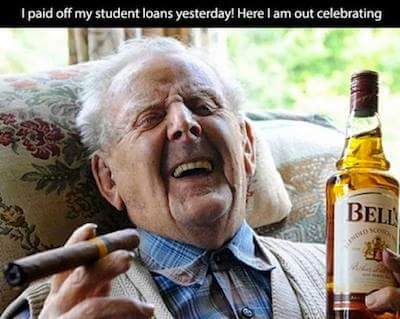

Investment Grin Of The Day

Can Stock Buybacks Save This Market?

9/6/2018 – Another mixed day with the Dow Jones up 20 points (+0.08%) and the Nasdaq down 72 points (-0.91%)

If you are a well researched bear, you might be wondering, who the hell is buying this market?

The answer shouldn’t surprise you.

Stock Buybacks Hit Record $680 Billion In The First Half

From a purely financial point, companies in the S&P 500 that have repurchased shares are expected to see a return on investment of about 6.4% this year, a percentage that falls below the past six rolling five-year periods as measured by Fortuna Advisors, a financial consulting firm that has examined buyback trends going back to 2007.

CEOs, CFOs and Treasurers know all of this, of course, but to them the real goal is simpler: to cash out as soon as possible, while using the company’s balance sheet to soak up any insider sales. If the stock goes up in the process, so much the better.

Gregory Milano, Fortuna’s CEO, summarized it best: “The majority of capital deployed is going right back to shareholders and not reinvestment in businesses. If that’s the only thing you’re relying on, it’s going to end badly.”

Of course it will, but as we approach an absolutely ridiculous $1 trillion in buybacks – actually the annualized first half buyback total of $678 billion would imply over $1.35 trillion in 2018 buybacks – at least it will end with a bang.

Indeed.

We have discussed this before. It is a well known fact that corporates behave in the exact same fashion as retail investors do. That is, they buy at the top and sell at the bottom.

So, it shouldn’t come as a surprise that they are blowing their debt driven cash stock piles on stock buybacks in the market that is selling at the highest valuation level in its history. In other words, just another red flag that something terrible is just around the corner.

If you would like to find out what happens next in the stock market, in both price and time, based on our mathematical and timing work, please Click Here

Ron Paul Discusses The ‘Everything Bubble’

These WTF Charts Of The Decade Will Lead To Sleepless Nights, If You Are A Bull

9/5/20018 – A mixed day with the Dow Jones up 22 points (+0.09%) and the Nasdaq down 96 points (-1.19%)

The stock market is behaving, more or less, as it should. If you would like to find out what happens next, in both price and time, based on our timing and mathematical work, please Click Here

Let’s start with just a few charts. To see the rest, which we highly recommend, please click on the link below.

http://realinvestmentadvice.com/fundamentally-speaking-q2-earnings-review-market-outlook/

If you have studied all of the WTF charts, the conclusion should be rather simple.

“This time is different” bullish war cry of the masses might very well represent the biggest “everything bubble” in human history.

If you would like to find out what happens next, in both price and time, based on our timing and mathematical work, please Click Here

Bullish Investors Insist: It IS Really Different This Time, Bears Are Idiots

The Great American Swindle: How The Rich Stole $30 Trillion By Destroying American Middle Class

9/4/2018 – A negative day with the Dow Jones down 12 points (-0.05%) and the Nasdaq down 18 points (-0.23%)

Every time Trump says MAGA I cringe. And not because I don’t want America to be ‘Great Again’, whatever that means, but because Trump’s actions are in direct contradictions to what he is saying.

For instance, Trump’s tax cuts did absolutely nothing to help your average American. The tax cuts went primarily to the corporates who in turn used the proceed for stock buybacks, making the ‘everything bubble’ infinitely bigger and of course, self enrichment. All while Trillion dollar deficits that will eventually lead to the great American collapse continue to pile up.

This article puts it all in perspective.

What Just Happened? $30 Trillion to the Richest White Americans Since 2008

Wealth statistics since the recession are provided in the Credit Suisse Global Wealth Databook. A summary of relevant data can be found here.

Post-recession data shows that about $33 trillion went to the richest 10%, who are overwhelmingly millionaires (13 million millionaires, 12.6 million U.S. households!). That nearly doubled the wealth of each member of the richest 10%. Average net worth is now $14 million for each 1% household, and the greater part of a million for even the ‘poorest’ household in the top 10%.

In comparison, average net worth for the poorest half of America decreased from $11,000 to $8,000 since the recession.

There is another description for all of the above.

One giant Ponzi Scheme, a swindle.

It is unfortunate, but most Americans do not understand that their wealth has been stolen from them and that their economy has been gutted in the process. They will, but that will happen in the midst of the next recession. I wonder if they will blame Putin.

If you would like to find out what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here

Charles Nenner Issues A Stark Warning For The Stock Market: We Are Going To 5,000 On The Dow

Investment Wisdom Of The Day

Trump Begs The FED: Give Me More Juice For This Massive ‘Everything Bubble’- Back On Sept. 4th

PLEASE NOTE: THIS FREE INVESTMENT BLOG WILL BE BACK ON SEPT 4TH. OUR PREMIUM ANALYSIS GOES ON WITHOUT INTERRUPTION. CLICK HERE

8/21/2018 – A positive day with the Dow Jones up 63 points (+0.25%) and the Nasdaq up 38 points (+0.49%)

President Trump is in real trouble. And no, were are not talking about Mueller, Cohen or Monafort. We are talking about the upcoming implosion of the Trump’s ‘Everything Bubble’

You see, the sugar rush associated with Trump’s tax cuts to the rich/corporates (stock buybacks) and the weak dollar are wearing off. Understandably, the above was used to cover up massive imbalances of debt, speculation and crony capitalism. Unfortunately, this Ponzi Scheme of massive proportions is about to make its maker.

That is why Mr. Trump is so desperate and is now attacking the FED.

Trump Complains About Fed Rate Hikes: Expected Powell to be “Cheap Money Chair”

Trump, in an interview with CNBC, said he does not approve, even though he said he “put a very good man in” at the Fed in Powell. “I’m not thrilled,” he told CNBC’s Joe Kernen in an interview to air in full Friday at 6 a.m. ET on “Squawk Box.” “Because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time I’m letting them do what they feel is best.” “But I don’t like all of this work that goes into doing what we’re doing.”

Exclusive: Trump demands Fed help on economy, complains about interest rate rises

After leaving its policy interest rates at historic lows for about six years after the 2008 global financial crisis, the Fed began slowly raising rates again in late 2015.

Trump said China was manipulating its yuan currency to make up for having to pay tariffs on imports imposed by Washington. “I think China’s manipulating their currency, absolutely. And I think the euro is being manipulated also,” Trump said.

“What they’re doing is making up for the fact that they’re now paying … hundreds of millions of dollars and in some cases billions of dollars into the United States Treasury. And so they’re being accommodated and I’m not. And I’ll still win.”

Watch Out Dollar Bulls: Trump’s Criticism of the Fed is Getting Serious

This puts investors in-between a rock and a hard space.

On one end: the Fed’s continuing to tighten – which is bullish for the dollar.

‘Real’ interest rates (inflation minus nominal rates equals the real rate of interest) are still near zero – maybe slightly negative.

And because of this, the Fed’s rate hikes haven’t caused the ‘tightening’ in the economy many expected.

Thus, until the Fed achieves their 3% rate target by the end of 2019 – or until U.S. growth plummets – expect them to continue hiking.

But on the other end: Trump’s worried about the strong dollar and continues criticizing The Fed’s tightening – both which are bearish for the dollar.

If the Fed continues raising rates – or if the dollar continues being, as Trump calls it, “overvalued” compared to U.S. trading partners – Trump may personally step in.

Our view remains the same, President Trump has dug his own grave associated with everything bubble and must now lay in it. Here is why…

In simple terms, it is too late. The bubble is too big, the yield curve is already flat enough to cause a recession, Trump’s trade war is idiotic and damaging to the US, interest rates will keep going higher, the dollar is too strong, the bullish spirits are running at peak levels and if that wasn’t bad enough, the Democrats have a very good chance of winning in November.

Let us step away from the fundamental analysis for a second, something we have beaten to death here over the last few months, and answer the question from our TIMING and MATHEMATICAL perspective.

Our cyclical composition of various markets suggests the following.

The FED will continue to hike interest rates until the yield curve inverts (nearly there) and causes a recession. The simple truth is, they have no choice as they need to reload for the next recession. The US Dollar will continue to much higher levels. Not immediately, but don’t be surprised to see the DXY at $99 or above within a year.

Further, inflation will vanish into thin air, only to be replaced by deflation. Trump’s ill timed trade war will be disastrous for all involved and the stock market will crater. Once again, the above is based on the cyclical composition of various market.

If you would like to find out exactly when all of the above happens, based on our timing and mathematical work, please Click Here.