Dead On Accurate

Unfortunately, Mr. Stockman does not work with TIMING, but we do. If you would like to find out what happens next, in both price and time, please Click Here

Dead On Accurate

Unfortunately, Mr. Stockman does not work with TIMING, but we do. If you would like to find out what happens next, in both price and time, please Click Here

I remember watching in disbelief as Americans loaded up on massive amounts of debt post 2003 to speculate in real estate. We know how that ended, but even those highs appear to be nothing but a tiny speed bump on the way to the promise land of milk and honey.

U.S. Consumers On An Unprecedented Debt Binge As Credit Card Debt Soars To An All-Time Record High

Americans are on an absolutely spectacular debt binge. Does this mean that the economy is getting better, or does this mean that U.S. consumers are totally tapped out and are relying on borrowed money to make it from month to month? On Monday, the Federal Reserve announced that total consumer credit in the United States increased by a whopping 24.6 billion dollars in May, which was far greater than the 12.4 billion dollar gain that economists were anticipating. Total U.S. consumer credit has now hit a grand total of 3.9 trillion dollars, but it is the “revolving credit” numbers that are getting the most attention. Revolving credit alone shot up by 9.8 billion dollars in May, and that was one of the largest monthly increases ever recorded. At this point, total “revolving credit” has reached a brand new all-time record high of 1.39 trillion dollars, and credit card debt accounts for nearly all of that figure.

What can possibly go wrong here?

Indeed.

All of the above can be interpreted in one of two ways. Either Americans have been so brainwashed by MAGA, seeing nothing but prosperity ahead, that the “hell with it” mentality takes over and people go on spending binges. Or, perhaps, Americans are so tapped out that they have to go into debt in order to maintain or sustain their existing lifestyles.

And while the latter is most likely explanation, it doesn’t really matter what the actual cause is. The truth of the matter is, this is a massive and unsustainable debt bubble. Not only in consumer credit, but in ALL credit. And not only in credit, but in EVERYTHING BUBBLE.

The above will blow up. It is simply unsustainable and not even MAGA can save us from the day of reckoning. Having said that, if you would like to find out exactly when this day arrives, in both price and time, please Click Here.

A positive day with the Dow Jones up 320 points (+1.31%) and the Nasdaq up 68 points (+0.88%)

The stock market continues to follow our short-term and long-term forecasts.

That is, we expect the stock market to continue on with its bounce into our XXX TIME turning point. If you would like to read the rest of this forecast, based on our timing and mathematical work, please Click Here

So, is this the final blow off top everyone has been talking about? Well, it depends which index you are looking at, but one investor certainly thinks so.

However, Minerd, chief investment officer for Guggenheim and one of the world’s pre-eminent bond-fund managers, advised more than a dollop of caution should be employed by investors, who risk whistling through the proverbial graveyard. Via Twitter, the investment manager said: “Markets are crazy to ignore the risks and consequences of a #tradewar. This rally in #stocks is the last hurrah! Investors should sell now, speculators may do better in August”

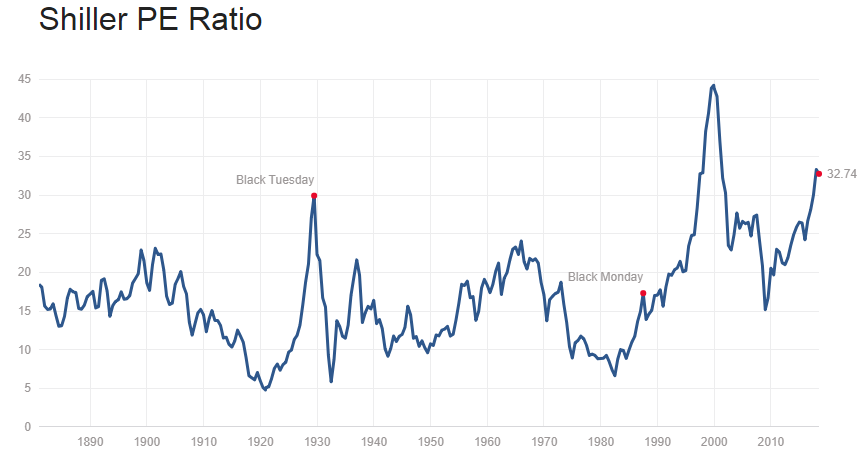

Let me put it this way. Over the weekend I raged about foolish investors (to put it mildly) buying small cap stocks at 100+ times earnings. Shiller’s Adjusted S&P P/E ratio is rather clear in that regard as well.

That is to say, the stock market is arguably selling at the highest valuation level in history. At the the very least, historically speaking, investors shouldn’t expect a return for decades to come.

Yet, we have to take something of significant importance into consideration here. The FED continues to hike, the yield curve is near inversion, Trump’s trade war just started and bullish animal spirits are running high.

Translation, the stock market finds itself in an explosive situation. And we would have to agree Mr. Minerd here. The explosion won’t be in the direction most investors believe. Luckily, our timing and mathematical work clearly shows what happens next. If you would like to find out, please Click Here

A positive week with the Dow Jones up 194 points (+0.79%) and the Nasdaq up 178 points (+2.37%)

It appears, at least for the time being, that this market is literally bulletproof. The yield curve is near inversion, the FED is hawkish, Mr. Trumps just officially kicked off a Global Trade War and what does the the Nasdaq do, it proceeds to gain 2%.

What’s going on?

Well, you can argue that the stock market is climbing some sort of a skyscraper of worry, but I have a much simpler explanation. Thus far, the stock market continues to behave exactly as our forecast had projected.

To very quickly summarize, we expected a bottom to occur on our June 27th (+/- 1 trading day) TIME turning point. A short-term point of force was identified to arrive within the first 60 minutes of trading on June 28th. The actual bottom arrived at 9:45 am EST, satisfying all of our long-term and short-term calculations in the process.

What happens next is rather interesting. If you would like to find out what the stock market will do next, in both price and time, please Click Here.

No doubt, things are not as they might appear to be in the stock market at the present moment. The same thing can be said about our lives in the US in general. Let’s go into the weekend with a few tears, laughs and perhaps a good bottle of whiskey.

Warning: The video below is from a “foreign agent entity” registered with the US Government.

7/5/2018 – A positive day with the Dow Jones up 182 points (+0.75%) and the Nasdaq up 83 points (+1.12%)

The stock market continues to perform, more or less, as anticipated.

Once again, we expect the stock market to……If you would like to find out what the stock market will do next, in both price and time, please Click Here

While President Trump did not talk about the stock market, he might as well have. I nearly fell off my chair when I saw the following headlines.

“The OPEC Monopoly must remember that gas prices are up & they are doing little to help,” Trump wrote on his personal Twitter account. “If anything, they are driving prices higher as the United States defends many of their members for very little $’s.”

“This must be a two way street,” he wrote, adding in block capitals, “Reduce pricing now!”

Maybe Iran is indeed right in saying that Trump should stop Tweeting about all of this.

This proves my point, once again, that Mr. Trump has no idea of what he is doing when it comes to trade and financial market. You cannot dictate what you would like to happen and you certainly cannot control it to a large degree. And you certainly shouldn’t take credit for markets when they move in your favor. We suspect Mr. Trump will very soon learn a valuable lesson in that regard.

Let me put it another way. The above is equivalent to President Trump demanding the Dow at 40,000 by year end. Senseless. Finally, just wait until his trade war with nearly everyone spikes prices across the board while wages stagnate.

Sometimes a picture is worth a thousand words, as is the case here.

Anyway, if you would like to find out what the stock market will do next, and trust me you ought to know, please Click Here