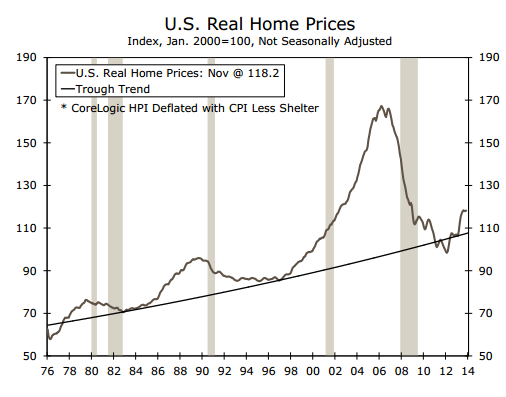

In another sign that the “Dead Cat Bounce” for the Real Estate market is now over, Blackstone Group has announced that it’s real estate acquisition pace has slowed 70% from last years pace due to higher prices. In fact, this is the trend seen across the industry. Investors, hedge funds, institutions are all slowing down their real estate acquisitions to the tune of 70-90%.

“The institutional wave has passed,” Gray, who oversees almost $80 billion in property investments, said in a telephone interview. “It’s at a much lower level than it was 12 or 24 months ago.”

What happens next?

Easy. The real estate market might hover here for some time. Not too long thought. As soon the Bear Market of 2014-2017 hits and the US falls back into a severe recession, you will see housing going down once again. Once investors realize where we are in the real estate cyclical composition (dead cat bounce and not expansion) you will see the likes of Blackstone trying to get rid of their properties as fast as possible. With investors heading for the doors, mass volume of real estate should hit the market. Collapsing existing values just as fast, if not faster, than their initial ascend between 2010-2014.

Good luck selling your 43,000 rental properties Blackstone.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

What Happens When Blackstone Starts Dumping Real Estate At Market? Google

Blackstone Group LP (BX) is slowing its purchases of houses to rent amid soaring prices after a buying binge made it the biggest U.S. single-family home landlord.

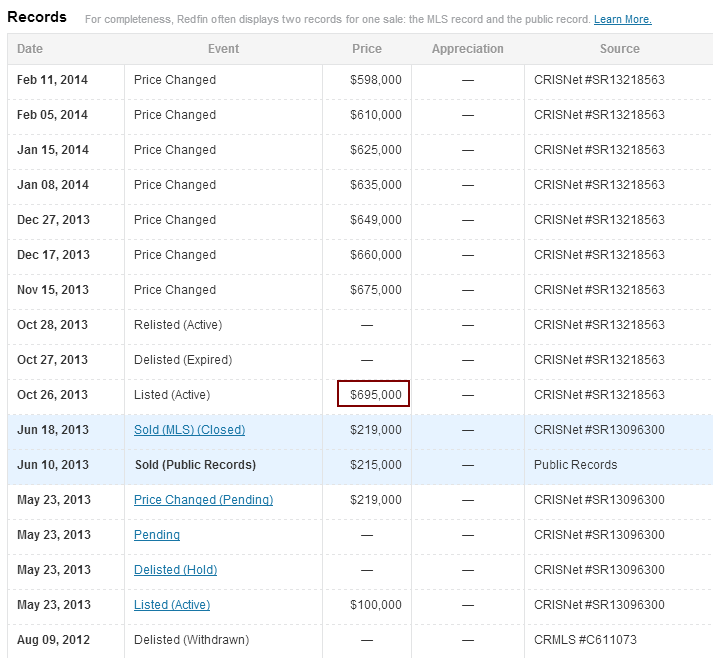

Blackstone’s acquisition pace has declined 70 percent from its peak last year, when the private equity firm was spending more than $100 million a week on properties, said Jonathan Gray, global head of real estate for the New York-based firm. After investing $8 billion since April 2012 to buy 43,000 homes in 14 cities, the company has narrowed most of its purchasing to Seattle, Atlanta, Miami, Orlando and Tampa.

“The institutional wave has passed,” Gray, who oversees almost $80 billion in property investments, said in a telephone interview. “It’s at a much lower level than it was 12 or 24 months ago.”

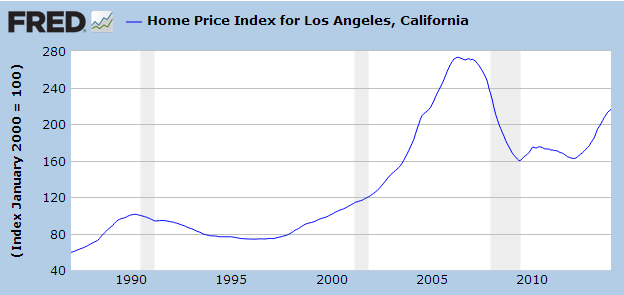

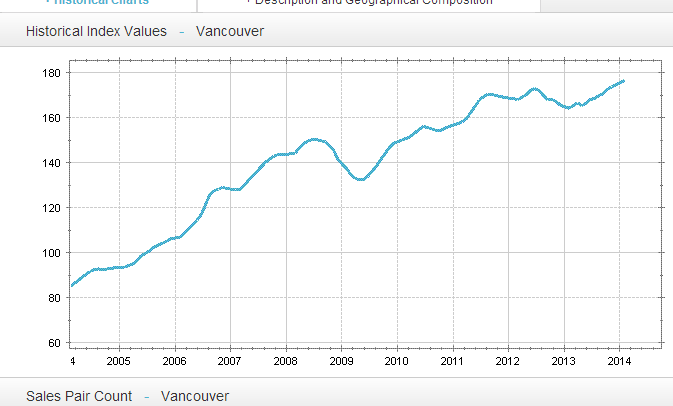

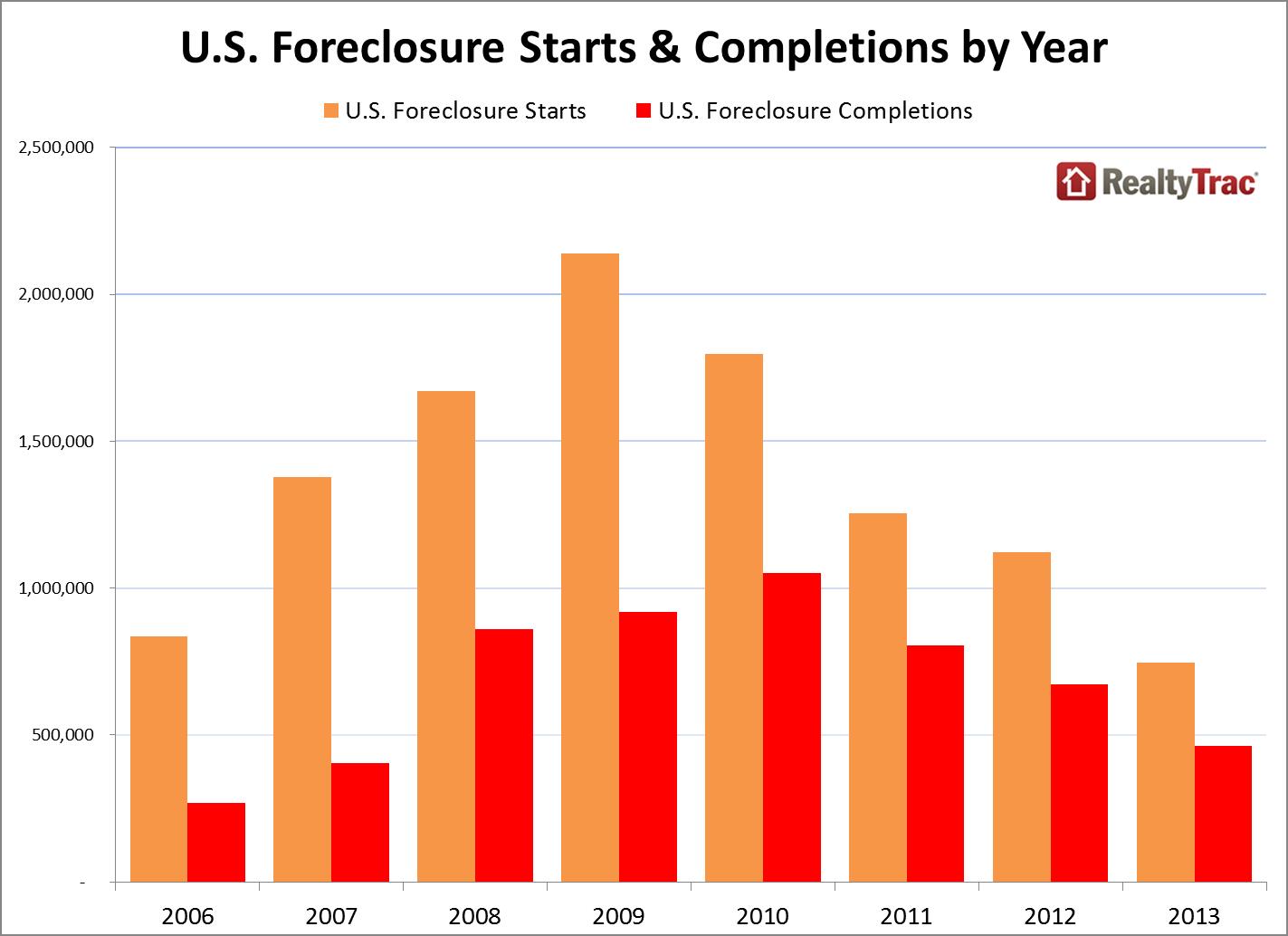

Private-equity firms, hedge funds, real estate investment trusts and other institutional investors have spent more than $20 billion to buy as many as 200,000 rental homes in the last two years. They snapped up properties after prices fell as much as 35 percent from the 2006 peak and rental demand rose from the almost 5 millionowners who went through foreclosure since 2008. PresidentBarack Obama credited the investors for helping put a floor under the plunging housing market and consumer advocates such as the National Community Reinvestment Coalition later blamed them for soaring prices in some cities.

Blackstone Group LP Global head of real estate Jonathan Gray said, “The institutional… Read More

Foreclosures Fall

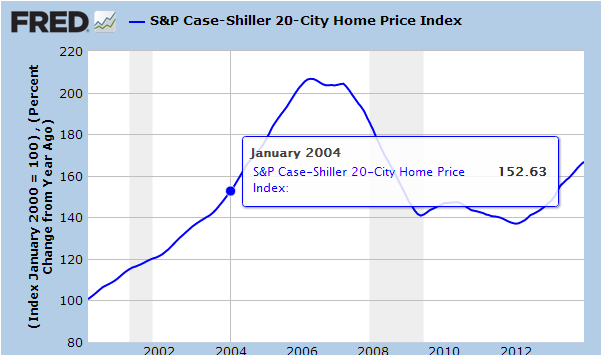

American Homes 4 Rent and Colony American Homes, the second- and third-largest single-family landlords, also have been scaling back as bargains dry up. Home prices have risen 24 percent since a post-bubble low in March 2012, which was about when corporate buyers started their buying spree, according to the S&P/Case-Shiller index. The rate of U.S. foreclosure startsfell to its lowest level in eight years in the fourth quarter as higher prices allowed more delinquent homeowners to sell without taking a loss, according to the Mortgage Bankers Association.

Jade Rahmani, an analyst for Keefe, Bruyette & Woods Inc., said large investors are focusing on fewer locations as they gain experience and prices go up.

“Home prices have increased, which narrows the acquisition opportunity,” Rahmani said. “In addition, these companies have done this for a certain amount of time and there are lessons learned.”

While institutional purchases nationwide fell to a 22-month low in January, corporate investors were more active in the Atlanta region, buying 25 percent of homes sold, according to data firm RealtyTrac. That helped drive up Atlanta prices 37 percent since the March 2012 trough.

Outbidding Homebuyers

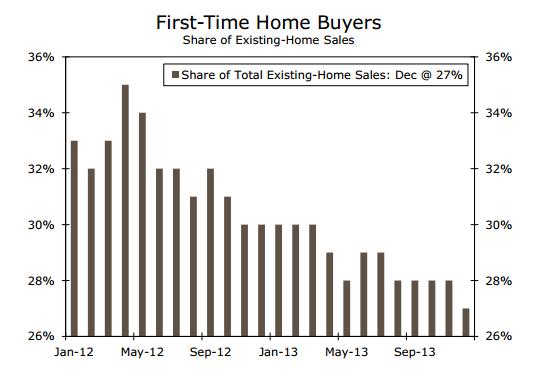

Last week, a group of 80 tenant and neighborhood advocacy organizations, including the National Community Reinvestment Coalition and the National Consumer Law Center, asked federal regulators “to address first-time homebuyers being outbid, tenants being displaced, and neighborhoods undergoing dramatic changes as private equity and investor cash continues flooding into local housing markets.”

Gray, 44, said the influence of corporate investors on home prices has been exaggerated. They represent at most 10 percent of the 2 million homes bought by investors in the last two years, according to Rahmani, the analyst.

“There’s a narrative out there that institutional buyers are driving the market,” Gray said. “But the reality is that institutional buyers are in a relatively limited number of markets, their buying is tapering and yet home prices continue to go up at a pretty strong clip nationally — even in markets where institutional buyers haven’t purchased a single home.”

American Homes

At the height of its activity, Blackstone’s Invitation Homes LP made purchases that may have comprised as much as 6 percent of sales for several months in one or more of its 14 markets, Gray said. This may have had a short-term impact on prices, he added.

“We definitely helped alleviate excess distressed housing stock,” he said. “We weren’t 5 or 6 percent for a sustainable period of time in any market.”

After collecting more than 21,000 homes in 42 markets, American Homes 4 Rent (AMH) has slowed its buying in some locations, chief executive officer David Singelyn said at a March 5 investor conference in Florida. The benefit of being in 22 states is that the Agoura Hills, California-based company has the ability to move within many locations and “buy as the opportunities ebb and flow,” Singelyn said.

Colony Financial Inc. (CLNY), a REIT that invests in Colony American Homes, slowed its funding for acquisitions last year to focus on improving operations, CEO Richard Saltzman said in a November conference call. Colony Financial has been gradually allocating less to the landlord business and capped its investment at $550 million for the quarter ending Dec. 31, Saltzman said last month.

Slowing Purchases

Colony American, which owns 16,000 homes, declined to comment, according to Owen Blicksilver, an outside spokesman for the Scottsdale, Arizona-based landlord. American Homes 4 Rent Chief Financial Officer Peter Nelson didn’t reply to a phone message seeking comment.

American Residential Properties Inc., a landlord with 6,000 homes, slowed acquisitions by almost half in its latest quarter ending Dec. 31. It invested $104 million in 633 homes compared with $204 million on 1,251 homes in the previous quarter, the Scottsdale, Arizona-based company said in a statement.

“We intend to maintain the pace of our acquisition activity at roughly the same rate we had in the fourth quarter,” CEO Stephen Schmitz said in an earnings conference call yesterday.

Ramping Up

Some corporate rental companies are still focused on growth.

“We’ve been ramping up acquisitions,” David Miller, CEO of Silver Bay Realty Trust, which owned 5,642 homes as of Dec. 31, said in a conference call with investors last week.

“Looking ahead, we plan to acquire in Florida and Texas while opportunistically adding properties to our Atlanta market and perhaps other markets as well.”

While their acquisitions slow, Blackstone and Colony are extending their reach into the rental business by offering financing to smaller landlords. Last month, Blackstone’s B2R Finance LP originated its first loan for $5.7 million and Colony formed a joint-venture with plans to originate $1 billion in landlord financing this year.

Both companies plan to package the loans as mortgage-backed securities, similar to Blackstone’s $479 million bond issue in October, the first securitization of single-family rental properties.

Long Haul

That’s concerning to U.S. Representative Mark Takano, a Democrat from California. This month he called for the Consumer Financial Protection Bureau, the Department of Housing and Urban Development, the Securities and Exchange Commission and the Treasury to report on the possible risks of “the recent increase of investor owned rental properties and the development of single-family rental-backed securities.”

Institutional investors are not going away even though their size will remain a modest part of the market, Gray said.

“We’re not selling the homes. We’re building a long-term business,” he said.