– State of the Market Address:

– State of the Market Address:

- The Dow is now above 25,000

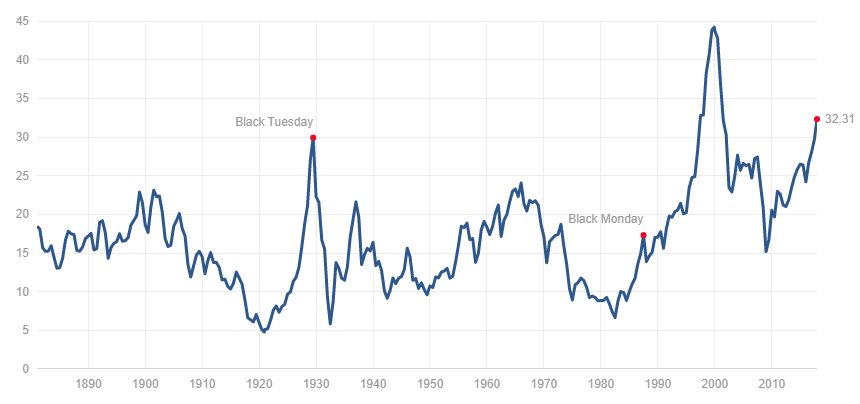

- Shiller’s Adjusted S&P P/E ratio is now at 33.27 Now at arguably the highest level in history (if we adjust for 2000 distortions) and still above 1929 top of 29.55.

- Weekly RSI at 88 – overbought. Daily RSI is at 81 – overbought.

- Prior years corrections terminated at around 200 day moving average. Located at around 18,700 today (on weekly).

- Weekly Stochastics at 97 – overbought. Daily at 97 – overbought.

- NYSE McClellan Oscillator is at +26. Neutral.

- Volatility measures VIX/VXX remains at suppressed levels. Commercial VIX long interest decreased to 50K contracts net long.

- Last week’s CTO Reports suggest that commercials (smart money) have maintained their positioning. For now, the Dow is 8X, the S&P is at 4X net short, Russell 2000 is now at 4X net short and the Nasdaq is net neutral.

In summary: For the time being and long-term, the market remains in a clear bull trend. Yet, a number of longer-term indicators suggest the market might experience a substantial correction ahead. Plus, the “smart money” is positioning for some sort of a sell-off.

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.

ATTENTION!!! Please note, we have moved most of our free editorial content to our new website MarketSpartans.com Please Click Here to view it.

ELLIOTT WAVE UPDATE:

Since many people have asked, I will attempt to give you my interpretation of Elliott Wave and how it is playing out in the market. First, I must admit. I don’t claim to be an EW expert, but I hope my “standard” interpretation is of help.

Let’s take a look at the most likely recent count on the S&P.

Explanation:

Long-Term: It appears the S&P is quickly approaching the termination point of its (5) wave up off of 2009 bottom. If true,we should see a massive sell-off later this year. Did it already complete? Click Here

Short-Term: It appears the S&P might have completed its intermediary wave 3 and now 4. It appears the market is now pushing higher to complete wave 5 of (5). If true, the above count should terminate the bull market. Did it already complete? Click Here

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.

ATTENTION!!! Please note, we have moved most of our free editorial content to our new website MarketSpartans.com Please Click Here to view it.

– State of the Market Address:

– State of the Market Address:

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please