A negative day with the Dow Jones down 135 points (-0.73%) and the Nasdaq down 29 points (-0.37%)

The stock market continues to perform, more or less, as anticipated. If you would like to find out what happens next, in both price and time, please Click Here.

Hey, remember when, during his Presidential campaign Mr. Trump blamed the FED for keeping interest rates too low for too long and as a result sparking the massive “Everything Bubble” we are seeing today?

No?

Well, neither does he.

“Because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time I’m letting them do what they feel is best.” He added, “But I don’t like all of this work that goes into doing what we’re doing.” “I don’t like all of this work that we’re putting into this economy and then I see rates going up,” Trump said.

Mish has a very good read on the subject matter as well…..

During his presidential campaign, Trump was highly critical of Fed Chair Janet Yellen. He accused her of keeping interest rates low to help Democrats. Ms. Yellen denied the accusation and said politics didn’t factor into the Fed’s decisions.

In addition to not understanding trade, Trump just proved he does not know anything about currencies either.

“Easy money”? Sheeesh! And what about that selective memory?

I will go one step further.

President Trump meeting Mr. Putin to avoid further deterioration with Russia is wonderful. I give credit where it is due.

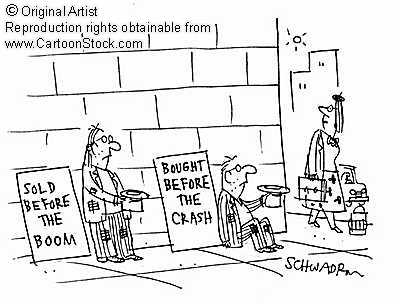

President Trump taking credit for today’s highly speculative boom while attempting to control interest rates, oil prices and the price of import/exports is idiotic. No, borderline criminal.

I didn’t know if I should laugh or pull my hair out when I read his statement……..

“I don’t like all of this work that we’re putting into this economy and then I see rates going up,”

What f***ing work?

The stock market is selling at its highest valuation level in history (aka massive speculative bubble). Trump’s tax cut was the last ditch effort heroin infusion to a dying patient about to have a heart attack. Works for a bit, but the ensuing cardiac arrest will be twice as worst.

Unemployment at a historic lows? Perhaps. Yet, lack of wage pressure suggests cooked numbers and ridding co tails of Obama driven FED is not really honest. And who could forget Trump’s idiotic trade war that we have beaten here to death. Open your history books and take a look at what happened in 1928-1932.

This is proof, once again, that Mr. Trump has no idea of what he is talking about when it comes to financial markets and how the US Economy works in its now highly distorted form.

The stock market hasn’t figured that out yet, but it will. If you would like to find out exactly when the stock market will tank, in both price and time, please Click Here.