Explaining Away December 26th, 2018 Bottom In Both Price And TIME

2/6/2019 – A negative day with the Dow Jones down 21 points (-0.08%) and the Nasdaq down 26 points (-0.36%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

I just realized that I never performed full analysis of our well defined December 26th, 2018 bottom. And since I have to do so for our “market calls” section anyway, today is as good as any other day.

Our subscribers have been looking at the following chart since about June of 2018…..

In early June of 2018 we presented our subscribers with the following chart. At that time it was just a red dotted line you see above projecting upcoming stock market moves. June 27/28th bottom was a direct hit. The biggest discrepancy for the forecast above was our anticipated early September bottom. September 11th bottom ended up being much shallower than we originally anticipated.

The forecast was slightly adjusted in our weekly/daily updates with price/time calculations as we went along and an important top arrived on early October.

Not too bad for a forecast issued 6 months ago.

Leading into December low I issued the following warnings to our premium members.

December 8th Update: Market’s structural composition suggests the market will very quickly slice though both 24K and 23K on the Dow over the next 10 trading days. Once those major support levels are taken out, the Dow might very quickly collapse to 20K by the time our December TIME turning point arrives.

December 15th Update: The Dow did briefly break below 23K on Monday, followed by an ideal structural bounce discussed in our daily updates. It appears the bounce did conclude on Wednesday and that we are now in very early stages of Wave 3 down. A word of caution. These structural locations in the stock market are incredibly dangerous and/or violent.

As we came into December most traders/investors were anticipating a massive “Santa Rally”. Our work was projecting the exact opposite months ago and we made sure our subscribers knew.

Subsequently, as the market approached our December 27th (+/- 1 trading day) important TIME turning point, two mathematical points of force were identified on the Dow in our daily updates. One was located at about 20,750 and the other at 21,725 (+/- 50 points). A trade entry point and a plan of action were offered at the time for our 21,725 PRICE turning point.

Like clockwork, the Dow proceeded to bottom on December 26th at 21,713 and the rest, as they say, is history.

Not all of our market calls are as accurate as the one above has been. Yet, we do our best in an attempt to nail them all…..tops and bottoms.

If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Warren Buffett Reveals His Secrets

Investment Grin Of The Day

Bullish Investors Declare Victory – Up, Up And Away

2/5/2019 – A positive day with the Dow Jones up 172 points (+0.68%) and the Nasdaq up 54 points (+0.74%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Despite the market remaining below key technical resistance levels, all while returning to overbought levels, most bullish investors have seen enough. The correction is over, the bull is back and the time to “load up” is now. Consider this small sample from today’s news flow…….

- The Nasdaq is on the brink of escaping from bear-market territory

- Billionaire Howard Marks to Goldman Sachs: We’re not in bubble.

- Bull trend strengthens, S&P 500 approaches 200-day average

- If stock-market investors missed January’s surge, they’re out of luck, says Goldman Sachs

- Time for stock-market investors to shake off the 3rd ‘recession scare’ of the cycle, analyst says

Indeed, shake it off losers. The above is designed to make you all warm and fuzzy inside so you go out and load up on stocks. Should you? Consider the following……

Let’s cut through the nonsense.

The only reason that stocks are rallying is because investors are hoping the Fed has reinstated its policy of inflating stocks…

However, HOPE is very different from reality. And the Fed hinting at halting its rate hikes and possibly altering the schedule of QT is VERY different from cutting rates and engaging in QE.

Put simply, a Fed that says it might be less hawkish is not a dovish Fed. And the markets know it, though stocks always “get it last.”

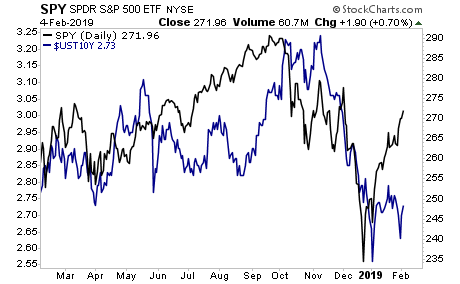

Bonds don’t buy this “risk on” move at all.

In other words, no one said investing would be easy.

Luckily, you don’t have to guess what the stock market will do next. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Must Watch: Ron Paul And David Stockman Issue Their Final Warning

Investment Wisdom Of The Day

Forget Economic Collapse, Today’s Imbalances Will Lead To A Nuclear WW-3

2/4/2019 – A positive day with the Dow Jones up 175 points (+0.70%) and the Nasdaq up 83 points (+1.15%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

When I first published my Nuclear WW-3 forecast over 10 years ago most people thought I was crazy. After all, why in world would the USA/NATO wage war on Russia/China. If you recall, at the time Bush Jr. was drinking vodka was Putin while any notion of a trade war with China and Russiangate were fantasies of a deranged mind.

Fast forward to today and we are right on schedule……..

US Revives Cold War “Arms Race” With Russia And China After Abandoning INF Treaty

This latest step comes after the Trump Administration repeatedly warned Russia that it would leave the treaty if Moscow didn’t comply with the family by Feb. 2. Both sides have been meeting in Beijing, but Russia’s Deputy Foreign Minister Sergei Ryabkov said on Thursday that the talks had failed.

“Unfortunately, there is no progress,” he told the Russian news agency RIA Novosti according to a translation by Reuters. “As far as we understand, the next step is coming, the next phase begins, namely the phase of the United States stopping its obligations under the INF, which will evidently happen this coming weekend.”

Andrea Thompson, US undersecretary of state for arms control and international security affairs, said Washington would most likely announce the suspension of the INF Treaty in the coming days.

“The Russians still aren’t in acknowledgment that they are in violation of the treaty,” she said. However, Thompson did add that “diplomacy is never done.”

Ladies and gentlemen, these people are deranged lunatics. Pure evil. Their actions today will lead to a global catastrophe of unimaginable proportions.

Now, many gung ho and MAGA type of Americans will argue that we can and will defeat anyone and everyone. Perhaps. What they don’t realize is that the executive actions of today will KILL, when the time comes, their entire families in an instant.

BTW, more information about my Nuclear WW-3 forecast can be Found Here. If you want the book, shoot me an email and I will send you my book for free. I am in process of taking this information down in order to make it available to a select few.

In terms of the stock market, you don’t have to guess what the stock market will do next. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.

Investment Grin Of The Day

Brilliant Or Stupid: American Investors Step Up And Buy Everything In Sight

2/1/2019 – A positive week with the Dow Jones up 326 points (+1.31%) and the Nasdaq up 99 points (+1.38%)

As we have been saying, the stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Let’s start with a terrifying chart and a simple questions, who the hell is buying the gigantic flood of new US Government Debt? After all, Japan, China and other foreign entities are dumping big time.

Who Bought the Gigantic $1.5 Trillion of New US Government Debt Issued over the Past 12 Months?

And who holds the Rest? The only entities left:

American banks (very large holders), hedge funds, pension funds, mutual funds, and other institutions along with individual investors in their brokerage accounts or at their accounts with the US Treasury were huge net buyers, while nearly everyone else was selling, increasing their holdings by $1.36 trillion over the 12-month period. These American entities combined owned the remainder of the US gross national debt, $7.5 trillion, or 34.4% of the total!

When that appetite among American banks and other big institutions for US Treasury debt wanes, yields will rise because buyers will have to be lured into this market to absorb this flood of new securities on a weekly basis. But so far, so good – with the enormous appetite among American entities pushing down the 10-year Treasury yield today to 2.63%.

AKA……Keeping the Ponzi alive. But wait, there’s more……

Individual investors were on a shopping spree for stock-market bargains in January: E-Trade

Individual investors grew cautiously optimistic in January, with E-Trade clients aggressively buying stocks of companies they saw as having become oversold in December, Chris Larkin senior vice president of trading at E-Trade, told MarketWatch.

“Clients were net buyers [in January], but it wasn’t the strongest month of buying we’ve seen,” he said. “Traders are thinking defensively in the marketplace, but were also looking for bargains after December’s selloff.”

GOD bless their brave little souls. In the meantime……

These billionaires are issuing terrifying warnings about global debt levels

Seth Klarman runs the $28 billion hedge fund, Baupost Group. The guy is famously secretive (and conservative). So the fact that he went out of his way to make this public statement means you should pay attention.

Also, Klarman’s fund is closed (he’s actually been returning money), so he’s not doing this to scare people into investing in his fund.

In a 22-page letter to his investors, Klarman warned that government debt levels, particularly in the US (where debt exceeds GDP), could lead to the next global financial crisis.

That is to say, the conundrum remains. While most investors continue to drink the kool-aid from Trump’s punch bowl of the “Best Economy Of All Time”, quite a few brilliant investors are ringing the proverbial bell.

Luckily, you don’t have to guess what the stock market will do next. If you would like to find out what the stock market will do next, in both price and time, based on our mathematical and timing work, please Click Here

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.