Investment Grin Of The Day

Trump’s ‘Economic Miracle’ Explained

3/5/2019 – A negative day with the Dow Jones down 13 points (-0.05%) and the Nasdaq down 1 point (-0.02%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

President Trump continues to claim that he has created the best economy this great land has seen, since, well, ever. Let’s take a closer look at some stunning data points….

The study, led by Dr. David Himmelstein, Distinguished Professor at the City University of New York’s (CUNY) Hunter College and Lecturer at Harvard Medical School, indicates that about 530,000 families each year are financially ruined by medical bills and sicknesses. It’s the first research of its kind to link medical expenses and bankruptcy since the passage of the Affordable Care Act (ACA) in 2010.

Delinquencies are rising despite the allegedly robust jobs market. Stress is not at 2008 levels but it has been on the upswing since 2014 or 2016 depending on the age group.

So what happens in a downturn?

“Reaching this unfortunate milestone so rapidly is the latest sign that our fiscal situation is not only unsustainable but accelerating,” said Michael A. Peterson, chief executive officer of the Peter G. Peterson Foundation, a nonpartisan organization working to address the country’s long-term fiscal challenges.

Sometimes, multiple roommates. Just ask Kelsey Riley Dixon. The 29-year-old business owner and her husband, a semi-pro kayaker, share a four-bedroom home with three male roommates “to reduce costs in the very expensive city of Seattle,” she says. “It allows us to have a home in a really expensive city with a deck, a backyard, a basement — and we are able to pay half the rate that we would living on our own.”

Never better, indeed.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Talking Head Bimbos Slam David Stockman

Investment Wisdom Of The Day

Putin Prepares Russia For Nuclear War And Why You Should Worry

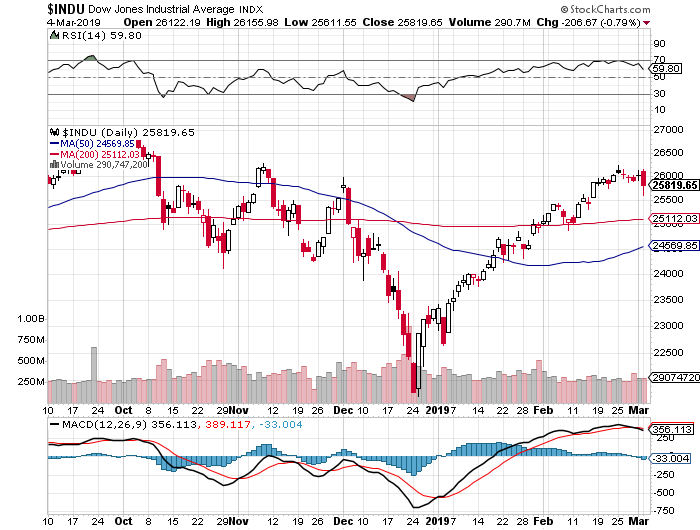

3/4/2019 – A negative day with the Dow Jones down 206 points (-0.79%) and the Nasdaq down 17 points (-0.23%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Our Nuclear WW – 3 forecast, marked as perceived impossibility just ten short years ago, is now becoming a reality with scary accuracy. Consider this……

WSJ: Russia Suspends Nuclear Missile Treaty With U.S.

After Washington warns of pullout, Putin formally backs out of obligations under 1987 pact

MOSCOW—President Vladimir Putin formally ordered a suspension of Russia’s obligations under a Cold War-era nuclear treaty with the U.S., his office said Monday, a death knell for the pact that heightens the threat of a new arms race.

The Kremlin said the decision to suspend the agreement was made after the U.S. said it would stop abiding by the pact, the Intermediate-range Nuclear Forces Treaty, which prohibited the possession, production and flight testing of certain short and intermediate-range nuclear missiles.

The statement didn’t acknowledge Washington’s accusations that Russia had broken its obligations under the INF treaty with the testing of its nuclear-capable 9M729 missile. Those accusations have been met by sabre-rattling from Moscow, with Mr. Putin warning that the unraveling of the agreement would lead to a new arms race.

In other words, if you are not paying attention as you should be, major superpowers are preparing to fight a major life ending conflict. And right on schedule I might add. If you would like to find out exactly when this Nuclear Exchange will take place, please contact us for more information.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Must Listen: Jim Rogers Delivers Again

Investment Grin Of The Day

Should You Prepare For A ‘Shock And Awe’ Stock Market Rally?

A mixed week with the Dow Jones down 5 points (-0.01%) and the Nasdaq up 68 points (+0.90%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

While the stock market continues its improbable levitation, all sorts of fundamental drivers continue on with their respective deterioration at an accelerating pace. Let’s take a quick look.

So why does Seyhun’s model now predict a drop for the market in the coming year? According to the model, insiders – those who by definition have the most insight into the future performance of their own stocks – sold more of their company’s stock in the first half of February relative to buying, than they have in a decade. Five of every six companies for which there were recent insider transactions have experienced net selling.

That said, the model creator is already making excuses about his own model, saying it’s important to not “put too bearish of an interpretation” on the data because it came after a large rally. Insiders have “no choice” but to sell when their compensation comes in the form of equity, he told Barron’s, calling the selling nothing more than “opportunistic behavior”. That remains to be seen.

#1 Farm loan delinquencies just hit the highest level that we have seen in 9 years.

#2 We just learned that U.S. exports declined by 4 billion dollars during the month of December.

#3 J.C. Penney just announced that they will be closing another 24 stores.

#4 Victoria’s Secret has just announced plans to close 53 stores.

#5 On Thursday, Gap announced that it will be closing 230 stores over the next two years………

Trump still did not get the idea that the MOU and the trade agreement were the same thing and asked: “Are they going to put that into another agreement?”

An exasperated Lighthizer danced around for a bit talking about “major hurdles”, concluding “assuming you decide on an agreement, it will be signed by the two people and it will be a trade agreement between the United States and China.”

Trumpian Vocabulary

Trump was pleased.

However, the fact remains that the underlying issues in the financial system are still in place. Those issues are:

1) Too much debt/ leverage.

2) Too little capital.

And if the Fed is not going to be able to normalize policy to reduce leverage in the system, then the Political elite will need to come up with other sources of capital to do so.

With that in mind, the current political agenda to push for Wealth Taxes, cash grabs and other means of raising capital all makes sense.

However, fear not my dear friends,

“The ‘shock and awe’ upside scenario involves rescinding all U.S.-China tariffs instantly, causing certain tariff-sensitive firms to raise 2019 guidance, while the Fed commits to keeping reserves at ~$1.3T+. If all this were to come to pass, then the SPX will easily make a run towards 3K.”

Hmm, I wonder what they call the rally off of December 26th low. To rather quickly summarize, fundamental data continues its deterioration while bullish sentiment has never been higher.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.