Out in space two alien life forms are speaking with each other.

Is Warren Buffett Shorting Everything?

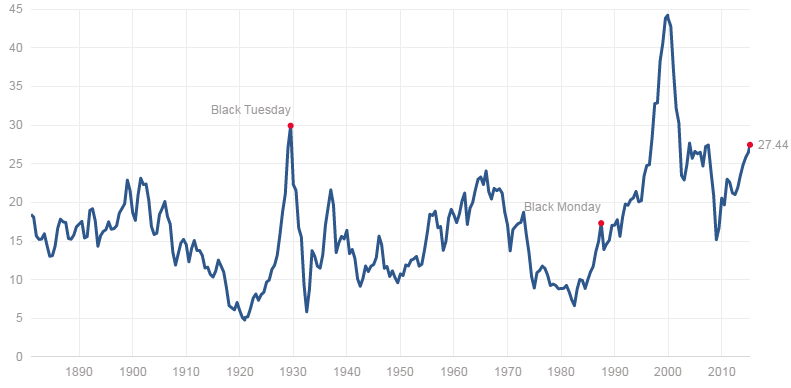

The chart above is as clear as night and day. Based on the adjusted P/E ratio, the stock market is more expensive today than it was at 1907, 1937, 1966 and 1987 tops. Just as expensive as it was at 1929 and 2007 tops. Only 2000 top stands above (due to the tech bubble and no earnings – it can be discounted away).

Now that I think about it, I am a little confused. I haven’t heard from a single value investor, or so called value investors, that the stock market is overvalued. David Stockman tends to agree.

David Stockman: ‘There Are No Markets, Just a Raging Casino’

“There are no markets left in any meaningful sense of the word, just a raging casino infected with the madness of the crowds and the central bank pied pipers who mesmerize them,” he writes on his blog.

Well said and I couldn’t agree more. Benjamin Graham must me spinning in his grave right about now. The only remaining question is, what is Warren Buffett and his disciples are up to? If they are to follow traditional Graham & Dodd valuation metrics, they should be completely out of the market by now. If not 100% short.

And while Warren Buffett’s corporate structure makes that impossible, the rest of the so called value investors should start asking this very same question.

Is Today’s Excessive Bullishness Warranted?

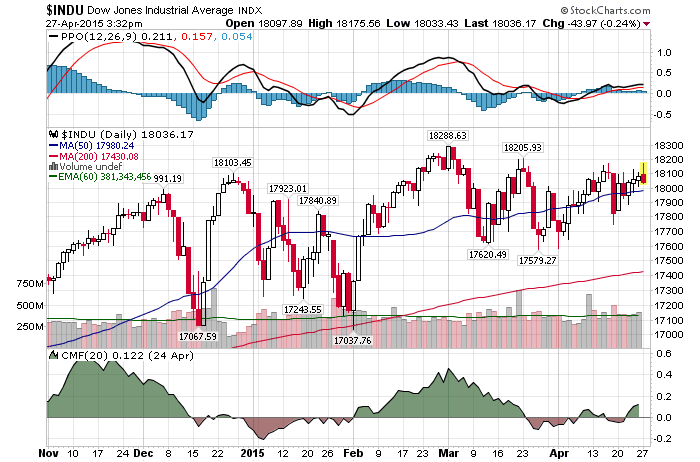

4/27/2015 – A down day with the Dow Jones down 41 points (-0.23%) and the Nasdaq down 32 points (-0.63%)

I would hate to poop on everyone’s parade, BUT the Dow is still sitting well bellow its March 2nd top, IBB is collapsing and I can still argue that we have been in a period of distribution or consolidation since July of 2014.

So, why is that I get the same feeling I had at 2007 top? For instance, Stocks can handle whatever the Fed throws at them

Wow, apparently everything is coming up roses and this market is getting ready to surge higher. That’s one way to look at things. And the other? How a $17 Trillion Bull Market Falls Short Relative to Past

“I look at U.S. stocks as very fully priced,” said Robert Arnott, the chairman of Research Affiliates in Newport Beach, California, and a pioneer in the field of fundamental indexing. About $170 billion is managed using his firm’s investment strategies. “Do I view them immediately vulnerable and dangerous? No. I view them dangerous for long-term investors.”

Now we are getting somewhere. I only have one problem with the statement/article above. “Not immediately vulnerable and dangerous….only for long-term investors?”. Based on my work the stock market can correct in one of two ways. A prolonged decline, similar to what we have experienced on the Dow between 2002 and 2003. Or, a quick drop followed by a prolonged period of consolidation. For instance, 1937.

That is to say, today’s stock market environment, given all of the things I talk about on this blog, is about as dangerous as you can imagine. So much so that investors might see a rapid 20-30% correction in a matter of months. And in an environment where most investors truly believe that such an adjustment is impossible, well, that could be a devastating move for quite a few people.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 27th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Two Charts That Will Send Chills Down Your Spine

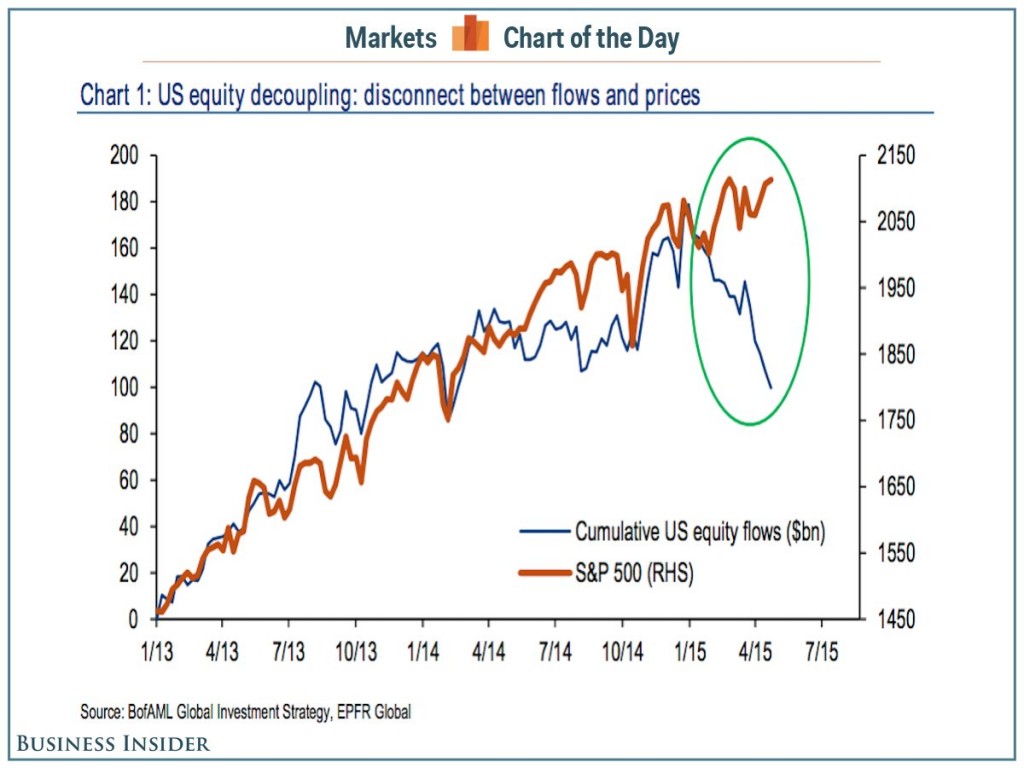

While major stock market indices continue on with their slow “melt up” on low volume, the two charts below should send chills down your spine.

And not only that. The S&P 500 has a serious revenue problem While quite a few corporates were able to push their accounting to the limit to beat the bottom line this quarter, they might not be able to do it next time around.

Doesn’t matter!!!

Perhaps, but lets review. Low volume melt up, macro data is collapsing and getting worse, earnings are expected to decline, fund outflows, anticipated interest rate increases, buybacks, accounting gimmicks, etc…. And I am expected to believe the stock market is about to surge higher…..Just as I was expected to believe that Pets.com was the next Microsoft?

It will be fun watching the stock market catch up to the down slopping lines below.

Two Hedge Fund Managers Discuss The Stock Market, Currencies, Commodities & Investment Ideas – Weekly Podcast

April 25th, 2015: We have a great show for you this week. Hedge fund managers Matthew Demeter and Alex Dvorkin discuss the following topics….

- What the stock market is doing and what we expect to happen over the next few weeks.

- COT Report and what the big guys are buying. Listen to make sure you are not on the wrong side of the trade.

- Deflation, employment numbers, gold, geopolitical and macroeconomic issues.

- A multitude of great investment ideas and various tops/bottoms that can make you a ton of money.

- And of course, much…..much more.

Don’t miss this one and join us again next Saturday.

Listen to the podcast by clicking on the player above. If you prefer iTunes, please Click Here

Stock Picker’s Market….For Short Sellers

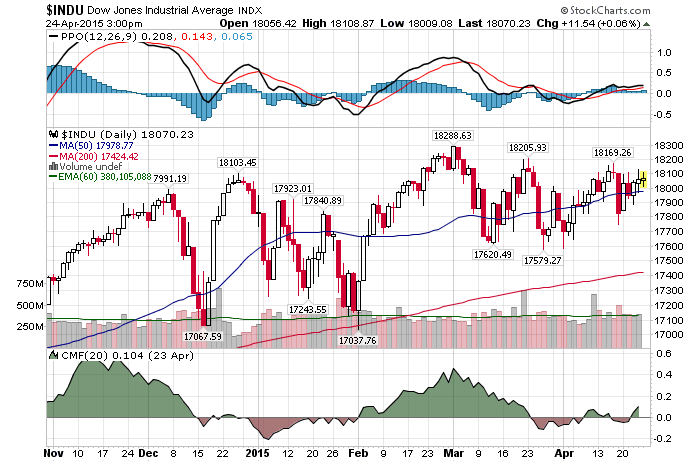

4/24/2015 – A positive day with the Dow Jones up 21 points (+0.12%) and the Nasdaq up 36 points (+0.71%)

The stock market continues to behave exactly as forecasted. If you would like to find out what happens next, please Click Here.

Are we in a “stock picker’s” market as this article suggests …….Is this the ‘stock picker’s market’ you’ve been asking for?

The short answer is: NO. We are in the sell/short everything market.

The long answer is a follows. I started my hedge fund on January 1st, 2002. In 2002 the Dow declined 21% (Nasdaq did much worse), while my fund returned +24%, net of fees. How did I do it? Not by shorting. I concentrated on significantly undervalued companies that were selling at dirt cheap prices. You know, your vanilla Warren Buffett kind of stuff.

I remember investing in quite a few home builders and financials. Most of them were significantly undervalued at the time. In other words, that was the stock picker’s market.

Today? Not so much. I wish I was kidding, but I am not exaggerating when I tell you that I am unable to find a single undervalued company in today’s market. Outside of a few special situations. Everything has been driven to exuberant levels. That is the primary difference. We are now in a bigger bubble than we were in 2000-2002.

I would love to buy stocks here, but I cannot. And I am not the only one having this problem. Quite a few successful money managers are seeing the same problem. I wrote about it before. Good Luck Finding Something To Invest In

The moral of the story is, there are times when it makes sense to buy everything in sight (2009 bottom) and the there are times when you should sell everything and run for the exist (2000, 2007 and today). Well, assuming you want to get there before everyone else does.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 24th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Investment Grin Of The Day

Oh NO!!! China To Outlaw Strippers At Funerals

To be honest, this sounds like a good idea for my own funeral. I wonder if Service Corp. International (SCI) can add it to one of their packages. As WSJ reports, a new craze is sweeping across China

China Says Please Stop Hiring Funeral Strippers

Only if the Chinese government was as proactive in curbing their debt, real estate, economic and stock market bubbles. Well, now that I have your attention, lets once again review our Chinese macro economic setup.

Here are just a few more bits about China that should scare the bejeezus out of you.

- Stock market bubble. Blow off gaps and housewife speculation included.

- Chinese corporate borrowers owed $14.2 trillion at the end of 2013 Vs $13.1 trillion owed by U.S. corporations.

- This means that as much as 10 percent of global corporate debt is exposed to the risk of a contraction in China’s informal banking sector.

- Cash flows and leverage at Chinese corporations are the worst among global peers, having deteriorated from being the best in 2009.

As I have mentioned in the past, most of China’s economic growth over the last 5-6 years has been financed by massive credit expansion. The likes of which we have never seen before. The result?

- $21 Trillion Debt Mountain. Roughly the same size as the entire US Banking Sector. It took the US 220 years to get to that number, it took China just 5 years of explosive credit growth.

- $6 Trillion In Shadow Banking. Actually, no one knows how large this number is. I have read good data/reports putting this number at $10-15 Trillion range.

- Empty cities, shopping centers, massive speculative bubble in real estate, built out infrastructure, rising cost of labor and export driven economy.

How much longer can this go on? Well, that’s a Trillion dollar question…..or a $40 Trillion dollar question. Apparently, it is already unraveling. Either way, one thing is for sure, this will not end well nor will it end in an orderly fashion.

The FED To Investors: Expect Panic And Illiquidity

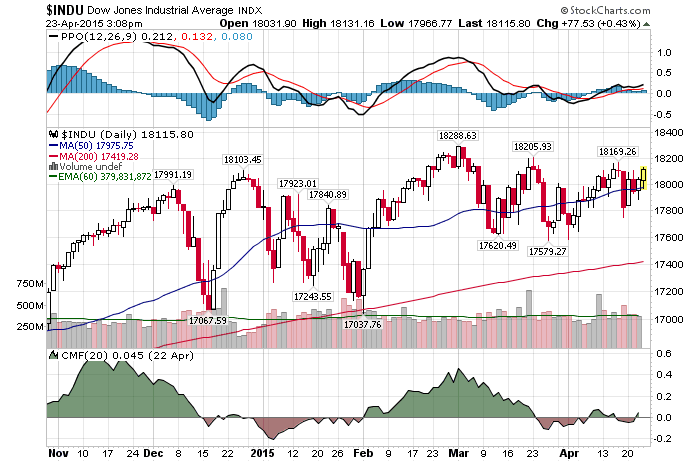

4/23/2015 – Another up day with the Dow Jones up 21 points (0.11%) and the Nasdaq up 21 points (0.41%)

The stock market continues to behave as anticipated. If you would like to find out what happens next, please click here.

You know the bubble is getting out of control when even the FED is warning investors about today’s high risk environment.

Market liquidity drought raises alarm bells inside Fed

Sections of the U.S. financial system that may be vulnerable to investor panic are raising concerns inside the Federal Reserve, as policymakers preparing for the first interest-rate hike in nearly a decade seek to ensure the market is ready and able to handle it whenever it happens.

Liquid markets could quickly turn illiquid in response to a shift in Fed policy or some other shock, which could amplify any adverse market response, as occurred during the taper tantrum.

In other words, investors continue to play chicken with the FED. Here is one thing most investors are forgetting. Given recent all time highs on most major indices, the volume has been declining. This is atypical and suggests that the stock market is already illuquid. I wrote about it before Top Hedge Fund Manager: No Liquidity, Stock Market Shock Is Imminent

Does that mean we are about to experience the repeat of 2007-2009? Not likely in terms of magnitude of the move, but it is quite possible that any upcoming correction will be violent.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 24th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Shocking: Americans Are Simply Drugged Out

Pharmaceutical companies hate me. Not only do I think Biotech (IBB) will collapse in a spectacular fashion, I also add zero revenue to any of their coffers.

Pharmaceutical companies hate me. Not only do I think Biotech (IBB) will collapse in a spectacular fashion, I also add zero revenue to any of their coffers.

One of the benefits of not being born in America is having the ability to observe the culture from the sideline. Now that I think about it I can probably name two people, within my network, who do not take some sort of a medication.

Feeling a little down…..take a pill. Too much energy……take a pill. Fast food is giving you indigestion….take a pill before and after your meal. How bad is the problem?

U.S. drug spending increases most in 13 years to $373.9 billion

F&#*ing crazy!!! Something tells me that at least half of this money came from the same people buying stocks on margin right about now.