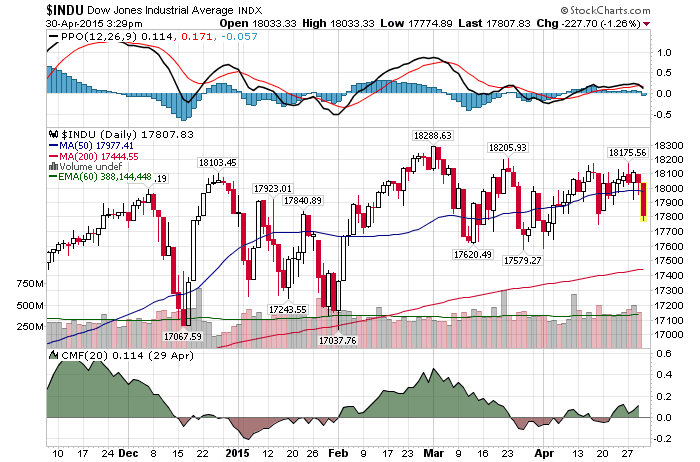

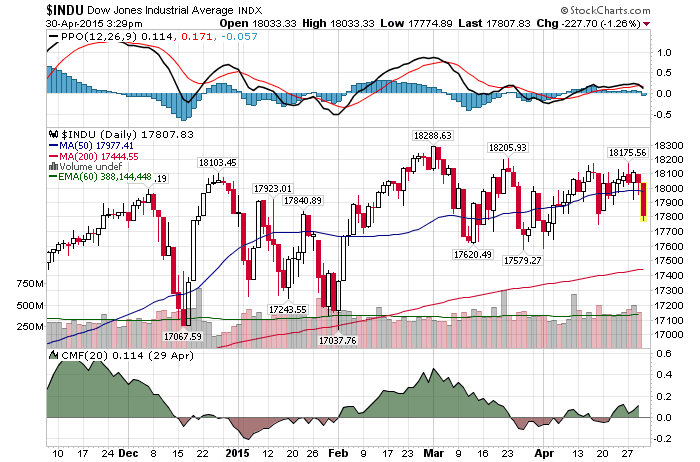

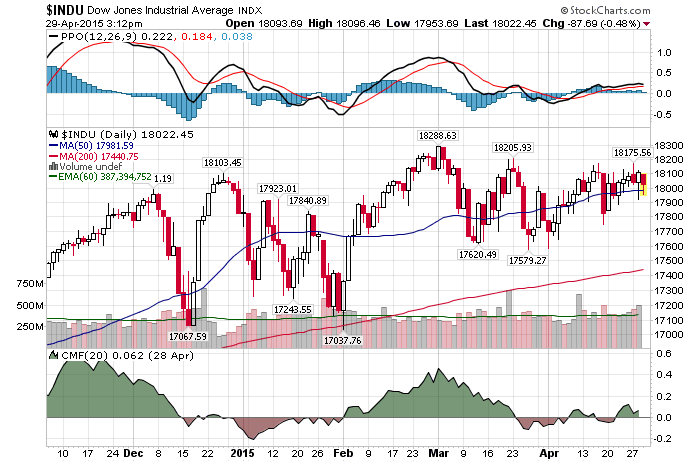

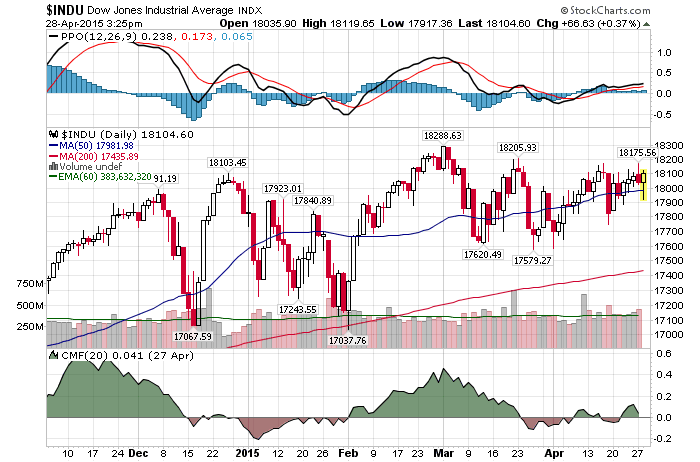

4/30/2015 – A big down day with the Dow Jones down 196 points (-1.09%) and the Nasdaq down 82 points (-1.64%).

The stock market continues to behave as forecasted in our subscriber section. Are we about to bounce to new all time highs -OR- is this sell-off just getting started? Click Here to find out.

Marc Faber has been off of his game over the last few years. So much so that the talking heads within the financial media community now openly laugh at his “Bear Market” forecasts. Now, more bearish than ever, Marc expects a rapid 40-60% decline. Has he gone insane? Let’s take a look.

“For the last two years, I’ve been thinking that U.S. stocks are due for a correction,” Faber said Wednesday on CNBC’s “ Trading Nation .” “But I always say a bubble is a bubble, and if there’s no correction, the market will go up, and one day it will go down, big time.”

My Comment: Oftentimes the best researched bears are too early to the party. I am guilty of the same…..at least I used to be. I remember shorting sub-prime lenders in early 2006 and then wondering how these clearly bankrupt companies can surge higher. By the summer of 2008 they were worth ZERO.

“The market is in a position where it’s not just going to be a 10 percent correction. Maybe it first goes up a bit further, but when it comes, it will be 30 percent or 40 percent minimum!” Faber asserted.

My Comment: Bingo. Most investors have assumed, wrongfully I might add, that we are in a new secular bull market. As a result, everyone believes that every 10-15% correction will be recovered. Nothing to worry about – buy the dips. It will be interesting to watch as a 10% correction turns into a 20%, 30%, etc…..

Faber says low yields and stimulative central bank policies around the world have led to a condition in which “all assets are grossly overvalued … and eventually this will unwind and cause some problems. Look at the market since November of last year to now. The market is up 2 percent. It hasn’t done much, and a lot of stocks are breaking down. I don’t think that the market is in a healthy condition.”

My Comment: I have been talking about the same thing for at least a few months now. Even though the stock market hasn’t really gone anywhere for close to 9 months, based on NYSE, bullish animal spirits are as strong as ever. Crazy.

Despite his massively bearish call, Faber said he’s “not short the market yet,” since he doesn’t know how high stocks could go in the interim. Still, he makes clear that “I’m not interested to buy momentum, I’m interested to buy value.”

My Comment: He is absolutely right. Buying now would be a suicide mission. At the same time, Marc is too scared to go short. And not only Marc. Every single bear I know, except yours truly, is scared of this market. Do I smell an opportunity? That’s why it helps to know exactly when the top is due.

In conclusion, NO, Marc Faber is not insane. In fact, he might be the only sane person in this insane asylum we call the stock market.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 10th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Marc Faber Expects A 60-40% Decline. Is He Insane? Google

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

This is rather a sobering look at how most investors think and behave at market tops. Forget about your mom and pop retail investors, we are talking about the top 0.5% of professionals out there.

This is rather a sobering look at how most investors think and behave at market tops. Forget about your mom and pop retail investors, we are talking about the top 0.5% of professionals out there.