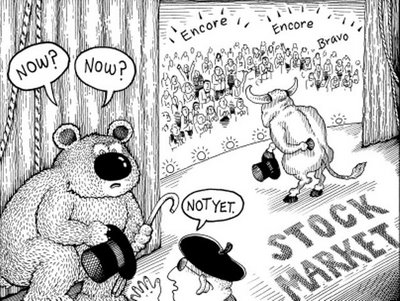

Or so says the mainstream financial media. According to them, you must be some sort of a crazy lunatic not to believe in what the market is doing. After all, the returns are easy and sweet.

I have personally heard it all before at 2000 and 2007 tops. And I have read about the many other instances where the above statement makes a rare appearance. Just take a brief look at how bullish this article is……

Bloomberg: The Cost of Missing the Market Boom Is Skyrocketing

Skepticism in global equity markets is getting expensive.

From Japan to Brazil and the U.S. as well as places like Greece and Ukraine, an epic year in equities is defying naysayers and rewarding anyone who staked a claim on corporate ownership. Records are falling, with about a quarter of national equity benchmarks at or within 2 percent of an all-time high.

“You’ve heard people being bearish for eight years. They were wrong,” said Jeffrey Saut, chief investment strategist at St. Petersburg, Florida-based Raymond James Financial Inc., which oversees $500 billion. “The proof is in the returns.”

To put this year’s gains in perspective, the value of global equities is now 3 1/2 times that at the financial crisis bottom in March 2009. Aided by an 8 percent drop in the U.S. currency, the dollar-denominated capitalization of worldwide shares appreciated in 2017 by an amount — $20 trillion — that is comparable to the total value of all equities nine years ago.

And yet skeptics still abound, pointing to stretched valuations or policy uncertainty from Washington to Brussels. Those concerns are nothing new, but heeding to them is proving an especially costly mistake.

Clinging to such concerns means discounting a harmonized recovery in the global economy that’s virtually without precedent — and set to pick up steam, according to the International Monetary Fund. At the same time, inflation remains tepid, enabling major central banks to maintain accommodative stances.

“When policy is easy and growth is strong, this is an environment more conducive for people paying up for valuations,” said Andrew Sheets, chief cross-asset strategist at Morgan Stanley. “The markets are up in line with what the earnings have done, and stronger earnings helped drive a higher level of enthusiasm and a higher level of risk taking.”

The numbers are impressive: more than 85 percent of the 95 benchmark indexes tracked by Bloomberg worldwide are up this year, on course for the broadest gain since the bull market started. Emerging markets have surged 31 percent, developed nations are up 16 percent.

Big companies are becoming huge, from Apple Inc. to Alibaba Group Holding Ltd. Technology megacaps occupy all top six spots in the ranks of the world’s largest companies by market capitalization for the first time ever.

Up 39 percent this year, the $1 trillion those firms added in value equals the combined worth of the world’s six-biggest companies at the bear market bottom in 2009. Apple, priced at $810 billion, is good for the total value of the 400 smallest companies in the S&P 500.

Overall, U.S. corporate earnings are expected to rise 11 percent this year, on track to be the best profit growth since 2010. And after years of disappointments, European profits are set to climb 14 percent in 2017, Bloomberg data show. The expectations for both regions are are roughly in line with forecasts made at the beginning of the year, defying the usual pattern of analysts downgrading their estimates as the months go by.

Meanwhile, Asia is home to some of the world’s steepest rallies, led by Hong Kong stocks that are up 29 percent this year. Shares in Tokyo also hit fresh decade highs this week, bolstered by investor confidence before the local corporate earnings season and a snap election this month.

“Asia will benefit from continued improving regional growth, stable macroeconomic conditions and undemanding valuations,” said BNP Paribas Asset Management’s head of Asia Pacific equities Arthur Kwong. Any pullback in Asian equities after the year-to-date rally presents a buying opportunity for long-term investors, he wrote in a note.

Global economic growth has been robust in most places, with Europe finally joining the party and the euro-area economy on track for its best year since at least 2010. The region’s steady recovery has eclipsed worries about populism, which a few years ago would have been enough to derail any stock market rally.

“I’ve never been so optimistic about the global economy,” said Vincent Juvyns, global market strategist at J.P. Morgan Asset Management. “Ten years after the financial crisis, Europe is recovering and we have synchronized economic growth around the world. Even if we get it wrong on a country or two, it doesn’t change the big picture, which is positive for the equity markets.”

Alright, alright……..I am a believer. Here, take my money and buy me those FANG things. And don’t forget some Bitcoin. I’ve never been so optimistic about any of this.

On a more serious note and if you recall, these views were nowhere to be found at 2016 lows. On the contrary, many of the same people were expecting a collapse. Now they are as optimistic as ever. Perhaps that should be taken as a warning sign.

Finally and if history is any guide, be careful, the market might wipe out the above gains and excitement in a matter of days. Sending the cost of participating in this rally to the moon and back.

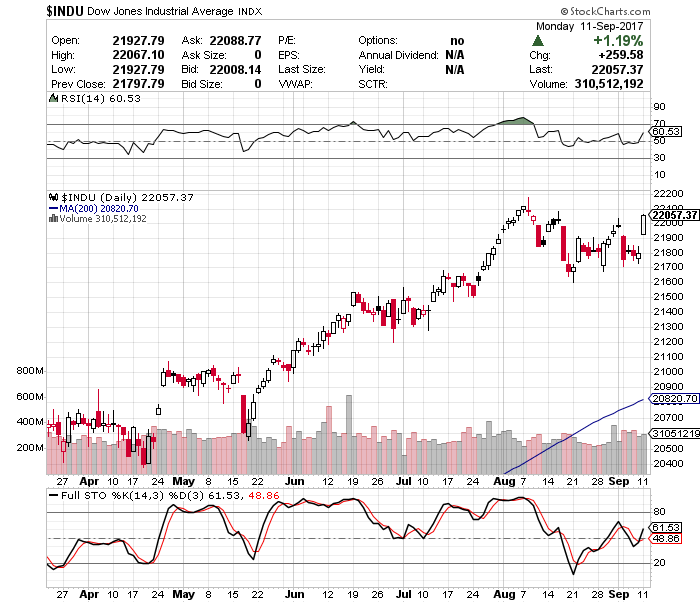

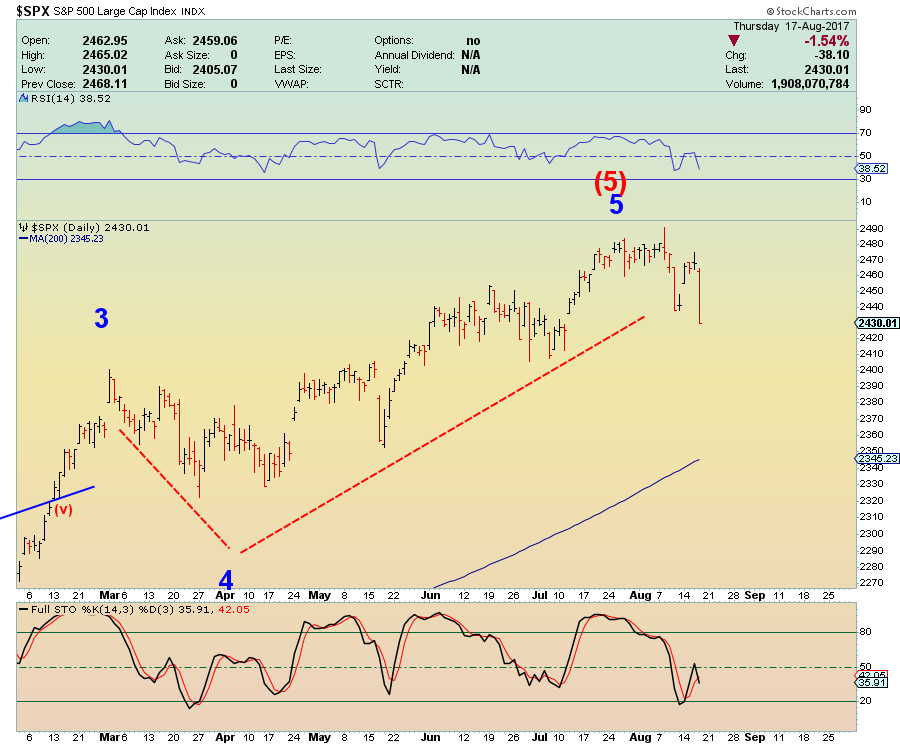

In terms of the stock market, the situation is incredibly complex. If you would like to find out what happens next, based on our mathematical and timing work, please Click Here.

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please  – State of the Market Address:

– State of the Market Address: If you are semi-aware of what is going on in the world you are familiar with the fact that Mr. Kim has been pocking Mr. Trump in the eye with his never ending and annoying missile launches. And doing so fairly successfully I might add.

If you are semi-aware of what is going on in the world you are familiar with the fact that Mr. Kim has been pocking Mr. Trump in the eye with his never ending and annoying missile launches. And doing so fairly successfully I might add. If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

If you would like to find out exactly what happens next based on our Timing and Mathematical work, please

– State of the Market Address:

– State of the Market Address: State of the Market Address:

State of the Market Address: