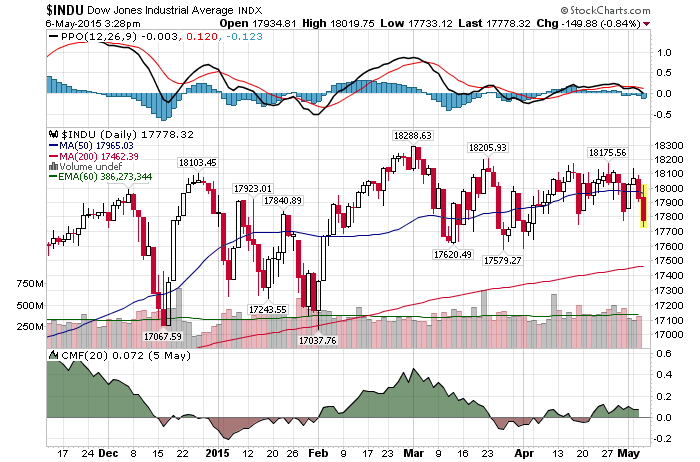

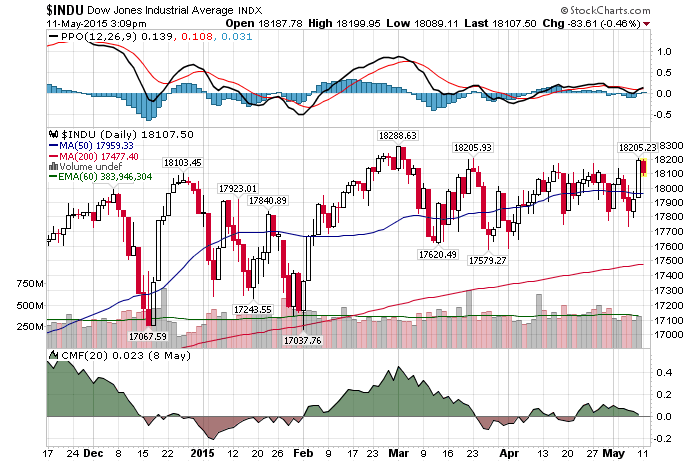

5/11/2015 – A down day with the Dow Jones down 86 points (-0.47%) and the Nasdaq down 10 points (-0.20%).

A massive and rather rapid stock market decline is coming later on this year. And while we won’t have a crash, considering the amount of margin debt out there, quite a few people will get wiped out. If you would like to find out exactly when this move will develop, to the day, please Click Here.

Over the last few months a few analysts suggested that a bear market and a possible crash will occur in 2016. Something to do with the presidential cycle, the need to have a blow off top and increased gravitational forces in Andromeda Galaxy. For instance, Analyst Says Bull Market Will Not End With Top Tech Stocks So Cheap.

Excuse my ignorance, but why exactly is it impossible for us to have a large scale decline, maybe even a crash, in 2015?

Personal preferences and wishful thinking aside, here is our current setup…..

- Extreme overvaluations in most sectors of the stock market.

- Outright bubbles in Tech and Biotech.

- An adjusted P/E ratio above 1929, 1937, 1966, 1987, 2007, etc…. tops. Only 2000 top was higher, due to the lack of earnings in the tech sector at that time.

- The FED is about to raise interest rates.

- Any remaining QE velocity is quickly dissipating.

- Macroeconomic data is collapsing (previous charts).

- The US Economy is on a verge of an official recession. Q1 growth of 0.2%. Inventory build up saved the GDP from going negative.

- Earnings growth estimates are accelerating down (previous charts).

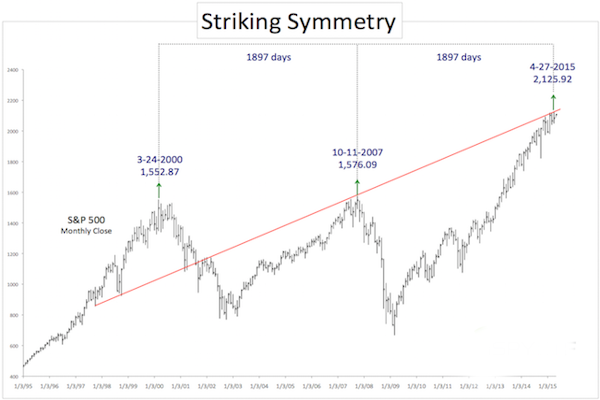

- We are still in a secular bear market.

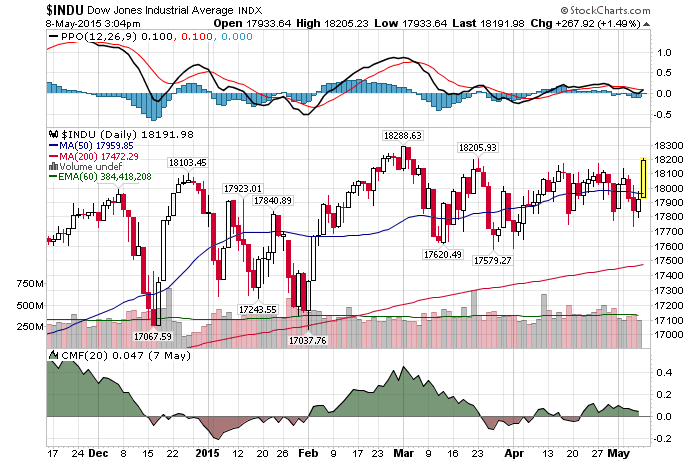

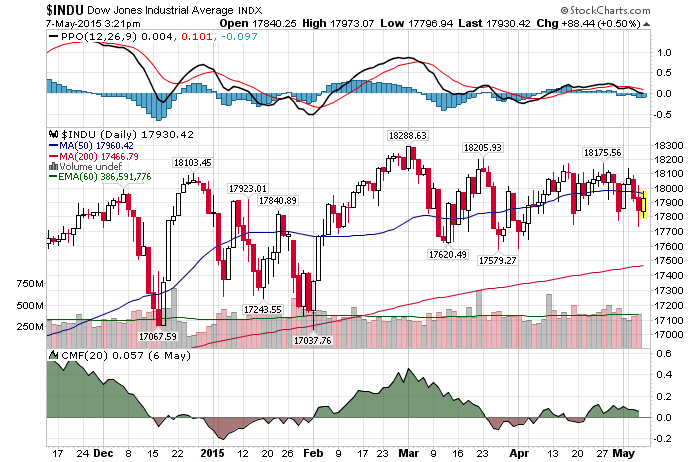

- 10 Months of market distribution. (NYSE since July of 2014)

- Extreme bullish sentiment.

- Margin debt is at an all time high.

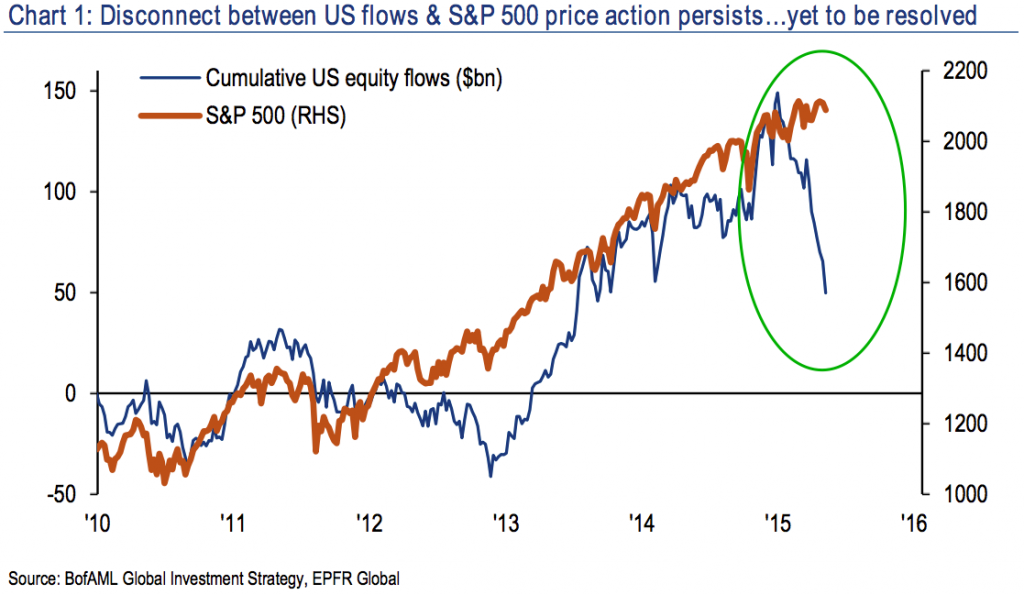

- Fund outflows continue to accelerate (weekend update).

- Etc….

I am sure I have missed quite a few points, but you get the idea. Sounds like a perfect recipe for a disaster to me. The best part is, I don’t think we have to wait until 2016.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. May 11th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!