Continuation of part 5….

PRIMARY CYCLES WORKING IN THE STOCK MARKET

(Please note that it took me a considerable amount of time to work out the cycles and their appropriate allocation. After reading this section, I would highly encourage you to perform your own cycle analysis to confirm the cycles below. Doing so will give you a better level of understanding and reassurance.)

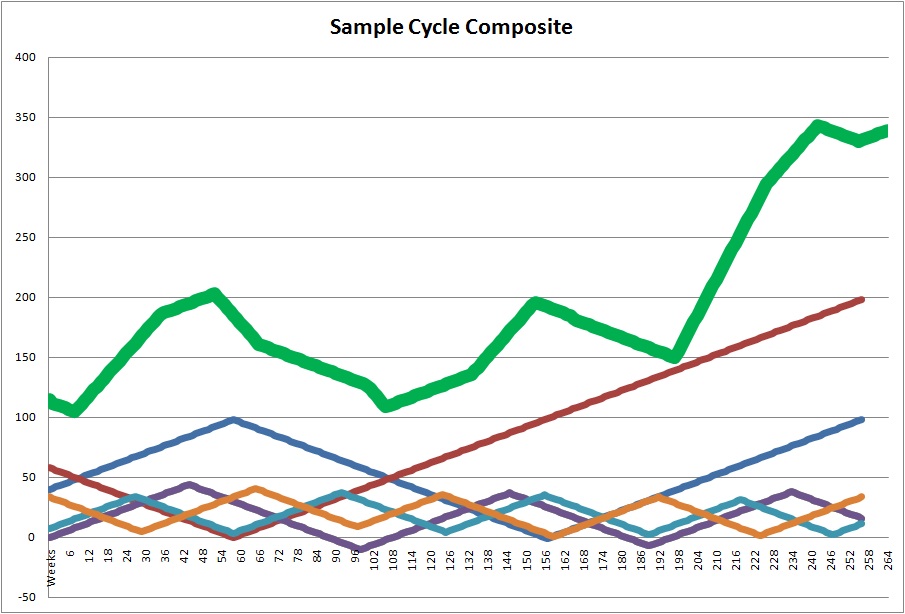

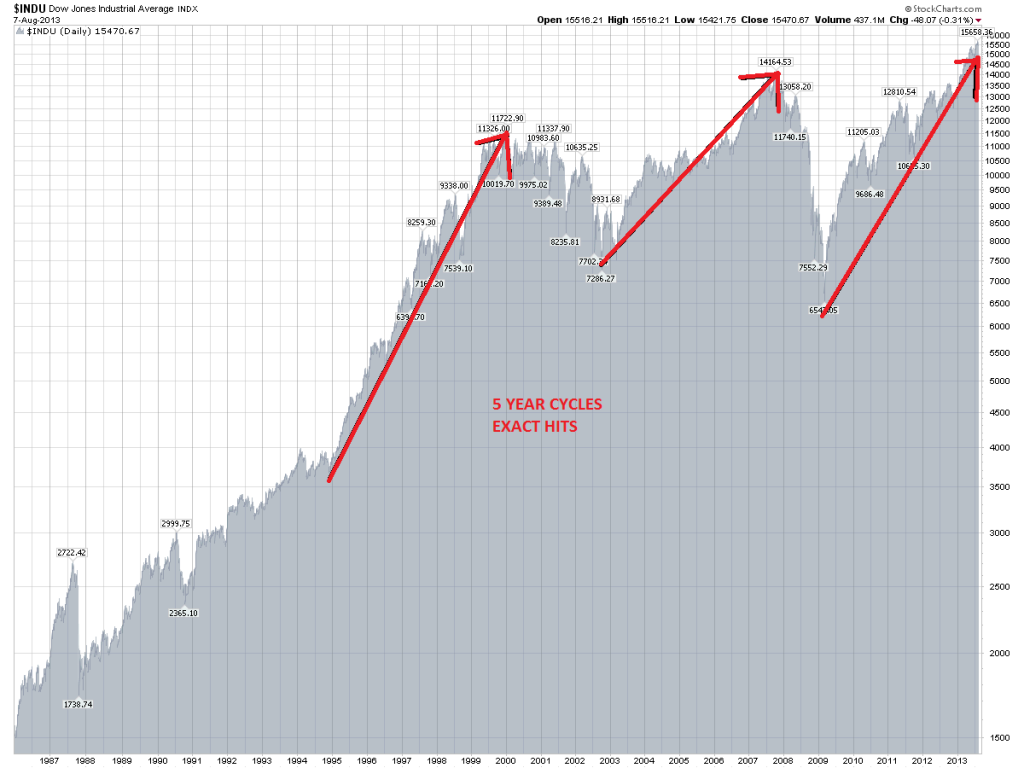

Market Cycle #1: 5-Year Cycle. This cycle represents the primary trend in the stock market. In fact, this cycle had been mentioned earlier in this book when it was indicated that this particular cycle represents major long-term movements in the stock market. For example, 1982 to 1987, 1994 to 2000 and 2002 to 2007 are ALL represented by this exact five year cycle. Typically this cycle moves 5-years up and then 5 years down.

Internally, this cycle moves in the following fashion. Five years up and five years down. During the bull market the cycle moves 2 years up-1 year down-2 years up and during the bear market 2 years down-1 year up – 2 years down. Because this cycle represents the primary trend in the stock market, an analyst who is working with this cycle would have to multiply the composite created by the cycles below by the five year cycle in order to create an accurate representation of the stock market.

Market Cycle#2: 52-Months Cycle. This cycle moves bottom to bottom every 52 months. Meaning the bull phase is represented by the first 26 months and the bear phase is represented by the following 26 months.

Market Cycle#3: 27-Months Cycle. This cycle moves bottom to bottom every 27 months. Meaning the bull phase is represented by the first 13.5 months and the bear phase is represented by the following 13.5 months.

Market Cycle#4: 18-Month Cycle. This cycle moves bottom to bottom every 18 months. Meaning the bull phase is represented by the first 9 months and the bear phase is represented by the following 9 months.

Market Cycle#5: 13-Month Cycle. This cycle moves bottom to bottom every 13 months. Meaning the bull phase is represented by the first 6.5 months and the bear phase is represented by the following 6.5 months.

The cycles above represent the longer term moves in the market. However, as mentioned before cycle analysis can be applied to any time frame. An analyst working with shorter time frames (daily/hourly) would just have to narrow down the window of analysis in order to figure out the short term cycles and their relevant application to the stock market. When done, these shorter term cycles must be added into the composite above. Doing so will produce a very accurate composite on both the long-term and the short-term time frames.

To be continued……

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Timing The Market & Advanced Cycle Analysis (Part 6)