Continuation of part 2

Now, before we jump headlong into cycle analysis, we must first look at and address three primary cycle issues.

Issue #1: Why do cycles exist in the stock market?

To begin with, everything in nature is cyclical. If we wish to get very technical and look at the fundamental particles we will learn that everything in nature is energy. That energy itself is in the constant state of cyclical movement where the primary difference between various elements and matter is the rate of vibration or oscillation (which in itself is a cycle).

Since everything in nature is cyclical and the stock market itself represents a natural growth spiral, we can safely assume that the stock market is cyclical as well. Yet, it is a little bit more intricate than that. It is not necessarily the stock market that moves in cyclical fashion, but the human psychology that underlines the stock market. If you study mass human psychology you will soon learn that men go on repeating the same mistakes over and over again. Not only are they incapable of learning from history, but they tend to repeat exactly the same mistakes that their parents and their grandparents had made. .

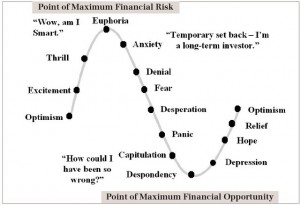

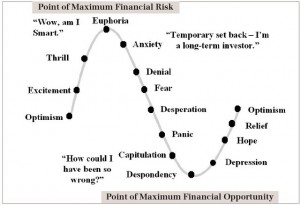

When it comes to the stock market and mass human psychology it is very easy to see how people pool their emotions (or mass delusions) together to justify what the stock market is doing. For instance, 2000 and 2007 stock market tops present us with a perfect opportunity to illustrate just that. In both cases it was clearly visible that market participants are suffering from a mass delusion. With the tech stocks selling beyond any reasonable valuation in early 2000 and with the credit/housing market feeding a massive speculative bubble throughout the entire economy in 2007.

From bottom to growth, from growth to excess, from excess to a decline/collapse. Rinse and repeat. Each one of these cycles servers their purpose, from start to finish. They always had and they always will, for one simple reason. You cannot change the human nature of greed, hope, fear and panic. It will always be within us. The tricky part is identifying these cycles, how long they will last and more importantly, where do they start and end. This section clearly illustrates how to do just that.

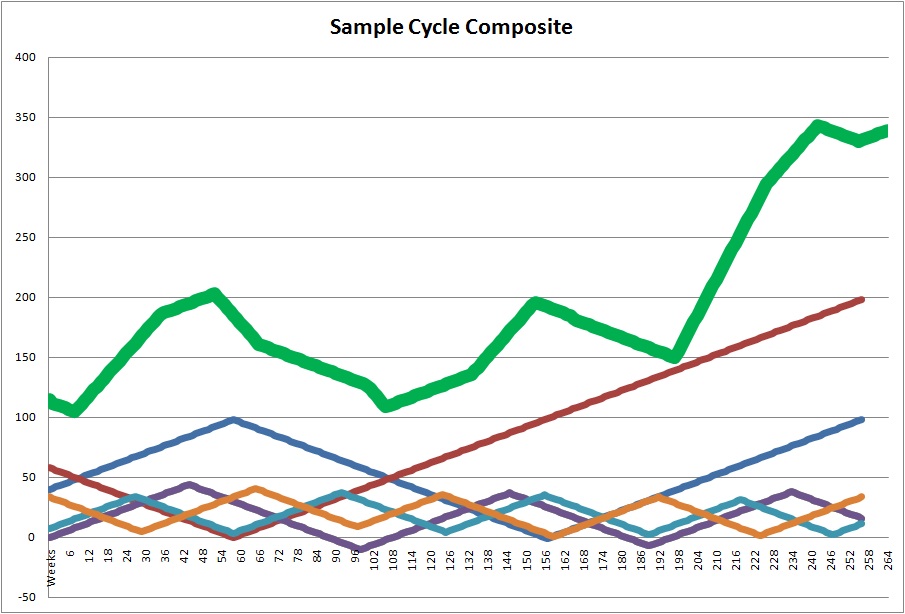

Issue #2: Why do some cycles work perfectly fine over a certain period of time only to break down and never work again?

As mentioned earlier, this issue has caused major headaches for most cycle analyst since the day their craft was born. At times analysts are able to de-trend various cycles out of the market that, at first glance, work perfectly fine. In fact, they might work so well that an analyst might get too comfortable with it. The trouble starts when these cycles brake down and stop working. Eventually they all do. Most analyst have been trying to figure out why that happens, thus far without any luck.

To be continued……

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Timing The Stock Market (Part 3)