11/19/2018 – A negative day with the Dow Jones down 395 points (-1.56%) and the Nasdaq down 219 points (-3.03%)

As we have been saying for some time, the stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here

Some of Wall Street’s biggest firms are beginning to say that a prolong bear market might be already upon us. Can they possibly be right?

Morgan Stanley Calls It: “We Are In A Bear Market”

More ominously, Wilson notes that what’s notable about Exhibit 1 is the fact that the only years the Buy the Dip hasn’t worked was during bear markets, or the beginning of one (1982, 1990, 2000, 2002). In the cases of 1982, 1990, and 2002 it was also accompanied by a recession. In the case of 2000, it was the year preceding a bear market and recession and the topping of the TMT bubble.

In other words, while 2018 is clearly not a year of recession, the market is speaking loudly that bad news is coming. Our view is that the market is sniffing out an earnings recession and a sharp deceleration in economic growth–something we have written about extensively.

To be sure, there are exceptions: did buying dip work in 2008-09, however Wilson has a specific explanation for this: “in 2008-09, the Fed was easing aggressively and began its QE program along with TARP. That’s a lot of stimulus that probably offset the very real concerns about the economy and corporate earnings.” Furthermore, Wilson adds, while the S&P 500 was down in both 2008 and 2009, buying the market on weakness was still a profitable strategy because the rallies were just as vicious given the incredible uncertainty and unprecedented volatility which also made it almost impossible to execute.

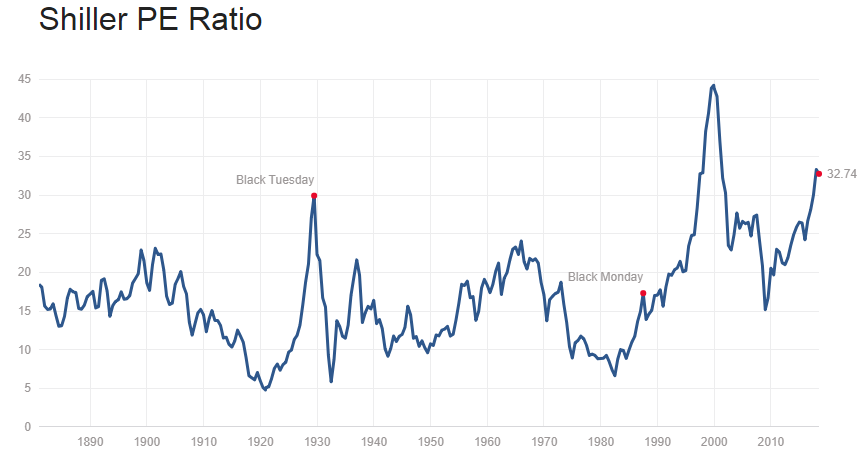

Whether or not the bear market has started is not necessarily the right question. This is – Investors Might Want To Start Wondering Why The Hell They Are Fully Invested In The Biggest Bubble Of All Time

Still, if you would like to find out if a bear market has started and exactly what the stock market will do next, based on our mathematical and timing work, please Click Here.