Investment Grin Of The Day

Earnings Recession Suggests The S&P Might Have To Drop 70%

10/3/2018 – A positive day with the Dow Jones up 54 points (+0.20%) and the Nasdaq up 25 points (+0.32%)

The stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Not that anyone investing in the stock market today cares, but earning estimates are feverishly collapsing.

Peak Earnings: Companies Furiously Guide Earnings Estimates Lower

In contrast to the forward PE, the current Shiller PE Ratio is 33.49.

The only time the cyclically-adjusted PE was higher was during the dot-com bubble. But unlike now, there were plenty of companies with low PEs and excellent profits in 2000.

Energy companies were a standout example. Now, we are in a “damn near everything bubble”. Affectionately called the “everything bubble”.

Gold is now one of the few and far between non-bubble standouts. Some might even disagree with that.

Here is another way to look at all of the above.

Forget forward guidance or anticipated slowdown in earnings. In order for the stock market to revert back to its mean Shiller P/E of 16 it would have to slide 55%. Today.

And we are not even talking all the other headwinds the market might be facing in the very near future. For instance, massive budget deficits, rising interest rates, massive margin debt in the stock market, everything bubble, trade war, Trump, QT, etc…..

If we assume that earnings recession is ahead and the S&P earnings collapse from 115 today to let’s say 80, a modest drop considering today’s environment, the market would have to drop about 70% to reach its Shiller’s Adjusted P/E of 16. And we are not even talking about overshooting on the downside.

Will such a move down ever develop?

We might have an answer.

If you would like to find our exactly what the stock market will do next, based on our mathematical and timing work, in both price and time, please Click Here

Important To Understand: Trump’s New NAFTA Deal Is A Marketing Scam – Nothing More

Investment Grin Of The Day

Everyone Is In The Stock Market…..Now What?

10/2/2018 – A mixed day with the Dow Jones up 123 points (+0.47%) and the Nasdaq down 38 points (-0.46%)

The stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Now that your day trading grandma is fully invested, what happens next?

U.S. HOUSEHOLDS LOADED UP ON STOCKS

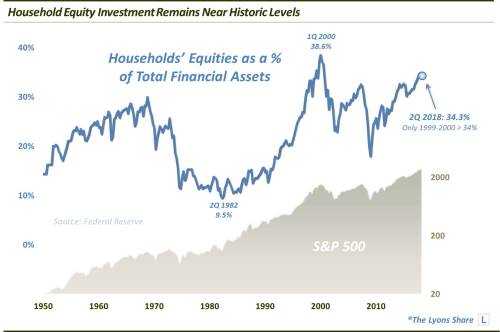

Outside of the 2000 dotcom bubble, U.S. households have never had more of their assets invested in the stock market.

The U.S. stock market, i.e., the S&P 500, soared back to new all-time highs again today – always a welcomed development for investors. And it is especially welcomed now considering the fact that investors are loaded up with stocks at the moment. That information comes courtesy of one of our favorite investment related statistics.

From the Federal Reserve’s Z.1 release, we find that U.S. Households had a reported 34.3% of their financial assets invested in the equity market as of the 2nd quarter. Outside of a slightly higher reading in the 4th quarter of 2017, that is the highest level of stock investment in the 70-plus year history of the series, other than the 1999-2000 bubble top.

The above is consistent with numerous other indicators we have looked at before. For instance, Shiller’s Adjusted P/E Ratio is at 33.50 (double the mean) and arguably at the highest level in the stock market’s history (if we adjust for 2000 tech distortions).

The margin debt is nearly 2.5 times higher than it was at 2007 top and numerous bullish sentiment indicators are flashing an all time high.

In other words, everyone is long, strong and on margin at the highest valuation level in the stock market’s history. What can possibly go wrong?

We might have an answer.

If you would like to find our exactly what the stock market will do next, based on our mathematical and timing work, in both price and time, please Click Here

Could Soaring Twin Deficits Lead To A Stock Market Crash In October?

Investment Grin Of The Day

All Hail “Single Greatest Agreement Ever Signed”

10/1/2018 – A mixed day with the Dow Jones up 192 points (+0.73%) and the Nasdaq down 9 points (-0.11%)

The stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Not entirely sure if we should cry or laugh here. Feel free to do both……

Trump Hails “Single Greatest Agreement Ever Signed”

The previous (more current) article shows Canada is exempt as well. Nothing changed vs NAFTA.

Wins and Losses

- Trump won a minor concession on dairy.

- Auto manufacturers are spared disastrous tariffs, but that is the status quoa vs NAFTA.

- No job wins. No job losses.

- Based on new rules, there might be supply chain disruptions, a clear loss.

- Union leaders are lukewarm to the deal. They did not think it went far enough.

- If there is an increase in price due to labor provisions, it will be a direct loss to consumers who will pay a higher price or manufacturers who will eat the cost increase. Most likely, consumers will take a hit, if anyone does.

Summation

The deal tweaked some things resulting in a small win for US dairy farmers. The rest keeps the status quoa vs NAFTA with a potential win for unions at the expense of consumers. If, so, that is a larger net-negative.

This we hail as the “Single Greatest Agreement Ever Signed“

In other words, Trump’s 10th dimensional chess game becomes apparent. President Trump creates a huge stink/problems where none exist (Iran, N. Korea, NAFTA, etc…), then claims insignificant and superficial victories over the subject. Of course, proclaiming them to be the greatest victories of all time in the process.

Just as he has already claimed the ownership of the largest “Everything Bubble” in human history. Unfortunately for him, that one is as real as it gets.

If you would like to find our exactly when the stock market will crater, based on our mathematical and timing work, in both price and time, please Click Here