How much would you pay for this this Pay Per View Event? I would pay quite a bit.

Stock Market Update. March 3rd, 2014

3/3/2014 – The volatility is back with the Dow Jones down -153 points (-0.94%) and the Nasdaq down -31 points (0.72%).

While the rest of the world blames Ukraine and Russia we know better than that. The stock market is tracing out its exact structure. Throughout last week I have warned you that the volatility will back due to a number of significant points of force arriving throughout March. What we are seeing today is clear evidence of that…not in terms of downside, but in terms of volatility. With VIX (volatility index) up 16% today alone and interference patterns abound, March will remain a highly volatile month.

The question everyone is asking….will this be the start of the bear market?

In terms of bear market structure, my mathematical and timing work show, and I continue to believe, today’s gap down must be closed before this up leg from XXXX completes itself and the bear market resumes. In fact, in our weekly update I presented you with an exact price target that must be achieved before the market turns around. I see very little evidence that such a point will not be reached. .

Further, my analysis shows that Ukraine’s hostilities will die down over the next few days, allowing the market some time to close its gap, recover it’s losses and to push higher to our target below.

As reported over the weekend, at this stage I have a number of very strong indications that the market will hit this point before turning around.

Date: XXXX

Price Target: XXXX

(*** Please Note: About 75% of the information contained within this section has been deliberately removed. Particularly, exact dates and prices of the upcoming turning points. As well as trading forecasts associated with them. I deem such information to be too valuable to be released onto the general public. As such, this information is only available to my premium subscribers. If you are a premium subscriber please Click Here to log in. If you would be interested in becoming a subscriber and gaining access to the most accurate forecasting service available anywhere, a forecasting service that gives you exact turning points in both price and time, please Click Here to learn more.Subscription is through lottery only. Don’t forget, we have a risk free 14-day trial).

Hence, I suggest the following positioning over the next few days/weeks to minimize the risk while positioning yourself for a forecasted market action.

If You Are A Trader: XXXX

If No Position: XXXX

If Long: XXXX

If Short: XXXX

Please Note: XXXX is available to our premium subscribers in our + Subscriber Section. It’s FREE to start.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Ukranian Neo-Fascist Trying Their Best To Start A War. Obama & The US Media Buy It

The media war between Ukraine, Russian and the West is going into overdrive.Remember all of those innocent Ukrainians in Kiev wanting freedom, liberty and rainbows? Turns out, a lot of them are Neo-Fascist who hate Jews and Russians. Let’s take a closer look at who is trying to start this war.

Russia Government:

-

Russia dismisses Crimea ultimatum claims as ‘nonsense’: report

- Official: No Russian troops have entered Ukraine across northern border (interfax)

- Russian Duma Speaker: No need to send Russian troops to Ukraine now (interfax)

- Black Sea Fleet denies claims Ukrainian military in the Crimea will be stormed (interfax)

-OR- Ukraine’s Illegitimate Government Ran By Turchynov

- UKRAINE’S TURCHYNOV SAYS SHIPS THREATENED IF ARMS NOT LAID DOWN

- UKRAINE’S TURCHYNOV SAYS SHIPS THREATENED WITH SEIZURE

- UKRAINE’S TURCHYNOV SAYS SITUATION AROUND FLEET IS DANGEROUS

- UKRAINE’S TURCHYNOV SAYS RUSSIA INCREASING CRIMEA FORCES

- UKRAINE’S TURCHYNOV SAYS RUSSIAN BLACK SEA FLEET HAS BLOCKED UKRAINIAN NAVY VESSELS IN SEVASTOPOL BAYS

So, let me ask you. Who is beating the war drum here? Turchynov is begging the West to get involved at any cost. He doesn’t care what that cost is. Never mind that any involvement by NATO might lead to WW 3. It is my hope that the US Government and the US Media wake up, pull their head out of their collective ass and see who it is that they are dealing with. It’s never a good idea to do business with Neo-Fascist.

Here is my quick analysis. Russia is done. They have taken Crimea and they are more than satisfied with that. If no further provocation occurs, media hysteria will die down over the next few days and our financial markets will recover. Cheers!!!

CNBC: Russian officials: “Fascists in power now in Ukraine”

Russia’s Upper Council session on whether or not to approve President Vladimir Putin‘s request to send armed forces to Crimea was akin to traveling back in time, rhetorically speaking.

One Russian legislator said: “Look who came to power now in Ukraine—radicals, nationalists, fascists.”

(Read more: Parliament approves troops)

In fact, the word ‘fascist’ was used several times throughout the debate (though actual debate was limited since the legislators seemed to all be of the same opinion).

Another quoted a Russian poet and signaled that now, “it’s time to use weapons, not words.”

Though the White House said it was monitoring the situation in Crimea closely, Putin and most Russian officials see Obama as extremely weak.

A Russian business source with deep knowledge of Russia’s political, economic, and security situation, who requested anonymity, said morale in the Ukrainian army was low, giving Putin an upper hand.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Ukranian Neo-Fascist Trying Their Best To Start A War. Obama & The US Media Buy It Google

Attention Everyone: Janet Yellen Declares Victory.

As per Bloomberg, just two weeks into her tenure, Janet Yellen has already declaring victory on bond vigilantes. Even though FED’s own minutes (from 2008 collapse) show that they are completely incompetent and don’t really know what is happening in our financial markets, the idiots in our media continue to believe that the FED can somehow control the markets or interest rates.

Again, don’t confuse cause and effect. It is the market and not the FED that lead the economy. While it might look like the FED can control the interest rates, the yield curve and the financial markets, that is never the case. Anyone believing in such absurdity will lose money. Case and point, interest rates are up over 100% in the last 1.5 years. Once this correction is over the interest rates will continue to surge higher (despite upcoming recession).

As a side note, the market likes to Baptize all income Chairman by fire. So was the case with Greenspan in 1987 and Bernanke in 2007-09. With my timing forecasts indicating a severe bear market and recession between 2014-2017, are you ready Janet Yellen?

Yellen Tames Bond Vigilantes With Volatility at Pre-Taper Levels

When it comes to monetary policy, Federal Reserve Chair Janet Yellen is doing all she can to ensure there’s little difference between herself and Ben S. Bernanke. The bond market is taking notice.

Measures of volatility based on interest-rate swaps have plunged this year and are now approaching levels not seen since before the Fed first signaled in May its intention to reduce the unprecedented bond buying that’s supported the U.S. economy, according to data compiled by Bloomberg.

More from Bloomberg.com: Putin Crimea Grab Shows Trail of Warning Signs West Ignored

The relative calm underscores the strides Fed officials have made in reassuring investors that its pullback won’t automatically lead to higher interest rates. After yields on 10-year Treasuries reached a 29-month high at the start of the year, they have since retreated as Yellen pledged to maintain her predecessor’s tapering policy in “measured steps” and keep borrowing costs low to support the U.S. labor market.

“Bond markets understand that Bernanke and now Janet Yellen are talking from the same song sheet,” Neil Mackinnon, a global macro strategist at VTB Capital Plc and former U.K. Treasury official, said in a telephone interview from London on Feb. 24. “The market has bought into the idea that Fed tapering is not tightening.”

More from Bloomberg.com: Winter Storm to Strike New York to Washington Later Today

Treasuries have returned 1.9 percent this year, rebounding from a 3.4 percent annual drop that was the worst since 2009, index data compiled by Bank of America Merrill Lynch show.

Taper Tantrum

Yields on 10-year government bonds, a benchmark for everything from mortgages to car loans and corporate bonds, decreased to 2.65 percent last week from a high of 3.05 percent in January, which was the highest since July 2011. The yield was 2.6 percent as of 11:58 a.m. in New York.

More from Bloomberg.com: Russia Gas Threat Shows Putin Using Pipes to Press Ukraine

Because of the Fed’s quantitative easing, economists including Michael Feroli, the chief U.S. economist at New York-based JPMorgan Chase & Co., warned policy makers last week that a financial-market convulsion similar to the “tantrum” that occurred in 2013 may be unavoidable when the central bank does raise interest rates.

“Whenever the decision to tighten policy is made, then the instability seen in summer of 2013 is likely to reappear,” Feroli, a former Fed economist, and his co-authors Anil Kashyap of the University of Chicago, Kermit Schoenholtz of New York University’s Stern School of Business and Hyun Song Shin of Princeton University, said a Feb. 28 gathering.

In the debt markets, volatility gauges provide a more sanguine outlook.

Anxieties Diminish

The Chicago Board Option Exchange Interest Rate Volatility Index, a measure that reflects the cost for contracts to protect against sudden losses by locking-in fixed rates, tumbled last week to the lowest since May.

Normalized volatility on options for 10-year interest-rate swaps due in six months, a gauge of swings of yields (USGG10YR) on similar-maturity Treasuries, dropped as low as 73.99 basis points last month, the least since May 30.

The lack of skittishness stands in contrast to the surge of volatility set off by Bernanke’s comments in May, when he said policy makers could scale back the Fed’s $85 billion in monthly bond purchases in the “next few meetings.”

That month, implied volatility on the contracts known as swaptions surged by the most since Lehman Brothers Holdings Inc. collapsed in September 2008. Yields on 10-year Treasuries, which fell to a low of 1.61 percent on May 1, eclipsed 3 percent by September and sparked losses in fixed-income assets.

Seasonal Effect

“Much of the 2013 rate volatility was driven by uncertainty in the outlook for Federal Reserve policy,” Jake Lowery, a money manager in Atlanta at ING U.S. Investment Management, which oversees $200 billion, said by telephone on Feb. 25. This year, “the relative certainty in the near-term direction of Fed policy has had its own suppressive effect.”

Although the harsh winter weather contributed to retail sales, manufacturing and housing data that fell short of economists’ estimates, Yellen reiterated on Feb. 27 that the central bank is likely to keep curtailing its stimulus.

The Fed has reduced its purchases of Treasuries and mortgage-backed securities by $10 billion at each of its past two policy meetings and economists surveyed by Bloomberg estimate the central bank will maintain that pace until it stops buying bonds in December.

At the same time, she signaled the Fed is moving away from a year-old commitment to lift interest rates from close to zero once the jobless rate falls below 6.5 percent and will instead provide investors with qualitative guidance on its intentions.

Numerical Threshold

Joblessness (USURTOT) in the U.S. fell to 6.6 percent in January, the lowest since October 2008. Economists surveyed by Bloomberg predict the unemployment rate for February, set to be released on March 7, remained unchanged from the previous month.

“We do want to give markets as much of an indication of how we expect to conduct policy as we can,” Yellen said.

Implied yields on federal funds futures traded on the CME Group Inc.’s exchange now show a 58 percent chance the Fed will boost its benchmark rate, which has been in a range of zero to 0.25 percent since December 2008, in July. That’s seven months after economists predict the Fed will end its bond buying.

As recently as September, traders were pricing in the likelihood that the Fed will lift rates by the start of 2015.

The decline in volatility is evidence that debt investors are underestimating the risk yields will jump as the effects of the weather-related slowdown on the U.S. economy pass, said Vincent Chaigneau, global head of rates and foreign-exchange strategy at Societe Generale SA, one of the 22 primary dealers that are obligated to bid at U.S. government debt auctions.

American Optimism

“The economic data has been very distorted,” Chaigneau said in a Feb. 24 telephone interview from Paris. “By spring, when the data improves again, we’ll get some significant market action. Rates will increase and volatility will increase.”

The U.S. economy will expand 2.9 percent this year, according to forecasters in a Bloomberg survey released on Feb. 13. That’s higher than their projection for 2.6 percent growth at the start of the year and would be the fastest in a decade.

Consumer confidence improved in February from a month earlier as more Americans grew optimistic about the outlook for the economy, according to a Thomson Reuters/University of Michigan sentiment index released last week.

Even with the prospect of more robust economic growth, greater clarity by the Fed will help temper any increase in government bond yields, according to Charles Diebel, fixed-income strategist at Lloyds Banking Group Plc in London.

Fiscal Restraint

Yields on 10-year bonds fluctuated within a 0.22 percentage-point range in February, the narrowest since April 2007, data compiled by Bloomberg show.

“The last thing Yellen wants to do is be unpredictable,” Diebel said in a telephone interview on Feb. 24. “She wants to be as predictable as she possibly can be.”

The $11.8 trillion market for Treasuries may also benefit from a stronger fiscal balance in the U.S. and less political discord, according to Erik Schiller, a Newark, New Jersey-based money manager for Prudential Fixed-Income, which oversees $405 billion.

Faster growth and spending cuts will help narrow the U.S. deficit to 3 percent of the economy this fiscal year, the lowest in seven years, the Congressional Budget Office projected last month. The estimated gap would compare with 9.8 percent in 2009, the widest since at least 1974, and is close to the average of the past four decades, the agency said.

Lawmakers in December passed the first bipartisan budget from a divided Congress in almost three decades, just two months after a political stalemate caused a government shutdown and pushed the U.S. toward its first default. Last month, Congress suspended the nation’s debt limit until March 2015.

We have “relatively stable long-term deficit projections, very low potential policy risk,” Schiller said in a telephone interview. “Both of those are helping to keep things muted.”

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

What Does China Think About Ukraine?

Russia and China go way back and have a wonderful working relationship. This was evident at the beginning of Sochi Olympics when Putin and Jinping had a great time together at the opening ceremony and beyond.

Where was Obama? Oh, that’s right, Obama had tried to prove a point by sending an irrelevant “Gay Delegation”.

Of course, China is watching this situation very carefully, but not for the reasons that you might think. China could care less about Ukraine and at the end of the day is likely to stay out of it. What China is looking for is the level of international response. If Russia is able to get away with Ukraine (as I believe it will), China will be further emboldened to push its agenda in South China Sea and Japanese’s Islands.

Will this have an immediate impact on the US Economy and financial markets? NO. However, all of this will have a significant impact on the overall macroeconomic picture, a picture that will in time impact all of the above.

BEIJING: China, which consistently says it opposes interference in other countries’ internal affairs, is looking to “maintain principles” on Ukraine, it said Monday after Russia insisted the two were in broad agreement.

Moscow has appeared keen to stress that it has a major international ally on its military intervention in Ukraine, and Beijing frequently backs its positions against Western powers on thorny issues, such as the protracted conflict in Syria.

But analysts say China is torn between wanting to support Russia and keeping to its longtime opposition to foreign intervention, especially given its own separatist issues in the far-western region of Xinjiang.

When asked about Ukraine at a regular press briefing on Monday, Chinese foreign ministry spokesperson Qin Gang answered indirectly.

“China has always upheld the principles of diplomacy and the fundamental norms of international relations,” he said.

“At the same time we also take into consideration the history and the current complexities of the Ukrainian issue. It could be said that China’s position is to both maintain principles while also seeking to be realistic.”

Qin also referred to his statement posted on the ministry’s website a day earlier, which said on the one hand that “China has long maintained a principle of non-interference in internal affairs (of other countries), and respects Ukraine’s independence, sovereignty and territorial integrity”.

But it also noted that “there are reasons that the Ukrainian situation is what it is today”.

Niu Jun, a professor of international affairs at Peking University, said China wanted to maintain its relationship with Russia yet had strong concerns about foreign intervention.

“It’s all very inconvenient,” he said. “That’s why they came out with a statement nobody can understand.

“What this statement is really saying is, ‘what Russia did was not right and China does not want to support this military invasion’. But China also wants to support Russia, so it came up with excuses” such as Russia’s history with Crimea and Ukraine’s internal situation, he said.

“Yet at the same time they realise this excuse doesn’t hold water, so they also threw in a mention of sovereignty and territorial integrity.”

Earlier, Moscow’s foreign ministry said in a statement that minister Sergei Lavrov and his Chinese counterpart Wang Yi in a phone call noted “broadly coinciding points of view of Russia and China over the situation that has developed in the country and around it”.

Yet China’s account of the conversation was less direct, saying that the two men “thoroughly exchanged views on the matter” and agreed that “appropriately resolving” the situation was important to regional peace and stability.

Russia has found itself internationally isolated over its covert military intervention in Ukraine and on Monday its stocks and currency collapsed amid fears of a prolonged campaign.

The other members of the G8 on Sunday released a statement condemning Russia for violating international law and suspending their participation in a G8 summit set to be held in Sochi in June.

China is not a member of the G8.

China and Russia cooperated on vetoing three UN Security Council resolutions to put pressure on Syrian President Bashar al-Assad, although they voted through a resolution this month on allowing in humanitarian aid convoys.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Ukraine Is Already Lost. Russia Won, Markets Should Move On

No matter how much huffing and puffing, cursing and table pounding the US and their EU allies will do, Russia has already won. Let’s take a look at the situation from an analytical point of view.

- No one is fighting Russia in Ukraine. Yes, the illegitimate Ukrainian Government has called for “mobilization” and has “declared war” as the Western Media proclaims, but still, no one will join that mobilization nor will anyone fight against Russia. People there are not stupid and will not die for nothing.

- Russia is ready to go to an extreme if need be to keep Ukraine. It is ready to go to war. I don’t think the western world is ready to fight over Ukraine.

- The US and the EU is out of options. The only real option they have is to get NATO involved. However, any such action would quickly escalate into WW 3. It is just my hope that out mentally challenged government is not considering this move.

As such, Ukraine will go to Russia. Our financial markets will soon realize the same and will recover quickly (over the short term). When? Find Out Here

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Ukraine Is Already Lost. Russia Won, Markets Should Move On Google

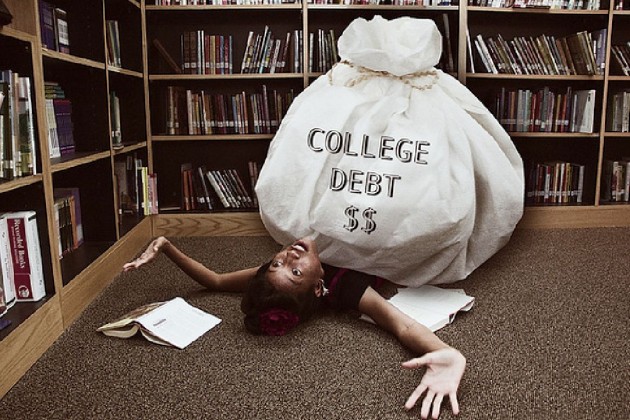

Warning: Student Loans Replace Home Equity ATM’s

Just when I think things can’t possibly get more idiotic and ridiculous, they do. As WSJ reports, tens of thousands (if not hundreds of thousands) of Americans are going back to school in order to take out student loans. Not for education, but to use them as their primary source of income. Once you think about it, it does make perfect sense and I do not blame the people trying to get whatever money they can in order to bridge their expense gap.

I guess this so called 6.6% unemployment is not working for everyone. I do blame the FEDs and the idiots at every level of our government. The situation we see today is the direct result of monetary policy implemented over the last 2 decades. Somehow, the fools believe that they can simply print money and insure that everything goes on as it should. Of course, it works until it doesn’t.

We have already experienced a number of sever bear markets since the 2000 top. With one more bear market and a severe recession left of the clock (2014-2017), it is my hope that the American people wake up and demand answers from their Government. But I will not be holding my breath. For most Americans, watching “The Biggest Loser” is a lot more important than understanding macroeconomic issues at hand. Oh well.

WSJ Writes: Student Loans Entice Borrowers More for Cash Than a Degree

Some Americans caught in the weak job market are lining up for federal student aid, not for education that boosts their employment prospects but for the chance to take out low-cost loans, sometimes with little intention of getting a degree.

Take Ray Selent, a 30-year-old former retail clerk in Fort Lauderdale, Fla. He was unemployed in 2012 when he enrolled as a part-time student at Broward County’s community college. That allowed him to borrow thousands of dollars to pay rent to his mother, cover his cellphone bill and catch the occasional movie.

“The only way I feel I can survive financially is by going back to school and putting myself in more student debt,” says Mr. Selent, who has since added $8,000 in student debt from living expenses. Returning to school also gave Mr. Selent a reprieve on the $400 a month he owed from previous student debt because the federal government doesn’t require payments while borrowers are in school.

A number of factors are behind the growth in student debt. The soft jobs recovery and the emphasis on education have driven people to attain more schooling. But borrowing thousands in low-rate student loans—which cover tuition, textbooks and a vague category known as living expenses, a figure determined by each individual school—also can be easier than getting a bank loan. The government performs no credit checks for most student loans.

College officials and federal watchdogs can’t say exactly how much of the U.S.’s swelling $1.1 trillion in student-loan debt has gone to living expenses. But data and government reports indicate the phenomenon is real. The Education Department’s inspector general warned last month that the rise of online education has led more students to borrow excessively for personal expenses. Its report said that among online programs at eight universities and colleges, non-education expenses such as rent, transportation and “miscellaneous” items made up more than half the costs covered by student aid.

The report also found the schools disbursed an average of $5,285 in loans each to more than 42,000 students who didn’t log any credits at the time. The report pointed to possible factors such as fraud in addition to cases of people enrolling without serious intentions of getting a degree.

Capella Education Co., which runs online schools, examined student costs and debt at institutionspublic and privatein Minnesota and concluded that between a quarter and three-quarters of loans taken out by students were for non-education expenses. At one of Capella’s master’s programs, the typical graduate left with about $30,200 in student debt even though tuition, fees and book costs totaled roughly $18,800. Borrowers are prohibited under federal law, except in rare instances, from discharging student debt through bankruptcy.

The share of student borrowers taking out the maximum amount of loans—$12,500 a year for undergraduates—has risen since the recession. In the 2011-12 academic year, federal Education Department data show, 68% of all undergraduate borrowers hit the annual loan ceiling, up from 60% in 2008.

Research suggests a fair chunk of that is going to non-education expenses. In 2011-12, about a quarter of student borrowers took out loans that exceeded their tuition, after grants, by $2,500, according to research by Mark Kantrowitz, a higher-education analyst and publisher of the education site Edvisors.com.

Some students say they intend to get a degree but must borrow as much as possible because they can’t find decent-paying jobs to cover day-to-day expenses.

Tommie Matherne, a 32-year-old married father of five in Billings, Mont., has been going to school since 2010, when he realized the $10 an hour he was making as a mall security guard wasn’t covering his family’s expenses. He uses roughly $2,000 in student loans each year to stock his fridge and catch up on bills. His wife is a stay-at-home mother who also gets loans to take online courses.

“We’ve been taking whatever we can for student loans every year, taking whatever we have left over and using it to stock up the freezer just so we have a couple extra months where we don’t have to worry about food,” says Mr. Matherne, who owes $51,600 in federal loans.

Some students end up going deeper into debt. Early last year, when Denna Merritt lost her long-term unemployment benefits, the 49-year-old Indianapolis woman enrolled part-time at the Art Institute of Pittsburgh’s online program, aiming for a degree in graphic design. She took out $15,000 in federal loans, $2,800 of which went to catch up on unpaid bills, including utilities, health-insurance premiums and cable.

“Obviously, it’s better not to use it that way if you can help it, because you’re just going to owe that much more later,” says Ms. Merritt, a former bookkeeper.

The government lets students use a portion of federal loans for living expenses on the grounds that it allows students to devote more time to studying and improves their chances of graduating. Even when schools suspect students are over-borrowing, they are restricted by federal law and Education Department policy from denying funds.

College and university trade groups are pushing legislation this year to set lower maximum loan limits for some types of students, such as part-timers. Dorie Nolt, spokeswoman for Education Secretary Arne Duncan, says the Obama administration is “exploring alternatives to see how we might ensure that students don’t borrow more than necessary.”

Mr. Selent, of Fort Lauderdale, knows he is getting himself deeper in a hole but prefers that to the alternative of making minimum wage. In his 20s, he earned a bachelor’s degree in communications from a local for-profit school but couldn’t find a job in the field after graduating and began falling behind on his student-loan bills. He is now taking courses for a degree in theater so he can become an actor.

Meanwhile, federal loans allow him to cover any needs that arise during the semester. Says Mr. Selent: “It keeps me from falling apart.”

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Gold Bugs Are Celebrating Today. Should You Join Them?

Gold surged $25 higher at the open today in response to geopolitical events happening in Ukraine and Russia. With the price now at 4 months high, the question on everyone’s mind is….Should we buy gold? Is the Gold sell off over? Is the new Gold bull leg about to begin?

I believe so. While I do not have a position in Gold (just yet), I believe that Gold is starting a bull run here. The miners have been oversold for quite some time and recently developed Bullish Trend bodes well for the metal. In addition, with the severe upcoming bear market and recession in the US between 2014-2017 (based on my timing work), gold is bound to do very well from the “safety” side as well.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Gold Bugs Are Celebrating Today. Should You Join Them? Google

Welcome To Cold War II

Mother Russia is furious at the West. Here is quick summary of what the Russian media is saying in regards to the West’s reaction.

- The west is responsible for destabilizing Ukraine to begin with.

- Russia is acting within lawful framework as it tries to protect Russian interest in Ukraine.

- New Ukrainian Government is illegitimate.

- Russia will not be intimidated by the West. They will answer every blow to Russia with the blow of their own.

As you can see, this tag of war between Russia and the US is a clear case of “My $%ck is bigger than your co*#”. Unfortunately, when we look back at this juncture a few years from now we might identify it as the beginning of Cold War 2. Where the only winners are 1. Retarded Politicians and 2. Military Industrial Complex. Too bad.

Запад угрожает Москве санкциями и отзывает собственных дипломатов, а в США собирают подписи по вопросу об исключении России из ВТО

Фото: ИЗВЕСТИЯ/Владимир Суворов

После того как 1 марта Совет Федерации РФ принял предложение президента Владимира Путина ввести войска на Украину для «нормализации общественно-политической обстановки» в стране, против Москвы развернулась настоящая дипломатическая война. Канада приняла решение об отзыве своего посла из России. Главу отечественной дипмиссии вызвал «на ковер» МИД Великобритании. Оттава, Париж, Лондон и Вашингтон приостановили подготовку к июньскому саммиту G8 в Сочи.

Кроме того, Запад заговорил о возможном введении политических и экономических санкций против Москвы. В частности, на сайте американского Белого дома начался сбор подписей под петицией об исключении России из ВТО, отмене виз для членов российского правительства и их семей, а также заморозке их финансовых счетов в американских банках. Ее подписали уже более 5,8 тыс. человек. Собственный ответ Москве пообещал подготовить и Евросоюз, министры иностранных дел стран-членов которого собираются 3 марта на экстренное совещание в Брюсселе.

Пока Россия отвечает ударом на удар. В ответ на оскорбительные заявления Обамы сенаторы предложили отозвать посла России в Вашингтоне. Найдутся адекватные меры и на другие заявления Запада.

— На самом деле, вся эта истерика Евросоюза — не более чем пиар-пузырь, приуроченный к выборам в Европарламент 25 мая. По всем прогнозам, в следующем его составе окажется большое количество евроскептиков и нынешние еврокомиссары во главе с председателем Жозе Мануэлем Баррозу вынуждены будут уйти в отставку. А потому подобные их заявления сегодня надо делить как минимум надвое — во время избирательной кампании часто врут, — сказал «Известиям» зампредседателя комитета Совета Федерации по международным делам Андрей Климов.

Новые же члены Еврокомиссии вряд ли продолжат после майских выборов затеянную в отношении Украины политику. По словам сенатора, те слишком хорошо понимают, что такого нахлебника, как Украина, членам ЕС просто не прокормить.

— Пока Россия сталкивается со своего рода дипломатическими демаршами, то есть демонстративными действиями символического значения. Не приходится рассчитывать, что Россию в вопросе по Украине поддержат, — считает глава Совета по внешней и оборонной политике Федор Лукьянов.

По словам эксперта, даже от Китая, который симпатизирует российской политике по отбрасыванию евроатлантической экспансии, ждать поддержки не стоит. Прежде всего — из-за довольно размытых постулатов международного публичного права.

В то время как Москва стремится представить свою позицию как отклик на призыв о помощи россиянам в Крыму и действующему президенту Украины Виктору Януковичу, Запад видит в этом лишь попытку аннексировать часть территории суверенного государства.

При этом, отмечает Лукьянов, ни США, ни страны ЕС не собираются проводить параллели с собственными вмешетельством «ради мира» во внутренние дела, например, Ирака или Ливии, а также призывами навести порядок в Сирии.

— Двойные стандарты были, есть и будут основой международных отношений. Западные державы интерпретируют международное право по-разному — в зависимости от собственной выгоды, — говорит Лукьянов.

Руководствуясь именно такими соображениями, США и Европа в определенный момент поддержали новое прозападное правительство Украины — закрыв глаза на юридический аспект произошедшей смены власти, отмечает председатель московской коллегии адвокатов «Николаев и партнеры», специалист по международному праву Юрий Николаев.

— Янукович был выкинут из президентского кресла при помощи физической силы. Согласно правовой оценке, это стало настоящим госпереворотом — произошел захват власти, не предусмотренный украинским законодательством, — объясняет юрист.

Как отмечает Николаев, ни Россия, ни, что примечательно, Евросоюз до сих пор не представили официальных документов, в которых признавали бы новое правительство как единственно легитимное. А значит, законным главой Украины всё еще остается Янукович. Следовательно, формально он вполне имеет право обратиться за помощью — в том числе и военной — к соседям.

— Согласно украинскому законодательству, Янукович должен был бы обзавестись поддержкой парламента, прежде чем обращаться с такой просьбой к России. Однако здесь у него не оставалось выбора, ведь законно избранной народом рады уже не существует, — отмечает Николаев.

Подобная логика отвечает позиции Москвы, которая настаивает еще и на своем долге. А именно — общем с Украиной историческом прошлом и защите проживающих на ее территории российских граждан. Ведь только в Крыму около 60% населения являются русскими.

На ООН как на арбитра рассчитывать тоже не стоит. Даже если другие страны попытаются провести через организацию санкции против России, Москва, обладающая правом вето, никогда их не пропустит и сможет заблокировать любое решение по Украине. По словам специалистов, ООН лишь в очередной раз показывает сегодня свою несостоятельность в решении подобных вопросов.

— В настоящее время такие вопросы переходят от международных организаций отдельным государствам. Так, вопреки ООН, ранее США и Великобритания решили самостоятельно нести в Ирак демократию на штыках, — отмечает Николаев.

А интересов на Украине у Вашингтона не меньше, чем на Ближнем Востоке, считает он. В прошлом году здесь открыли крупное месторождение алмазов в Кировоградской области. Да и возможность заполучить военную базу под боком у РФ США бы вполне порадовала.

Главный вопрос в том, экономические санкции какого рода и в каком объеме США и страны ЕС решатся самостоятельно применить против Москвы.

— Подобное «наказание» со стороны Брюсселя и Вашингтона было бы для России болезненно, — считает Лукьянов. — Правда, пока неизвестно, насколько Вашингтон и Европа сами захотят пойти на собственные издержки и потери своего бизнеса.

По словам сенатора Андрея Климова, США сегодня практически не имеют серьезного товарооборота с Россией, а потому экономические санкции Вашингтона большого вреда Москве не принесут.

— При этом страны ЕС зависят от нас ничуть не меньше, а может, даже больше, чем мы от них, — говорит Климов.

В частности, для Европы заменить поступающий из России газ будет нечем. По этой причине, ЕС вполне может начать переговоры с Россией отдельно от США. Да и единения в Евросоюзе в вопросе отношения к происходящему на Украине не наблюдается.

— В сложившейся ситуации я бы вообще порекомендовал Брюсселю и Вашингтону принять санкции друг против друга. В отношении США — за разжигание гражданской войны и взрывоопасной ситуации в Европе. В отношении ряда стран ЕС — за то, что своим бездействием нарушили договоренности о нормализации ситуации на Украине от 21 февраля, что открыло ящик Пандоры, — говорит Климов.

При этом экономически Россия может вполне выжить и в ситуации экономических санкций со стороны Брюсселя и Вашингтона. В настоящий момент Москва наращивает экономические связи со странами БРИКС. Как отмечает сенатор, в них проживает 40% населения Земли. По золотовалютным резервам группа в разы опережает Евросоюз. А совокупный ВВП входящих в БРИКС государств превышает ВВП США и ЕС

Читайте далее: http://izvestia.ru/news/566846#ixzz2uueXsK00

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Will The War In Ukraine Collapse The US Financial Markets?

The Dow Jones gapped down at the open to the tune of -130 points. Raising the question if the potential war in Ukraine and the continued escalation of tension between Russia and the US will be enough to set off a large bear market move. Based on my mathematical timing work the answer is YES and NO. The gap we see at today’s open is likely to be closed. Either today or over the next few days. It is my belief that the market will settle down to continue it’s present trend, but not for too much longer. While the trouble in Ukraine could be blamed as the catalyst that sets the upcoming bear market off, such is not the case. Again, the market is tracing out it’s exact structure. It will start the bear market when the time is right.

When is that time?

Check out our Subscription section.

NEW YORK (Reuters) – U.S. stocks were set to open sharply lower on Monday, alongside other risk assets, as Ukraine and Russia prepared for war after Russian President Vladimir Putin declared he had the right to invade his neighbor.

Ukraine mobilized for war on Sunday and Washington threatened to isolate Russia economically after Putin said he had the right to invade Ukraine, in Moscow’s biggest confrontation with the West since the Cold War.

The S&P 500 closed at a record high on Friday, and profit taking was expected on Wall Street due to the political uncertainty.

“There’s been a very significant rally,” said Rick Meckler, president of investment firm LibertyView Capital Management in Jersey City, New Jersey.

“If you need an excuse to sell, this is a good one.”

Russian stocks and bonds fell sharply and the central bank hiked interest rates to defend the ruble.

Energy stocks could stand to lose if relations between the United States and Russia deteriorate further. Volatility will likely spike alongside the uncertainty of the situation.

“Anything that involves a boycott of Russian supplies, which are very significant, could impact the energy sector dramatically,” said Meckler.

“In situations like this you see very quick reactions reverse as people understand the scenario and how things play out.”

S&P 500 e-mini futures fell 17 points and were below fair value, a formula that evaluates pricing by taking into account interest rates, dividends and time to expiration on the contract. Dow Jones industrial average futures fell 130 points and Nasdaq 100 futures lost 34 points.

Gold prices hit a four month high as investors sought safe-haven assets, boosting gold stocks.

Though the focus will likely remain on Ukraine, the economic calendar is full on Monday.

U.S. consumer spending rose more than expected in January, likely as chilly weather boosted demand for heating.

Will The War In Ukraine Collapse The US Financial Markets? Google