Margin Debt Horror Show Gets Even Scarier

7/3/2018 – A negative day with the Dow Jones down 132 points (-0.54%) and the Nasdaq down 65 points (-0.86%)

During the day the market attempted to rally, but despite oversold conditions the follow through just wasn’t there. Still, the market remains within confines of our exact forecast. If you would like to find out what the stock market will do next, in both price and time, please Click Here

We often talk about investor sentiment and how oversold/overbought the market is. And while no indicator is perfect, perhaps nothing tracks actual investor bullish/bearish sentiment better than the actual money, on the margin.

BLINKING RED BUBBLE LIGHT: Stock Market Investor Margin Debt Reaches New High

The world is standing at the edge of the financial abyss while most investors are entirely in the dark. However, specific indicators suggest the market is one giant RED BLINKING LIGHT. One of these indicators is the amount of margin debt held by investors. What is quite surprising about the level of investor margin debt is that it has hit a new record high even though the market has sold off 2,500 points from its peak in February.

It seems as if investors no longer believe in market cycles or fundamentals. Instead, the Wall Street saying that “This time is different” has become permanently ingrained in the market psychology. For example, it doesn’t seem to matter to the market that Amazon makes no money on its massive online retail business. The only segment of Amazon’s business that made a decent profit last quarter was from its Cloud hosting services.

We have touched on this subject matter a few days ago. Some Scary Charts To Keep You Up At Night Over The Weekend. At that time we looked at this chart.

It is truly mind boggling to see how long and leveraged everyone is. When the market finally cracks, as it surely will, all of the red on the right hand side will act as jet fuel to the downside.

Luckily, our mathematical and timing work is clear in identifying exactly when that will happen. If you would like to find out what the stock market will do next, in both price and time, please Click Here

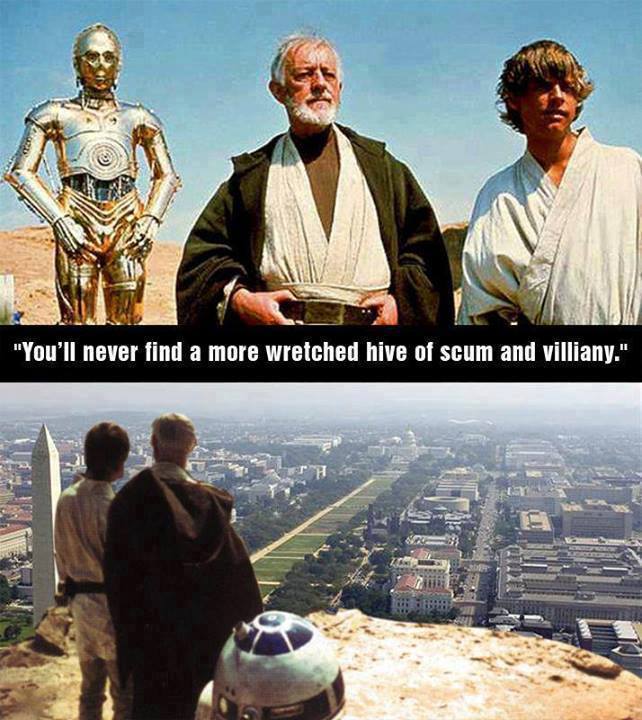

Investment Grin Of The Day

Imminent Yield Curve Inversion Points To Massive Losses Ahead

A positive day with the Dow Jones up 35 points (+0.15%) and the Nasdaq up 57 points (+0.76%)

We had a substantial gap down at the open that came close to testing last week’s lows. A powerful rally followed that saw the closure of today’s gap lower and subsequent recovery. In short, the stock market continues to behave just as our mathematical and timing work has predicted. If you would like to find out what happens next, please Click Here

Let’s talk about the yield curve.

Yield Curve Will Invert From the Inside Out

While some of the more obscure yield curves are getting close to inverting, most people watch the 3m/10yr curve. At 1.02%, it is not yet at risk of inverting. If, however, the Fed continues to hike without inflation materializing, this could quickly change. The market has seen this movie before. So far, the script is playing out as expected.

As of July 1, the 5-10 spread is still 12 basis points (0.12 percentage points), sinking slowly from 15 basis points on June 5.

Here is the key takeaway: “Since 1989 there are no instances when the 5yr/10yr curve inverts in isolation.”

The script is playing out, but whether it remains “as expected” will depend on who expects what.

No Crystal Balls

Just because the market usually gives a recession warning of approximately a year, does not mean we will get that year.

I expect we won’t. There are simply too many things going on with tariffs, in Europe, and in China.

But don’t count on my crystal ball. It’s been broken for some time. Then again, no one has a crystal ball, at least one that is accurate.

Here is my take away on the whole yield curve situation. Take a look at the chart below.

Notice something of incredible importance. The actual inversion is never very deep and does not last very long. Historically speaking. As a result, the event itself is of limited importance.

What is?

The flattening of the yield curve going into the recession and/or stock market collapse. It takes much longer and it is devastating to earnings of most financial firms. The primary driver behind today’s so called debt fueled recovery. And today’s yield curve is already as flat as a poor’s man pancake.

In other words, most of the damage has already been done. It is little beside the point if the yield curve actually inverts (it will) or not.

Our mathematical and timing work associated with the stock market tends to agree. If you would like to find out what happens next, please Click Here.

Let’s Talk About Nukes, Not Transgender Toilet Facilities

It has been my observation that America’s intelligence level has deteriorated to a level slightly above 4th grade playground. We now live in the world where Democrats call conservatives Nazis and the latter return the favor with Communist/Socialist labels of their own.

It has been my observation that America’s intelligence level has deteriorated to a level slightly above 4th grade playground. We now live in the world where Democrats call conservatives Nazis and the latter return the favor with Communist/Socialist labels of their own.

Our leading publications and media companies are not that far behind. And while they might use fancier language, the outcome is the same. A shit fight between decent Americans who have been used as pawns in the wicked games of their bloody overlords.

So, it is not surprising that a well written and thought out piece of information is hard to come by these days. Luckily, today is one of those days. I highly encourage you to read this article from Paul Craig Roberts in full.

The Two Superpowers: Who Really Controls the Two Countries?

Paul Craig Roberts

Among the ruling interests in the US, one interest even more powerful than the Israel Lobby—the Deep State of the military/security complex— there is enormous fear that an uncontrollable President Trump at the upcoming Putin/Trump summit will make an agreement that will bring to an end the demonizing of Russia that serves to protect the enormous budget and power of the military-security complex.

You can see the Deep State’s fear in the editorials that the Deep State handed to the Washington Post (June 29) and New York Times (June 29), two of the Deep State’s megaphones, but no longer believed by the vast majority of the American people. The two editorials share the same points and phrases. They repeat the disproven lies about Russia as if blatant, obvious lies are hard facts.

Both accuse President Trump of “kowtowing to the Kremlin.” Kowtowing, of course, is not a Donald Trump characteristic. But once again fact doesn’t get in the way of the propaganda spewed by the WaPo and NYT, two megaphones of Deep State lies.

The Deep State editorial handed to the WaPo reads: “THE REASONS for the tension between the United States and Russia are well-established. Russia seized Crimea from Ukraine, instigated a war in eastern Ukraine, intervened to save the dictatorship of Syrian President Bashar al-Assad, interfered in the U.S. presidential election campaign to harm Hillary Clinton and help Donald Trump, poisoned a former intelligence officer on British soil and continues to meddle in the elections of other democracies.”

The WaPo’s opening paragraph is a collection of all the blatant lies assembled by the Deep State for its Propaganda Ministry. There have been many books written about the CIA’s infiltration of the US media. There is no doubt about it. I remember my orientation as Staff Associate, House Defense Appropriation Subcommittee, when I was informed that the Washington Post is a CIA asset. This was in 1975. Today the Post is owned by a person with government contracts that many believe sustain his front business.

And don’t forget Udo Ulfkotte, an editor of the Frankfurter Allgemeine Zeitung, who wrote in his best seller, Bought Journalism, that there was not a significant journalist in Europe who was not on the CIA’s payroll. The English language edition of Ulfkotte’s book has been suppressed and prevented from publication.

The New York Times, which last told the truth in the 1970s when it published the leaked Pentagon Papers and had the fortitude to stand up for its First Amendment rights, repeats the lies about Putin’s “seizure of Crimea and attack on Ukraine” along with all the totally unsubstantiated BS about Russia interfering in the US president election and electing Trump, who now kowtows to Putin in order to serve Russia instead of the US. The editorial handed to the NYT insinuates that Trump is a threat to the national security of America and its allies (vassals). The problem, the NYT declares, is that Trump is not listening to his advisors.

Shades of President John F. Kennedy, who did not listen to the CIA and Joint Chiefs of Staff about invading Cuba, nuking the Soviet Union, and using the false flag attack on America of the Joint Chiefs’ Northwoods Project (look it up online). Is the New York Times setting up Trump for assassination on the grounds that he is lovey-dovey with Russia and sacrificing US national interests?

I would bet on it.

While the Washington Post and New York Times are telling us that if Trump meets with Putin, Trump will sell out US national security, The Saker says that Putin finds himself in a similar box, only it doesn’t come from the national security interest, but from the Russian Fifth Column, the Atlanticist Integrationists whose front man is the Russian Prime Minister Medvedev, who represents the rich Russian elite whose wealth is based on stolen assets during the Yeltsin years enabled by Washington. These elites, The Saker concludes, impose constraints on Putin that put Russian sovereignty at risk. Economically, it is more important to these elites for financial reasons to be part of Washington’s empire than to be a sovereign country. http://thesaker.is/no-5th-column-in-the-kremlin-think-again/

I find The Saker’s explanation the best I have read of the constraints on Putin that limit his ability to represent Russian national interests.

I have often wondered why Putin didn’t have the security force round up these Russian traitors and execute them. The answer is that Putin believes in the rule of law, and he knows that Russia’s US financed and supported Fifth Column cannot be eliminated without bloodshed that is inconsistent with the rule of law. For Putin, the rule of law is as important as Russia. So, Russia hangs in the balance. It is my view that the Russian Fifth Column could care less about the rule of law. They only care about money.

As challenged as Putin might be, Chris Hedges, one of the surviving great American journalists–who is not always right but when he is he is incisive–explains the situation faced by the American people. It is beyond correction. American civil liberties and prosperity appear to be lost. https://russia-insider.com/en/politics/america-shows-many-signs-impending-catastrophic-collapse-pulitzer-prize-winner-explains

In my opinion, Hedges leftwing leanings caused him to focus on Reagan’s rhetoric rather that on Reagan’s achievements—the two greatest of our time—the end of stagflation, which benefited the American people, and the end of the Cold War, which removed the threat of nuclear war. I think Hedges also does not appreciate Trump’s sincerity about normalizing relations with Russia, relations destroyed by the Clinton, George W. Bush, and Obama regimes, and Trump’s sincerity about bringing offshored jobs home to American workers. Trump’s agenda puts him up against the two most powerful interest groups in the United States. A president willing to take on these powerful groups should be appreciated and supported, as Hedges acknowledges the dispossessed majority do. If I might point out to Chris, whom I admire, it is not like Chris Hedges to align against the choice of the people. How can democracy work if people don’t rule?

Hedges writes, correctly, “The problem is not Trump. It is a political system, dominated by corporate power and the mandarins of the two major political parties, in which we [the American people] don’t count.”

Hedges is absolutely correct.

It is impossible not to admire a journalist like Hedges who can describe our plight with such succinctness:

“We now live in a nation where doctors destroy health, lawyers destroy justice, universities destroy knowledge, the press destroys information, religion destroys morals, and banks destroy the economy.”

Read The Saker’s explanation of Russian politics. Possibly Putin will collapse under pressure from the powerful Fifth Column in his government. Read Chris Hedges analysis of American collapse. There is much truth in it. What happens if the Russian people rise up against the Russian Fifth Column and if the oppressed American people rise up against the extractions of the military/security complex? What happens if neither population rises up?

Who sets off the first nuclear weapon?

Our time on earth is not just limited by our threescore and ten years, but also humanity’s time on earth, and that of every other species, is limited by the use of nuclear weapons.

It is long past the time when governments, and if not them, humanity, should ask why nuclear weapons exist when they cannot be used without destroying life on earth.

Why isn’t this the question of our time, instead of, for example, transgender toilet facilities, and the large variety of fake issues on which the presstitute media focuses?

The articles by The Saker and Chris Hedges, two astute people, report that neither superpower is capable of making good decisions, decisions that are determined by democracy instead of by oligarchs, against whom neither elected government can stand.

If this is the case, humanity is finished.

Investment Grin Of The Day

Trump Becomes An Inflation Expert Overnight – Launches Unprecedented Attack On The FED

Another negative week with the Dow Jones down 309 points (-1.25%) and the Nasdaq down 182 points (-2.36%)

This week’s downside was very much anticipated. At least based on our internal mathematical and timing calculations. Having said that, earlier in the week the stock market found itself under increasingly oversold conditions and with bearish sentiment soaring.

So, will these conditions deteriorate even further or is it time to load up on stocks? Unfortunately, the answer is not that simple. If you would like to find out what the stock market will do next, based on our timing and mathematical work, please Click Here

Let’s talk about inflation and Trump’s stunning attack on the FED.

Key US inflation indicator hits 6-year high

A key measure of US inflation hit a six-year high in May, matching the central bank’s target in another sign price pressures are finally rising, the government reported Friday.

The long-awaited rise in the Personal Consumption Expenditures price index, the Federal Reserve’s preferred inflation measure, came amid a slight slowdown in consumer spending last month, according to the Commerce Department.

The weak spending could weigh on GDP growth in the second quarter, but incomes posted sharp gains.

On an annual basis, the PCE price index hit 2.3 percent, the highest since March 2012.

Now, we can argue about the validity of this inflation data until the cows come home, but my opinion remains the same. Recent inflationary spike, mostly due to QE, zero interest rates and Trump’s tax cuts, will very soon go deflationary as the pendulum swings the other way. It is important to remember that ALL debt binges eventually end in deflationary collapses. And we are in a historic one right now.

Yet, that is not the most important variable to consider here. This is…..

It’s been decades since the White House has warned the Fed the way Kudlow just did

It has been a long time —the early 1990s in fact— since a White House tried to influence Federal Reserve policy the way Trump economic advisor Larry Kudlow did on Friday.

In an interview with Fox Business Network, Kudlow jawboned the Fed, saying: “My hope is that the Fed, under its new management, understands that more people working and faster economic growth do not cause inflation.”

“My hope is that they understand that and that they will move very slowly,” he added.

Let’s not kid ourselves. The FED is anything but independent. Their mandate is not necessarily to maintain price stability, at least not anymore, but to keep today’s highly leveraged economy and financial markets afloat…..whatever the means.

In that regard Trump’s request is dead on. Stop raising interest rates and let inflation run. That way Mr. Trump can continue to praise soaring capital markets, telling everyone how great his economy is in the process. What Else Do ‘Trade War Loving’ Presidents Trump & Hoover Have In Common??? – Meet The Stock Market Trajectory

Having said that, I continue to maintain that both Mr. Trump and the FED and in for a rude awakening. No matter what they do going forward or what President Trump forces them to do.

The FED is stuck between a rock and a container full of TNT. Should they fail to reload for the next recession, the market/economy might crash and never come back. At least for a very long time. Should they continue to rise, things will break. As today’s inverting yield curve clearly suggests.

In this environment the right financial analysis is more important than ever. As our timing and mathematical work suggests, what happens next is complicated. As it should be considering recent cross currents and unstable White House. Once again, if you would like to find out what happens next, at least in the stock market and the US Economy, please Click Here

Living In The Twilight Zone: Peter Schiff Rages Just About Everything

Investment Grin Of The Day

The ‘Unintended’ Consequences Of Trump’s Asinine Protectionism

A positive day with the Dow Jones up 98 points (+0.41%) and the Nasdaq up 58 points (+0.79%)

Today’s market action was nearly ideal if we consider our overall forecast.

As was discussed in our Intraday section, we were expecting a bottom at the open or within the first 60 minutes of trading. We got the said bottom at 9:45 AM EST at 23,997 on the Dow. This is exactly where…….if you would like to see the rest of our internal forecast, please Click Here.

We have been arguing for quite some time that President Trump has no idea what he is doing when it comes to trade. He is not protecting anyone and he is most certainly not MAGA, he is simply collapsing a corrupt system at peak bubble. I will leave it for you to decide if that is good or bad, just rest assured that millions of American jobs and today’s overpriced/overlevereged stock market will soon go up in smoke.

This is a wonderful look at the subject matter and the damage Mr. Trump has already done.

Trade War Hits Home: Trump’s Asinine Protectionism

Donald Trump is unjustifiably furious with Harley-Davidson for responding to tariffs in ways that any business in competitive markets must – namely, by minimizing its exposure to these government-imposed artificially higher costs (“Trump’s Motorcycle Club Revenge,” June 27). And he screeches like a banana-republic authoritarian when he threatens to impose more punitive taxes on Harley.

Finally, Trump reveals his cluelessness about competitive business when he suggests that, in moving more production overseas, Harley will suffer because Harley’s “customers are already very angry at them.” Obviously, Harley believes that its customers would be even more angry with it if it charges the higher prices that it must charge were it not to escape as much as possible the higher costs created by Trump’s asinine protectionism.

Don Boudreaux at Cafe Hayek puts it succinctly “Trump is insufferably stupid and officious on matters of trade.“

Indeed he is.

Paul Craig Roberts has the best advice for President Trump.

When are America’s global corporations and Wall Street going to sit down with President Trump and explain to him that his trade war is not with China but with them? The biggest chunk of America’s trade deficit with China is the offshored production of America’s global corporations. When the corporations bring the products that they produce in China to the US consumer market, the products are classified as imports from China.

Until the above happens, prepare for implosion.

Our stock market mathematical works points towards something very interesting in that regards. If you would like to find out what happens next, based on our timing and mathematical work, please Click Here