Why You Can’t Trust Anything Coming Out Of The MSM

3/25/2019 – A mixed day with the Dow Jones up 14 points (+0.06%) and the Nasdaq down 5 points (-0.07%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Whatever you think of President Trump you have got to be a dead brain primate to even consider the so called Russiagate. That is why we have spent ZERO time on the subject matter on this site. Yet, the following is truly mind numbing…..

Shame Of The Nation: 533,074 Articles Published About Trump/Russia Since May of 2017

Since May 2017, 533,074 web articles have been published about Russia and Trump/Mueller, generating 245 million interactions — including likes, comments and shares — on Twitter and Facebook, according to data from social-media analytics company NewsWhip.

Unfortunately, these are the same people who are telling you that the economy is booming, encoring you to buy the dip and that today “low valuation levles” represent the buying opportunity of a lifetime. Instead, we encourage you to consider the following analysis……

Hello Jerome Powell, We Have Questions

Why does the Fed ignore asset valuation models that do work over the long haul in favor of economic models that admittedly have an “uncertain distance between models and reality”?

Why, Jerome Powell?

Unlike others, I do not believe these are purposeful actions by the Fed for the benefit of banks, so the only logical answer is the Fed does not properly understand what inflation is, how to measure it, or the vast array of problems associated blowing asset bubbles.

In other words, it appears that everyone, including the FED, is flying blind.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Unreal Meltdown …..Imminent Recession

Investment Grin Of The Day

Bullish Investors Proclaim: At Record Valuations Tech Stocks Are Not As Risky As Before – We Are Back On March 25th

A positive week with the Dow Jones up 398 points (1.56%) and the Nasdaq up 280 points (+3.77%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Please Note: Our premium service continues uninterrupted.

A lot of interesting stuff to cover as we push into the weekend……

-

Trump wants a trade deal that includes agriculture. The EU says no.

-

Trump wants Germany to increase military spending, Germany has plans to cut military spending according to Eurointelligence. I do not know if Trump is aware of this yet. Discussion below.

-

Trump wants Germany to scrap Nord Stream 2, a gas pipeline between Russia and the EU underneath the Baltic Sea. The EU sided with Germany.

-

Trump wants the EU to buy US Liquid Natural Gas, but the EU instead will buy from Russia because its cheaper. This is part of the Nord Stream 2 issue…….

U.S. credit card debt hit $870 billion — the largest amount ever — as of December 2018, according to the data from the Federal Reserve. Credit card balances rose by $26 billion from the prior quarter.

“The increase in credit card balances is consistent with seasonal patterns but marks the first time credit card balances re-touched the 2008 nominal peak,” according to the report.

Nearly 480 million credit cards are now in circulation — up by more than 100 million since hitting bottom after the recession a decade ago.

“The tech sector isn’t as cyclical as it used to be,” Dave Lafferty, chief market strategist at Natixis Investment Managers told MarketWatch. He said that while semiconductor stocks remain classic cyclical investments, the rest of the information technology sector — the software and services and technology hardware and equipment industries — have become less cyclical as a result of changes to corporate needs, business models, and maturation of companies once seen as growth names.

Humans may one day have the ability to regrow limbs after scientists at Harvard University uncovered the DNA switch that controls genes for whole-body regeneration.

Some animals can achieve extraordinary feats of repair, such as salamanders which grow back legs, or geckos which can shed their tails to escape predators and then form new ones in just two months.

Planarian worms, jellyfish, and sea anemones go even further, actually regenerating their entire bodies after being cut in half.

Same as it ever was or did Mr.Market just put everyone into a trance?

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Ron Paul Asks: Will Trump End Yemen War?

Investment Wisdom Of The Day

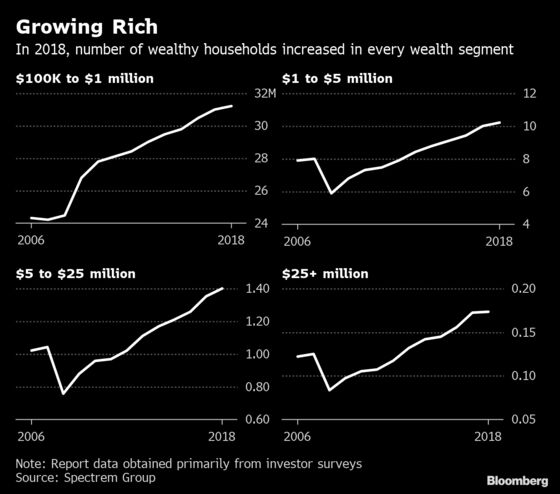

The U.S. Now Has More Millionaires Than……….

3/14/2019 – A mixed day with the Dow Jones up 7 points (+0.03%) and the Nasdaq down 12 points (-0.16%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

We have some wonderful news for a change. Something Mr. Trump is surely to take credit for……

The number of wealthy households in the U.S. reached a new high last year, roughly equivalent to the entire population of Sweden or Portugal. More than 10.2 million households had a net worth of $1 million to $5 million, not including the value of their primary residence, according to a survey by the Spectrem Group. That’s up 2.5 percent from 2017.

Even as the ranks of the mass affluent grew, the pace slowed because of “weakening global economic growth and a contentious U.S. political environment,” said Spectrem Group President George Walper.

I would hate to rain on this wonderfully bullish news, BUT this sort of a thing typically appears at the end of a business expansion cycle. Or, in this case, giant Ponzi Scheme credit expansion cycle.

It shouldn’t come as a surprise that so many people benefited, directly or indirectly, from trillions of artificial credit flowing into the economy. The real question is, as Warren Buffett puts it, how many of these newly minted millionaires are swimming naked as the tide goes out.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.