The Day Everyone In Washington Went Nuts, Quite Literally

2/7/2019 – A negative day with the Dow Jones down 220 points (-0.87%) and the Nasdaq down 87 points (-1.18%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Just when you think the fools in Washington cannot possibly get any more insane, they go on to defy the odds. Let’s start with media darling Rep. Alexandria Ocasio-Cortez (AOC)

AOC “New Green Deal” Stunningly Absurd: Far More Ridiculous Than Expected

Not to be outdone, Nuclear War proponent and top American diplomat Mike Pompeo made sure that the Trump Administration will not lose this “Nutso” game to a freshman congresswoman.

Pompeo Claims Hezbollah “Active In Venezuela” To Justify Possible US Intervention

And just so the US population does not lose plot, later in his Fox interview, the former CIA director described Maduro as “evil” and insisted the US was intervening on behalf of ordinary Venezuelans who have suffered under his rule.

In other words, yet another “humantiarian” coup under US auspices.

“We should not permit a country in our hemisphere to treat its own people this way,” he said, despite Washington’s – and the CIA’s – dismal track record of fomenting government overhauls in the region. “American values – America’s, not only our interests but our values – are at stake here.”

It wasn’t clear just which values he was referring to.

I don’t even know anymore. Should one laugh or cry, perhaps cry while laughing, hysterically? I give up.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Trump’s State Of The Union Confirms – US Government Is Insane

Two points of view from fairly smart people that come to the same conclusion

Trump’s Speech: An Assessment From Paul Craig Roberts

As this is the very last thing a sane government would want, I have concluded that the US government is insane.

This fact should disturbe us far more than anything else. Yet, as I, Stephen Cohen and a few others have emphasized, the rapidity with which Washington is pushing us to nuclear Armageddon receives no attention.

It is equally disconcerting that Trump, himself a target of an ongoing coup to remove him from office, has given his support to a coup to remove the elected president of Venezuela and to replace him with an unelected American stooge who declared himself to be president.

That Trump is conspiring against Maduro exactly as the corrupt Obama conspired against the elected presidents of Hondras and Ukraine leads me to see poetic justice in the Democrat Party’s conspiracy against Trump.

and……

Investment Grin Of The Day

Explaining Away December 26th, 2018 Bottom In Both Price And TIME

2/6/2019 – A negative day with the Dow Jones down 21 points (-0.08%) and the Nasdaq down 26 points (-0.36%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

I just realized that I never performed full analysis of our well defined December 26th, 2018 bottom. And since I have to do so for our “market calls” section anyway, today is as good as any other day.

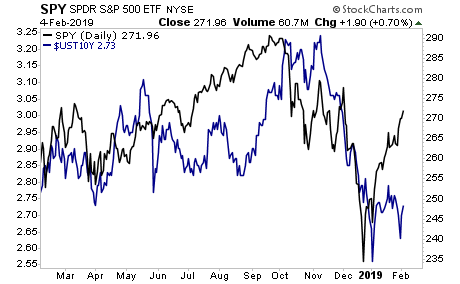

Our subscribers have been looking at the following chart since about June of 2018…..

In early June of 2018 we presented our subscribers with the following chart. At that time it was just a red dotted line you see above projecting upcoming stock market moves. June 27/28th bottom was a direct hit. The biggest discrepancy for the forecast above was our anticipated early September bottom. September 11th bottom ended up being much shallower than we originally anticipated.

The forecast was slightly adjusted in our weekly/daily updates with price/time calculations as we went along and an important top arrived on early October.

Not too bad for a forecast issued 6 months ago.

Leading into December low I issued the following warnings to our premium members.

December 8th Update: Market’s structural composition suggests the market will very quickly slice though both 24K and 23K on the Dow over the next 10 trading days. Once those major support levels are taken out, the Dow might very quickly collapse to 20K by the time our December TIME turning point arrives.

December 15th Update: The Dow did briefly break below 23K on Monday, followed by an ideal structural bounce discussed in our daily updates. It appears the bounce did conclude on Wednesday and that we are now in very early stages of Wave 3 down. A word of caution. These structural locations in the stock market are incredibly dangerous and/or violent.

As we came into December most traders/investors were anticipating a massive “Santa Rally”. Our work was projecting the exact opposite months ago and we made sure our subscribers knew.

Subsequently, as the market approached our December 27th (+/- 1 trading day) important TIME turning point, two mathematical points of force were identified on the Dow in our daily updates. One was located at about 20,750 and the other at 21,725 (+/- 50 points). A trade entry point and a plan of action were offered at the time for our 21,725 PRICE turning point.

Like clockwork, the Dow proceeded to bottom on December 26th at 21,713 and the rest, as they say, is history.

Not all of our market calls are as accurate as the one above has been. Yet, we do our best in an attempt to nail them all…..tops and bottoms.

If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Warren Buffett Reveals His Secrets

Investment Grin Of The Day

Bullish Investors Declare Victory – Up, Up And Away

2/5/2019 – A positive day with the Dow Jones up 172 points (+0.68%) and the Nasdaq up 54 points (+0.74%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Despite the market remaining below key technical resistance levels, all while returning to overbought levels, most bullish investors have seen enough. The correction is over, the bull is back and the time to “load up” is now. Consider this small sample from today’s news flow…….

- The Nasdaq is on the brink of escaping from bear-market territory

- Billionaire Howard Marks to Goldman Sachs: We’re not in bubble.

- Bull trend strengthens, S&P 500 approaches 200-day average

- If stock-market investors missed January’s surge, they’re out of luck, says Goldman Sachs

- Time for stock-market investors to shake off the 3rd ‘recession scare’ of the cycle, analyst says

Indeed, shake it off losers. The above is designed to make you all warm and fuzzy inside so you go out and load up on stocks. Should you? Consider the following……

Let’s cut through the nonsense.

The only reason that stocks are rallying is because investors are hoping the Fed has reinstated its policy of inflating stocks…

However, HOPE is very different from reality. And the Fed hinting at halting its rate hikes and possibly altering the schedule of QT is VERY different from cutting rates and engaging in QE.

Put simply, a Fed that says it might be less hawkish is not a dovish Fed. And the markets know it, though stocks always “get it last.”

Bonds don’t buy this “risk on” move at all.

In other words, no one said investing would be easy.

Luckily, you don’t have to guess what the stock market will do next. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.