10/16/2018 – A positive day with the Dow Jones up 547 points (+2.17%) and the Nasdaq up 214 points (+2.89%)

As we have been saying, the stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Since Trump went after the FED again, it is prudent we re-post this write up for a few days ago.

This is the main issue with Trump that we have been warning everyone about for over a year.

You can’t take FULL CREDIT for an all time high on the Dow just a few days ago and then turn around and blame the FED Chairman Powell for today’s sell-off.

That is exactly what we talked about yesterday Trump Continues His Unprecedented Attack On “Independent” FED

Now this…….

Trump Says Fed ‘Has Gone Crazy’ Following Stock Market Selloff

President Donald Trump slammed the Federal Reserve as “crazy” for its interest-rate increases this year in comments hours after the worst U.S. stock market sell-off since February.

“The Fed is making a mistake,” he told reporters on Wednesday as he arrived in Pennsylvania for a campaign rally. “They’re so tight. I think the Fed has gone crazy.”

Trump’s latest attack on the U.S. central bank appeared to blame the Federal Reserve for a stock rout that market analysts mostly attributed to fresh concern about his trade war with China. Trump has been publicly criticizing the Fed since July for interest-rate increases and declared he was “not happy” in September when the central bank raised rates for the third time this year.

Trump Blames Powell: “I Think The Fed Has Gone Crazy” After Selloff

While it is unlikely that the culprit will be revealed, there is nothing that would prevent Trump from pushing the former narrative and blaming Beijing for today’s rout.

That said, there is one more person who should be rather nervous after the plunge: recall that exactly 24 hours ago Trump said that he doesn’t “like what the Fed is doing.” What better justification could Trump have to “push” Powell than to accuse him of the second worst selloff of 2018?

Indeed, as one notable fintwit member said, a little more downside in the S&P, “and Powell can start putting his coffee cups and pencils in a cardboard box.”

Then again, maybe President Trump is playing a brilliant game of 10-D Chess.

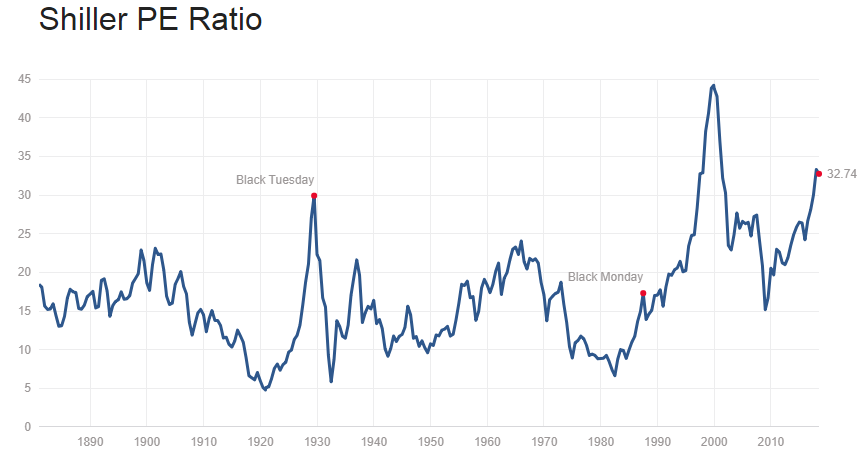

Juice the stock market to the 10th degree with tax cuts and MAGA, creating the biggest “Everything Bubble” in human history, then watch it collapse. Blame the FED, Iran, EU, Putin, Illegal Mexicans and who could forget, the Democrats for the collapse. Trump’s base will eat this up and Mr. President will get a massive landslide victory in 2020.

Checkmate.

Having said that, if you would like to remove all of the BS above from the equation and simply concentrate on the market, we might have an answer. If you would like to find out exactly what the stock market will do next in both price and time, based on our timing and mathematical work, please Click Here