In your dreams…. As CNBC Report below indicates “Perfect Storm For Inflation Could Rock The Market”. It shocks me how incompetent our financial media is. This should not come as a surprise since a pretty face, fake boobs and a good quoting/teleprompter reading skills seem to be the only job requirements.

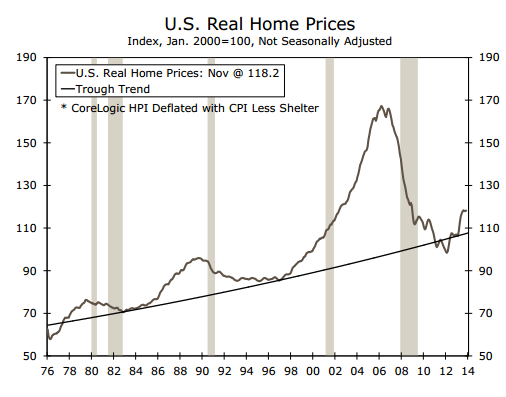

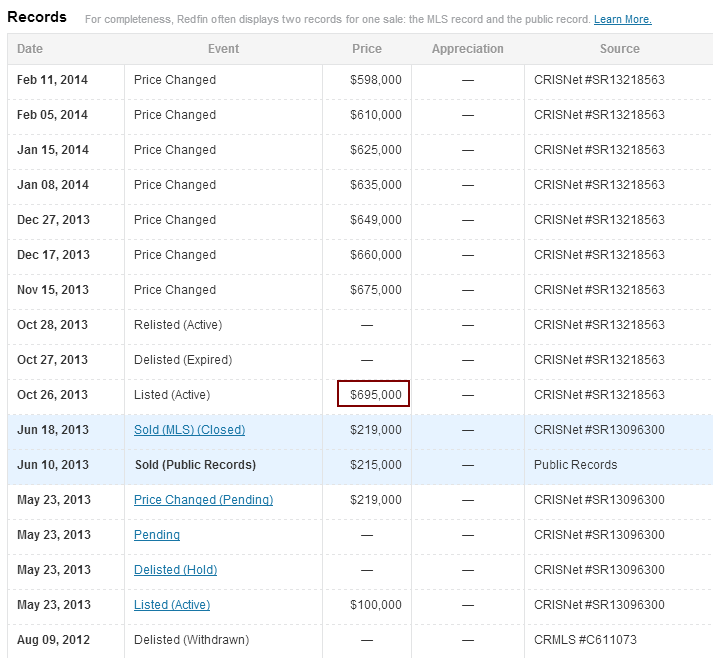

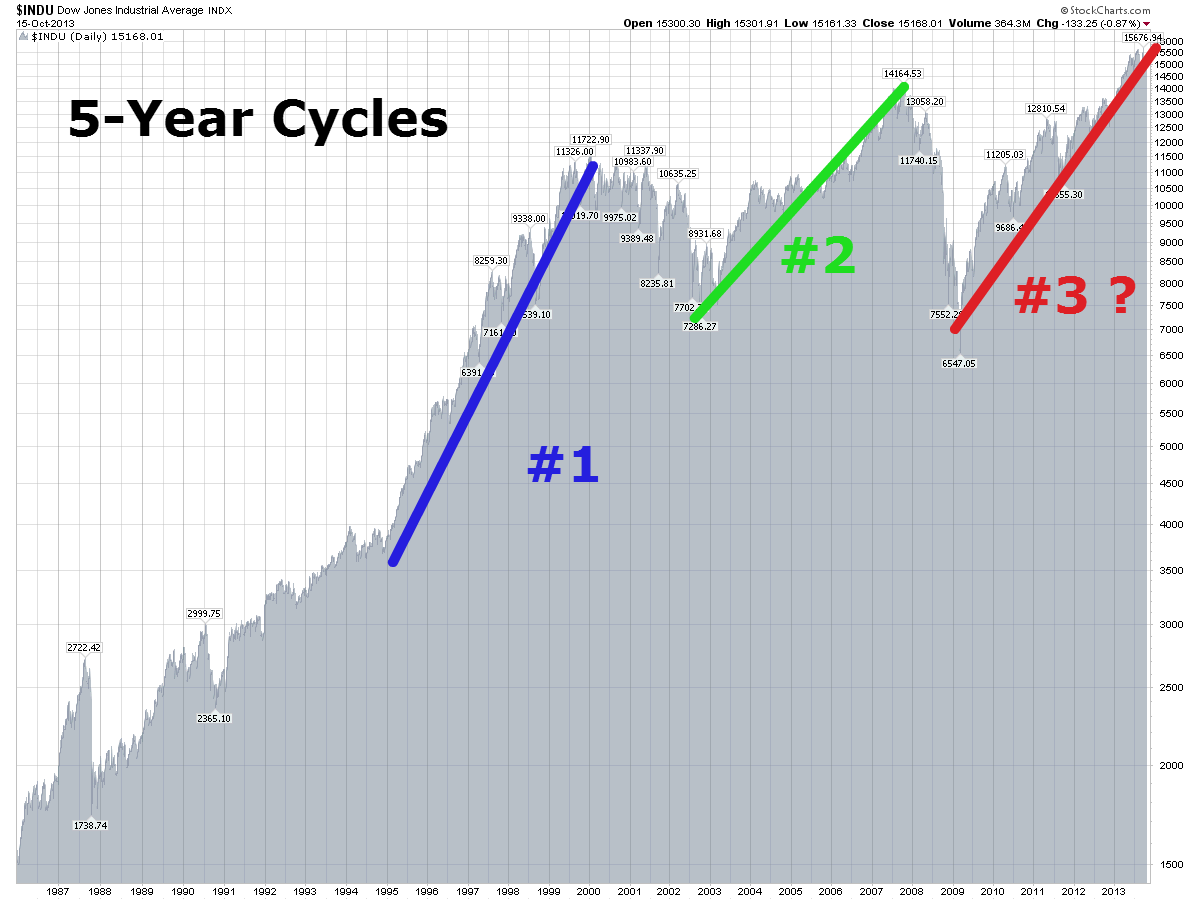

We are already having massive inflation you mindless monkeys of CNBC. However, instead showing up in wages, goods or commodities it is showing up in the stock market and the real estate market. The FEDs have been pumping a tremendous amount of credit into our financial system since 2008, hoping it would spur inflation in every sector of the economy. To their surprise, that didn’t work. Instead, the money flowed towards the stock market and other speculative endeavors. Blowing up massive speculative bubbles in the process.

When the stock market continues its bear market of 2014-2017 you should see the evidence of the underlying deflation instead of inflation. Yes, we will eventually have massive inflation, but that day is way off in the future. First, a deflationary collapse is a must.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

Massive Inflation About To Hit? Google

Perfect storm for inflation could rock the market

As investors cheer the good news for job growth that came with the February employment report, they may be overlooking a troublesome dynamic: A tightening jobs market, in combination with rising commodity costs, could stir inflation, cutting into corporate profits and forcing the Federal Reserve to become more hawkish.

On Friday, the nonfarm payrolls measure showed an increase of 175,000 jobs in February, well above the weather-dampened expectations. And though the unemployment rate ticked up to 6.7 percent from 6.6, the broadest measure of unemployment, the U-6, dropped slightly from 12.7 percent to 12.6 percent—the lowest reading since it was at that level in November 2008.

Since the U-6 counts all unemployed workers, plus marginally attached workers and workers employed part-time for economic reasons, it could be a better measure of the remaining supply in the labor market. The decrease in the U-6 could thus indicate that the “slack” in the labor force—which allows companies to hire more workers without paying more—is decreasing. Once the slack is gone, wage inflation tends to follow.

“Measuring slack is not an easy thing, but an unemployment rate of 6.7 tells you there’s a lot less slack than there used to be,” said Peter Boockvar, chief market analyst at the Lindsey Group. “The idea that all of the people who dropped out of the labor market will magically come back just doesn’t make sense—particularly for the low-end worker who is now enjoying a lot of government benefits. Therefore, the labor market is getting tighter than the Fed thinks.”

As a result, “the inflation trend is going to start moving higher. It’s not a single event that will happen—it’s a process. But it’s definitely worth watching,” he said.

(Read more: Jobs report signals higher interest rates ahead)

The other factor that could contribute to this trend is the recent rise in commodity prices. The CRB commodity index, a broad measure of prices, has risen some 10 percent this year. It’s at its highest level in over a year, due to tough agriculture conditions and winter weather issues that have sharply increased the prices of many commodities. More recently, the crisis in Ukraine seems to have boosted prices of commodities such as wheat and corn.

“Increasing commodity prices will drive a rise in inflation,” predicted Kathy Lien, managing director of FX strategy at BK Asset Management. “It’s a natural reaction to the recent growth as well as the geopolitical uncertainly that is happening in the global economy.”

A broad measure of inflation for the month of February will come on Friday, when PPI-FD is released. This recently revamped version of the Producer Price Index tracks changes in the “final demand” prices paid to producers for goods and services. And because it looks at inflation being experienced by producers, rather than consumers, it is considered an early gauge of the extent to which inflation will be experienced by consumers.

The consensus estimate is for the PPI to show a 0.2 percent month-over-month percentage change for February, while the PPI with food and energy stripped out is expected to come in at just 0.1 percent, according to FactSet.

“Even with the change in methodology, you’re going to start to see the commodity prices moves in these numbers, potentially,” Boockvar said.

Higher commodity prices and faster-than-expected wage growth are actually the two risk factors that legendary bull Jeremy Siegel pointed out in an interview Tuesday in CNBC’s “Futures Now.” He warned that the labor market “could be tighter than we think,” which will create a serious dent in corporate earnings, given that companies will need to pay more to their workers. And the Wharton professor cautioned that if commodity prices continue to rise, then the Fed will need to rethink its dovish activities.

(Read more: Siegel: I’m a bull, but these two things worry me)

After all, the continuation of the Fed’s shrinking quantitative easing program and maintenance of its ultra-low federal funds target rate are premised on low inflation. One major concern about stimulative policies is always that they could spur inflation if used irresponsibly.

In fact, if inflation rises to 2 percent and the headline unemployment rate drops by just another 0.2 percent (to 6.5), then both parts of the Fed’s quantitative guidance regarding what will make the central bank raise the federal funds rate target will be satisfied. And a higher federal funds rate will likely mean higher bond yields across the board, potentially making equities less attractive by comparison.

“The broad consensus is that there’s no inflation. But if there’s one thing that mucks up Fed policy, it’s a faster-than-expected uptick in inflation,” Boockvar said. “If that happens, the Fed isn’t just behind the curve—they’re behind 10 curves.”

That’s why Brian Stutland of the Stutland Volatility Group will be watching PPI so closely, especially as it relates to gold, which is considered an inflation hedge.

“If you see the PPI number start to creep up, that’s maybe the only reason I start to become more bullish about gold,” Stutland said.

However, he adds that if the measure comes in low, as he expects, “that’s going to give me more confidence that the stock market is the place to invest right now.”