Investment Wisdom Of The Day

Bulls Go On A Buying Spree As 100% Accurate Recession Indicator Screams Bloody Murder

2/26/2019 – A negative day with the Dow Jones down 34 points (-0.13%) and the Nasdaq down 5 points (-0.07%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

To hell with reasoning…….

Something Happening

Something is happening. What is it?

Possibilities

- The bond market is staring to worry about trillion dollar deficits as far as the eye can see

- The bond market has stagflation worries

- The bond bull market is over or approaching

My take is number one and possibly all three.

Probably nothing…….

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Want Super Healthy & Smart Children? Don’t Vaccinate Them

Investment Grin Of The Day

Economic Deterioration Goes Parabolic, As Does The Dow

2/25/2019 – A positive day with the Dow Jones up 60 points (+0.23%) and the Nasdaq up 26 points (+0.36%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Well, this is getting very interesting. As underlying economic deterioration gathers steam, so does the stock market. Let’s explore……

“In 30 years, I’ve never seen anything like this”: CEO of warehouse operator Pacific Mountain Logistics.

Meanwhile, the bulls are not yet satisfied……

10:39 a.m. The Dow Jones Industrial Average is rising again Monday morning, and that means the market is even more overbought than it was last week. Are stocks headed for a fall?

Consider: The Dow has risen 144.74 points, or 0.6%, to 26,176.55, while the S&P 500 has advanced 0.5% to 2807.33, and the Nasdaq Composite has gained 0.8% to 7585.50 after President Donald Trump said he would hold off on raising tariffs on Chinese goods on March 1. The Dow has returned 20% since bottoming on Dec. 24, 2018……

In other words, someone has it seriously wrong. The real question is……who?

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Stockman: Jerome Powell Is A Pathetic Coward – Crash Coming

Investment Grin Of The Day

Warren Buffett Can’t Find Anything To Buy As Valuations Go BatS#*% Crazy

2/22/2019 – A positive week with the Dow Jones up 148 points (+0.57%) and the Nasdaq up 55 points (+0.73%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Quite a bit of information to cover as we go into the weekend. I highly recommend the following…….

Stupidity Well-Anchored

The only thing that’s “well-anchored” is the stupidity of the belief that inflation expectations matter.

Asset Irony

People will rush to buy stocks in a bubble if they think prices will rise. They will hold off buying stocks if they expect prices will go down.

People will buy houses to rent or fix up if they think home prices will rise. They will hold off housing speculation if they expect prices will drop. The very things where expectations do matter are the very things the Fed and mainstream media ignore.

To rather quickly summarize all of the above…….Valuations remain at historically extreme levels (today’s P/E ratio is slightly above 1929 top) while underlying economic and earnings conditions continue to deteriorate at a fast pace.

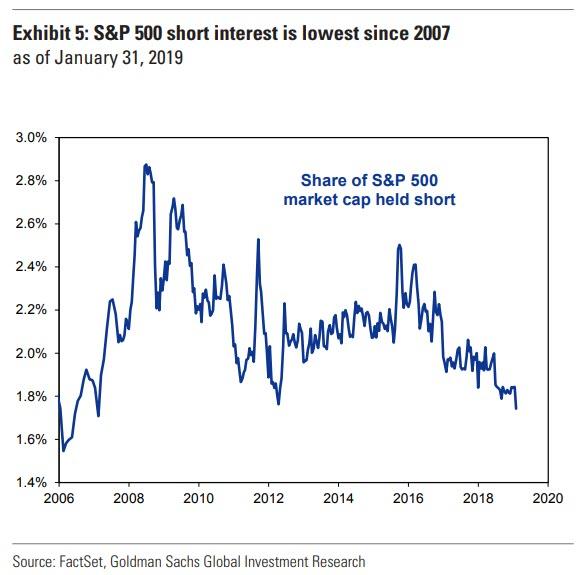

What’s more, short sellers have been decimated to 2007 top levels and various sentiment indicators are flashing extreme overbought levels. Not to mention that nearly everyone and their day trading grandma are “Long and Strong”.

No wonder Mr. Buffett is hard pressed to find anything to buy.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.