of “weakening global economic growth and a contentious U.S. political environment,” said Spectrem Group President George Walper.

I would hate to rain on this wonderfully bullish news, BUT this sort of a thing typically appears at the end of a business expansion cycle. Or, in this case, giant Ponzi Scheme credit expansion cycle.

It shouldn’t come as a surprise that so many people benefited, directly or indirectly, from trillions of artificial credit flowing into the economy. The real question is, as Warren Buffett puts it, how many of these newly minted millionaires are swimming naked as the tide goes out.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Jeff Gundlach Explains Why We Are In A Bear Market

Investment Grin Of The Day

Bullish Appetite Goes ‘Melt Up’

3/13/2019 – A positive day with the Dow Jones up 148 points (+0.58%) and the Nasdaq up 52 points (+0.69%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

A lot of interesting information to process ………..

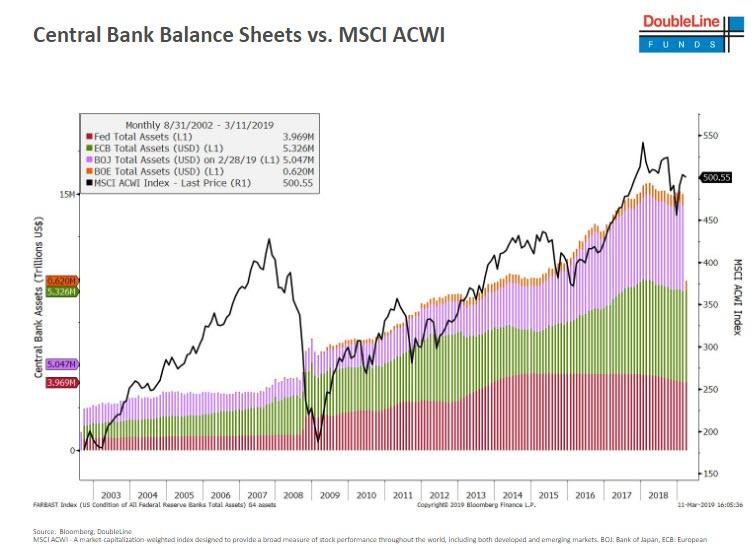

Fed’s QE Unwind Reaches $434 Billion, Remains on “Autopilot”

The Fed shed $32 billion in assets in January, according to the Fed’s balance sheet for the week ended February 6, released this afternoon. This reduced the assets on its balance sheet to $4,026 billion, the lowest since January 2014. Since the beginning of this “balance sheet normalization,” the Fed has now shed $434 billion.

In other words, the stock market and investors should pay attention to what the FED does, not what it says. Meanwhile, middle America is getting their own taste of MAGA…..

Trade War Causing Severe Pain As Farm Bankruptcies Surge Way Past The Level From The Last Recession

Farmers all across the middle part of the country are going bankrupt at an astounding rate, and over half of all farms in America are now losing money. The trade war with China has been the most devastating crisis to hit the U.S. farming community in decades, and at this point there is no end in sight. Farm after farm is being financially wiped out, and we haven’t seen this kind of economic pain for farmers since the Great Depression of the 1930s. In fact, it is being reported that bankruptcies in the key farming regions of the country are way above the level that we witnessed during the last recession.

Something tells me that is not what they have voted for Donald. Meanwhile, risk ON is back with the vengeance……

Super-Junk Leads the 2019 Asset Revival

The stock market is unlikely to crack until speculation in junk bonds gets blown out of the water.

The high-yield index hit record highs on Powell’s dovish Fed outlook. The lowest-rated debt has led the charge with 6% returns this year.

The loonies in Washington continue on with their drive towards Nuclear World War 3.

PCR: Venezuela Is An Opportunity For Russia And China To Change The World

Nothing better illustrates Washington’s opposition to democracy and self-determination than the blatantly public coup Washington has organized against the properly elected president of Venezuela.

Washington has been trying to overthrow the Venezuelan government for years. Washington wants the state owned oil company to be privatized so that it can fall into the hands of US oil companies. That would ensure Washington’s control over Venezuela. Transferring the wealth out of the country would prevent any economic development from inside the country. Every aspect of the economy would end up in the hands of US corporations. The exploitation would be ruthless and brutal.

And finally, bullish sentiment levels are back to their pre sell-off levels.

- How a ‘Fed put’ could leave stock market on path for a ‘late-90s-style meltup’

- The stock market dip? Keep buying, says Bank of America Merrill Lynch

To summarize all of the above, we currently find ourselves in a very complex environment where both bulls and bears can argue their respective “crash” or “meltup” scenarios with conviction.

That is why it is so important to dismiss fundamental data that people think drive the stock market and instead concentrate entirely on mathematical work that actually does. What it yields over the next few months, at least according to our work, will shock both bulls and bears to their core.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Even CNN Laughs At Trump Bashing David Stockman – Prepare For A Crash?

Investment Grin Of The Day

Highway To Hell

3/12/2019 – A mixed day with the Dow Jones down 96 points (-0.38%) and the Nasdaq up 32 points (+0.44%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

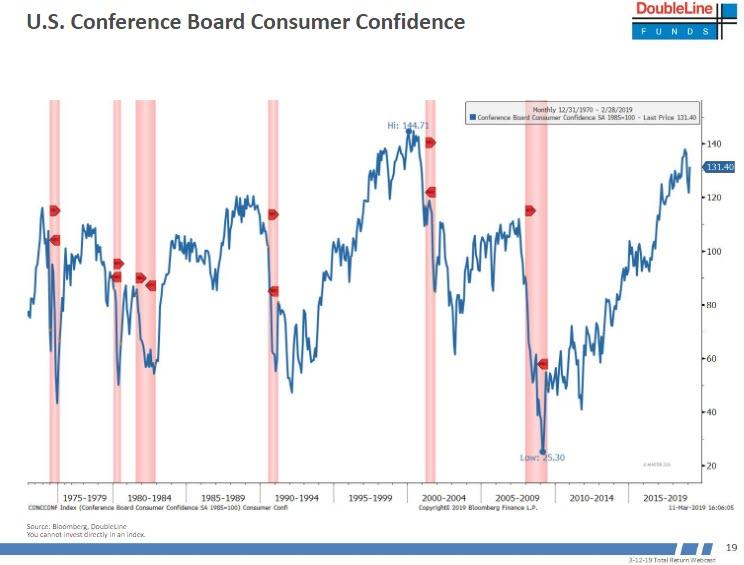

Jeff Gundlach believes the stock market is going lower, much lower. Here’s why…..

If that wasn’t bad enough, Gundlach also said that stocks will take out the December low during the course of 2019 and markets will roll over earlier than they did last year.

Shifting from the market to the economy, Gundlach shows that global economic momentum is getting worse across the globe…

We don’t disagree and we encourage you to review Mr. Gundlach’s “Highway To Hell” presentation in full.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.