Re-Test Of 2018 Lows Followed By Yet Another Bull Market?

1/29/2019 – A mixed day with the Dow Jones up 51 points (+0.21%) and the Nasdaq down 57 points (-0.81%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

While most investors out there remain incredibly bullish, quite a few technicians now expect a re-test of December 2018 lows……

We Now Expect A Full Re-test Of The S&P Low At 2,346

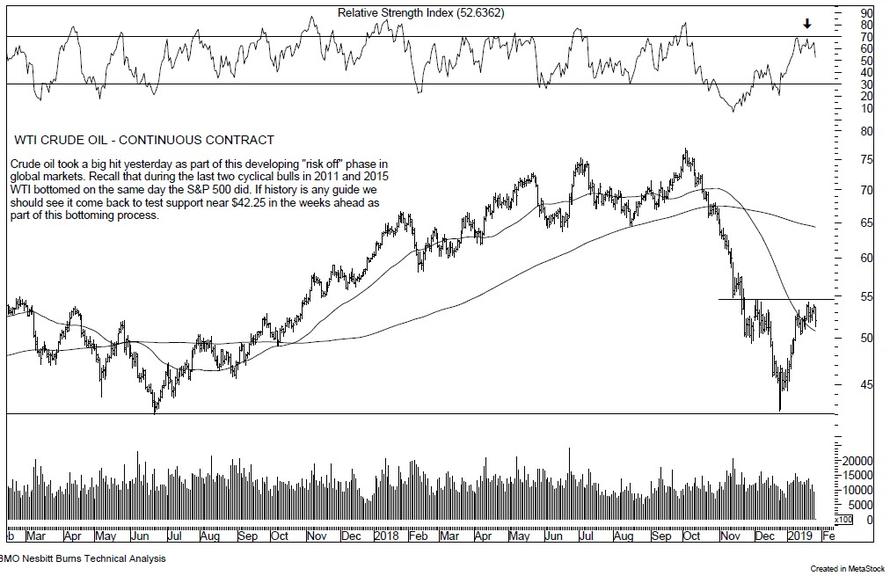

Picking up on a theme that Nomura’s Charlie McElligott has been pounding the table on for the past few weeks, namely that the market is poised for a potential steep drop in the coming days, especially with the $7.5BN MBS rolloff from the Fed’s balance sheet on Jan 31, this morning BMO’s chief technician Russ Visch writes that after highlighting the deterioration underway in his short-term timing model for more than a week, “it appears as if the rubber is finally beginning to hit the road in a real way with respect to the “re-test” phase of this bottoming process.”

Specifically, Visch notes that yesterday the S&P 500 reversed back to the downside after failing at a declining trendline and warns that “given the history of how the bottoming process plays out for declines of this magnitude we expect the index is now likely to retrace most, if not all, of the rally since late December. i.e. – a full re-test of the low at 2346.”

Please note something of significant importance here.

While quite a few market technicians discuss a distinct possibility of the market re-testing its December lows, no one, and I mean no one, is even talking about the possibility of the market slicing through December low and falling much further.

This is consistent with the extreme long-term bullish sentiment we have been discussing here for months.

Luckily, we have a chart in our premium section that shows not only what the stock market should do over the next few weeks, but for the rest of the year. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

David Stockman: If You Are Buying This Dip You Are Smoking Something

Investment Grin Of The Day

Apocalyptic Economic Conditions Set To Swallow Trump’s Miracle (…AKA Bubble)

1/28/2019 – A negative day with the Dow Jones down 209 points (-0.84%) and the Nasdaq down 79 points (-1.11%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Just as we have predicted, things are starting to get ugly…..very ugly.

Morgan Stanley “Confident This Early Year Rally Will Fade”

Bottom line, this is just one more piece of evidence suggesting that NTM EPS growth faces a steep decline ahead, which may take several quarters to play out. If so, we are confident this early year rally will fade.

We simply wonder, which way will this divergence resolve. Yet, that might not be the biggest issue for the Trump Administration. This is….

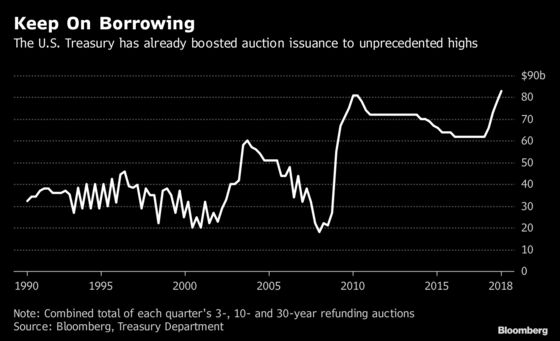

U.S. Treasury Set to Borrow $1 Trillion for a Second Year to Finance the Deficit

In other words, Trump’s so called “the best of all time miracle economy’ is nothing more than a credit card maxing out party. The bill is coming due. And to add insult to injury, deterioration of American society continues unabated.

People robbed of Canada Goose coats at gunpoint in Chicago

Chicago police are reporting gunpoint robberies targeting people wearing pricey Canada Goose jackets as temperatures plunge in the city.

Over the past two weeks, police say there’s been a spate of the thefts in which people wearing the luxury coats have been targeted and forced to give up the jackets. The coats can cost upward of $1,000 and are often seen on celebrities.

To summarize, the stock market finds itself selling at some of the highest valuations in its history. Plus, despite massive infusion of debt earning estimates are now collapsing. Trump’s economic miracle is not a miracle at all, but rather, a scary looking Ponzi exercise in debt creation. And finally, it is really, really cold in Chicago.

If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Must Watch Jim Rogers Interview

Investment Grin Of The Day

Investors Refuse To Acknowledge Any Possibility Of A Bear Market

2/28/2019 – A negative day with the Dow Jones down 69 points (-0.27%) and the Nasdaq down 22 points (-0.29%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Despite multiple economic, technical and fundamental indicators pointing towards a severe bear market, most investors refuse to acknowledge any possibility of such a travesty. Consider the following…..

Dow needs to give back some gains before stocks see another big leg up

How steep and long a pullback is required to count as “significant?” Unfortunately, Hamilton never precisely answered that question. One rule of thumb that some Dow Theorists have used over the decades is that, in order to be counted as significant, a pullback must last between three weeks and three months and retrace between one-third and two-thirds of the previous rally.

If that’s so, needless to say, a Dow Theory buy signal is several weeks away at the earliest.

Schannep, editor of TheDowTheory.com, has modified this traditional rule of thumb, on the grounds that while it may have been appropriate for the slower-moving markets of yesteryear, it’s not suited to today’s faster-paced markets. He imposes no minimum time limit on a pullback, and says that a 3% decline is sufficient to be significant. The stock market has yet to hurdle even this much lower bar.

Has anyone considered what would happen if the next leg down turns into a major sell-off that will take out most recent lows? I guess not….

Why upbeat investors are counting on the ‘Powell put,’ the ‘Trump put’ and the ‘Xi put’

In real life, a put is an option that gives the holder the right but not the obligation to sell the underlying instrument at a set price by a certain time — a potentially valuable hedge if a bullish position goes south. Since at least Alan Greenspan’s tenure as head of the Federal Reserve beginning in the late 1980s, investors have talked of a “Fed put,” a reference to the idea that the central bank would take steps to soothe markets in the event of a violent downturn.

Deutsche Bank macro strategist Alan Ruskin, fresh off a round of client meetings in Hong Kong and Singapore, said in a Friday note that he noted a “strong consensus about a newfound Powell put” — reference to Fed Chairman Jerome Powell — due to the Fed’s sensitivity to financial conditions and expectations it will hold off on further rate increases at least through the first half.

The reality distortion field is strong here. Don’t forget, investors always find reasons to rationalize away their position, be it bullish or bearish.

What is different this time is how massively out of sink everything is. Over the last few years we have proven on this blog, without a shadow of a doubt I might add, that stocks are selling at some of the highest valuation levels in history. All while the underlying fundamental structure has been propped up by a giant Ponzi Scheme of massive debt and deficits, stock buybacks, liquidity infusions at all cost, zero interest rates, etc…..

In other words, the most ugly “Everything Bubble” is out there for everyone to see in all of its glory. Unfortunately, most investors refuse to see the Emperor in its true form. And considering the sentiment above, it would be our guess that they will pay dearly for it.

Luckily, you don’t have to guess. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.