Sometimes I read something that really gets my blood boiling. Here is the latest from the Ponzi Operators who are literally running our country into the ground.

Evans Says Fed Must Convince Public It Will Allow More Inflation

“In order to dispel any impression that 2 percent is a ceiling, our communications should be much clearer about our willingness to deliver on a symmetric inflation outcome, acknowledging a greater chance of inflation at 2.5 percent in the future than what has been communicated in the past,” he said in remarks prepared for a speech in London.

“I am concerned that persistent factors are holding down inflation, rather than idiosyncratic transitory ones,” Evans said, citing declines in various measures of inflation expectations in recent years.

“By and large, central bankers are conservative types who view their most important task as preventing an outbreak of 1970s-style inflation,” he said. “So perhaps then it’s not surprising that we as a group have not convincingly demonstrated to the public our commitment to a symmetric inflation target.”

Excuse my language, but these so called “smart guys” are f#*$ing morons in suits.

I am not sure how many times I have to repeat myself here, but here we go. The FED is wondering where in the world inflation is after pumping Trillions of dollars into the economy through zero interest rates and QE.

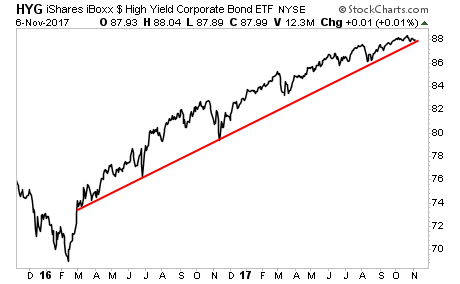

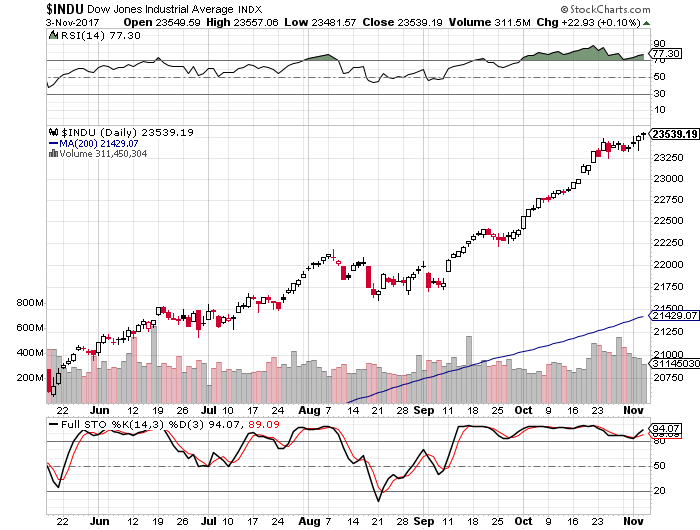

The inflation they seek is responsible for blowing up historic bubbles of unbelievable proportions in the stock market, the bond market, the art market, the real estate market, Bitcoin, etc….

Basically, all speculative assets.

The debt they have created doing so is deflationary in nature. That is why the real economy cannot get inflation going. As has been the case in Japan. What’s worse, when the velocity of credit runs out, the overall economy will slip back into a deflationary spiral. As bad debts will have to be liquidated.

The only way to avoid a deflationary collapse is through outright monetization. And while slow erosion of the dollar sounds good in theory, any sort of a violent adjustment there can end up being far worse than a deflationary collapse.

Idiots, idiots I tell you!!!

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please Click Here.

– State of the Market Address:

– State of the Market Address:

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please  I am going to propose something outlandish here. President Trump is indeed playing 8 dimensional chess while the rest of us are trying to figure out checkers. Bare with me for a second.

I am going to propose something outlandish here. President Trump is indeed playing 8 dimensional chess while the rest of us are trying to figure out checkers. Bare with me for a second.

– State of the Market Address:

– State of the Market Address: If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please