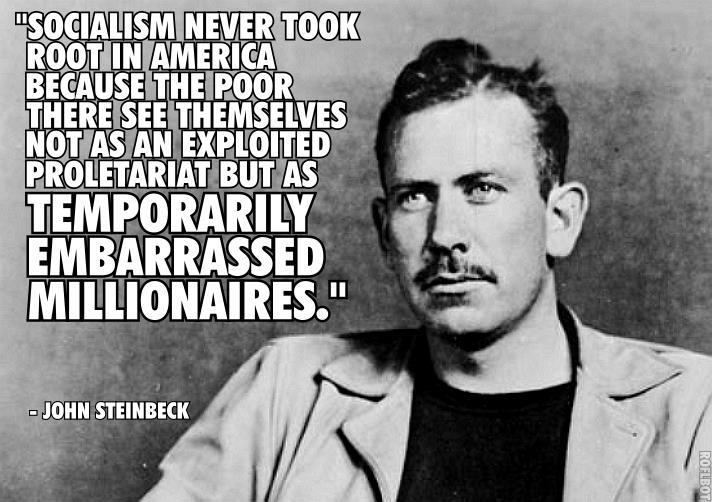

Investment Wisdom Of The Day

Who The Hell Needs Fundamental Analysis, It’s For Fools

A mixed week with the Dow Jones up 393 points (+1.56%) and the Nasdaq down 83 points (-1.06%)

This week was incredibly important for the stock market. I am not entirely sure how long, but it has been quite a while since we have seen such a significant % divergence between the Nasdaq and the Dow.

That is exactly what we talk about in our weekly update and what that means for the stock market. If you would like to learn more, and/or what the stock market will do next, in both price and time, please Click Here

This week’s market action in Facebook (FB) is perfect example of “Price is what you pay and value is what you get”. As we have discussed earlier in the week Facebook was the largest holding across the board for all hedge funds and most likely other institutional investors.

Do you think any of these money managers were concerned about fundamental analysis? Not a trick question. Do you think they cared that they were paying 15 times revenue for a highly speculative company that is being taken over by “old people and cats”. Do you think they care that they are still paying 100+ times earnings for highly speculative small cap companies (Russell 2000)

Of course not.

The situation we are witnessing today is identical, in terms of dismissal of time proven fundamental analysis, to what we have seen at 2000 and 2007 tops. Perhaps no one does fundamental analysis better today than John Hussman. His latest market analysis is out, it is full of wonderful information and we highly encourage you to read it in full.

Market returns and economic growth have underlying drivers. At their core, long periods of extraordinary growth and disappointing collapse reflect large moves in those drivers from one extreme to another. Extrapolation becomes a very bad idea once those extremes are reached.

The present combination of record valuations and divergent market internals, coming off of the most wicked ‘overvalued, overbought, overbullish’ extremes in history, creates a danger zone that will not be resolved until some combination of those factors – valuations, internals, and overextended conditions – shifts to a less dangerous mix.

Fundamental analysis is wonderful in helping you identify larger trends. Yet, if you would like to concentrate on immediate market moves, timing analysis is a must.

If you would like to find out what happens next, in both price and time, based on our timing and mathematical work, please Click Here.

What Facebook Can Teach Us About Unprecedented Insider Selling To Foolish Retail Investors, A New Form Of Pump & Dump

7/26/2018 – A mixed day with the Dow Jones up 113 points (+0.44%) and the Nasdaq down 80 points (-1.01%)

7/26/2018 – A mixed day with the Dow Jones up 113 points (+0.44%) and the Nasdaq down 80 points (-1.01%)

Consider the following….

“SEC May Want To Take A Look”: Facebook Insiders Dumped $4.1 Billion Weeks Ahead Of Record Crash

We wrote about it a few weeks ago. Here is how the scam works. A corporation announces a multi-billion stock buyback at an all time bubble high valuation levels, followed by a pop in the stock price, followed by a barrage of insider selling to unsuspecting retail fools. A nice gig if you can get it.

We had a number of interesting views on the subject matter. Let’s take a look…..

He reminded us that “in the years leading up to the financial crisis, top executives at Bear Stearns and Lehman Brothers personally cashed out $2.4 billion in stock before the firms collapsed.”

Tying executive pay to the growth of the company, he said, “only works when executives are required to hold the stock over the long term.”

Part of the problem is that the SEC has not yet turned the provisions in the Dodd-Frank Act that were “designed to give investors more information about whether and how managers cash out” into actual rules. Thus investors are still kept “in the dark about executives’ incentives.”

“But it’s not just that the regulations haven’t been finalized. It’s that the problem itself keeps getting worse,” he said. The new tax law “has unleashed an unprecedented wave of buybacks, and I worry that lax SEC rules and corporate oversight are giving executives yet another chance to cash out at investor expense.”

SEC Says Executives Dumping Shares on Buyback Announcements: No Skin in the Game

-

In 385 buybacks over the last fifteen months, a buyback announcement lead to a big jump in stock price.

-

In half of the buybacks, at least one executive sold shares in the month following the buyback announcement.

-

Twice as many companies have insiders selling in the eight days after a buyback announcement as sell on an ordinary day. So right after the company tells the market that the stock is cheap, executives overwhelmingly decide to sell.

-

On average, in the days before a buyback announcement, executives trade in relatively small amounts—less than $100,000 worth. But during the eight days following a buyback announcement, executives on average sell more than $500,000 worth of stock each day—a fivefold increase.

In simple terms, this is yet another red flat for our bubblicious stock market.

I have argued in the past,with corporate buybacks being at record highs, that corporation are acting in foolish, but predictable way of buying their own stocks at record highs. The flip side of that view is corporate officers unloading their own shares to unsuspecting investors.

Criminal, unethical or above the board? None of that really matters. This is just another indicator that we are either at or approaching a bubble top. If you would like to find out what happens next and/or when the market will crater, please Click Here.

Mish Calls BS On Trump-EU Trade Deal……We Agree

According to President Trump he was able to achieve some sort of a major trade war victory against the EU. The stock market rallied and everything was, as Janet Yellen used to say, peachy.

Before you come to the same conclusion, consider the following…..

Trump and Juncker Supposedly Agree to Trade Deal: Lies All Around

Lie When It’s Serious

Ahead of the meeting, Juncker said it was not his intent to work out a deal. Now he says it was his intention all along.

In case you forgot, please consider the most honest thing Juncker ever said: “When it becomes serious you have to lie.”

So, is Juncker lying today or was he lying two days ago?

The US is not going to supply the EU with LNG. That is a direct and blatant lie by Trump. The EU will get natural gas from Russia via Nordstream2. US LNG would be far more costly.

So there are lies all around.

Meaningless Agreement

As I have pointed out, it will take the EU and the US a decade to work out a real agreement. Juncker by himself cannot promise anything. All 27 nations in the EU have to ratify trade deals.

The EU can add retaliatory tariffs without every nation agreeing and now it can remove them.

Winning?

Is this winning?

I highly encourage you to read the whole thing, but I believe Mish is dead on the money here.

The only positive from all of the above is de-escalation of Trump’s trade war. At least for the time being.

Yet, none of that matters. The stock market has a clear cyclical path ahead of itself and no matter what Mr. Trump does, things will play out as they should.

If you would like to find out what the stock market will do next, based on our timing and mathematical work, in both price and time, please Click Here.

Investment Wisdom Of The Day

What Happens When F In FAANG Gets F*ed

7/25/2018 – A positive day with the Dow Jones up 172 points (+0.68%) and the Nasdaq up 91 points (+1.17%)

7/25/2018 – A positive day with the Dow Jones up 172 points (+0.68%) and the Nasdaq up 91 points (+1.17%)

We are currently dealing with a lot of cross currents in the market with a bit of excitement in the after hours. If you haven’t heard…..

Facebook stock falls 24 percent on forecast for slowing growth, rising expenses

The plummeting stock price wiped out about $150 billion in market capitalization in under two hours.

The company had cautioned investors to expect a big jump in costs because of efforts to address concerns about poor handling of users’ privacy and to better monitor what users post. Total expenses in the second quarter surged to $7.4 billion, up 50 percent compared with a year ago.

“Our total revenue growth rates will continue to decelerate in the second half of 2018, and we expect our revenue growth rates to decline by high single-digit percentages from prior quarters sequentially in both Q3 and Q4,” said Chief Financial Officer David Wehner.

As we have been warning for years, Facebook is not only massively overpriced/speculative, it is fast becoming the hang out place for “old people” and cats. A more detailed analysis of the subject matter can be found here

Facebook Plunges Into Bear Market, Wipes Out $132 Billion In Value

BUT, it gets worse, much morse……

And The Most Popular Hedge Fund Stock Is…Facebook

In other words, a lot of people will take massive losses with Facebook (FB) tomorrow. More importantly, Facebook is an F is the so called FAANG group that has been basically keeping the stock market afloat by becoming the Dot.Com bubble of this decade.

The real question here is whether or not the stock market can survive this massive blow from one of its leaders?

We might have an answer. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here

Find Out Why Trump & The Fed Will Blame Each Other For Recession

Investment Grin Of The Day

American Heist Was Intentional – Where Is My Pitchfork

Another mixed day with the Dow Jones up 197 points (+0.79%) and the Nasdaq down 1 point (-0.01%)

Another mixed day with the Dow Jones up 197 points (+0.79%) and the Nasdaq down 1 point (-0.01%)

Today’s market action was incredibly important. First, I believe it resolves the conundrum that we have been talking about here over the last few days. Particularly, the divergence between TIME and our price/time calculations. The Dow is clearly looking for a……..

If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

We have two incredibly important subject matters to discuss today.

More Lies From The Corrupt Elite

For two decades the offshoring of American jobs to Asia and Mexico has destroyed the careers and incomes of tens of millions of US citizens, the pension tax base for state and local governments, the federal tax base for Social Security and Medicare, and the opportunity society that once characterized the United States of America.

The rise in corporate profits that resulted from substituting foreign labor for American labor rewarded corporate executives and boards, hedge funds, large shareholders, and Wall Street with profits at the expense of the American population and the US economy.

The low rates of economic growth claimed since the alleged recovery from the 2008 financial crisis that resulted from financial deregulation, a huge mistake made by politicians in service to capitalist greed, is based entirely on under-measuring inflation. Allegedly, Americans have suffered no inflation for a decade, but anyone who buys anything knows that that is a lie. What jobs offshoring did is to destroy the growth in productivity based US consumer purchasing power that drove the US economy. In short, the short-sighted executives, boards, and Wall Street have impaired aggregate demand in the US.

Paul Craig Roberts is dead on in his latest analysis. If you are still able to generate free and independent thoughts in your heavily influenced brain, I highly encourage you to read it in full.

Researchers Warn Income Inequality In US Getting Worse, It Was “Intentional”

While EPI warns that the overall income inequality trend is intact and getting worse, we remain troubled why the Trump administration continues to push economic propaganda of the “greatest economy” on record. At some point, the American people are going to awaken from their MAGA daze and realize that economic gains were only made by the top 1 percent, that is when the disappointment phase will be ushered in. However, there is new talk about Trump tax cut 2, as if, more of the same will work…

Here is what I find absolutely fascinating. Most Americans could care less about any of this. They either don’t understand or they simply don’t care.

Yet, the future is bleak. First, most Americans will be kicked in their teeth economically when the “Everything Bubble” finally collapses. As time goes on, more of American freedoms and liberties will be taken away. Only to be replaced by mindless social media and fake news experiences.

Then, it will get better or worse, depending on you outlook on things. When the Nuclear Holocaust World War 3 finally hits all of the above will wiped away. Along with most Americans, of course.

Now, before you dismiss the above is crazy, understand something very important. The rich are building Doomsday Bunkers in droves while you are eating up Fake News BS.

And don’t tell me that you were not warned. If you would like to find out exactly when all of the above fires off, in both price and time, please Click Here