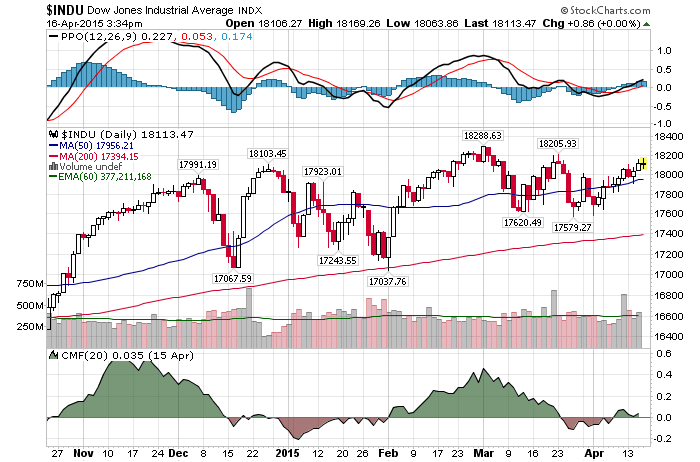

4/15/2015 – A positive day with the Dow Jones up 74 points (+0.41%) and the Nasdaq up 34 points (+0.68%).

Something strange is in the air. While most people will agree that we are heading towards some sort of an economic storm, most believe we won’t see any major trouble before 2017-2018, even as late as 2022. So much so that St. Louis Fed President James Bullard believes the US Economy is about to boom.

Now, wait a second. Let’s bring an ounce of common sense to the statement above. Since 2009 bottom we have lived in an environment of zero interest rates and 3 massive capital infusions in the form of QE. And even with all of that money floating around the US Economy has failed to show any signs of a “Boom”.

Sure, our capital markets have experienced a massive boom, but as I have shown here so many times before, the US Economy is rolling over and accelerating down.

Bullard: We risk a market bubble if we don’t move on monetary policy

“A risk of remaining at the zero lower bound too long is that a significant asset market bubble will develop.”

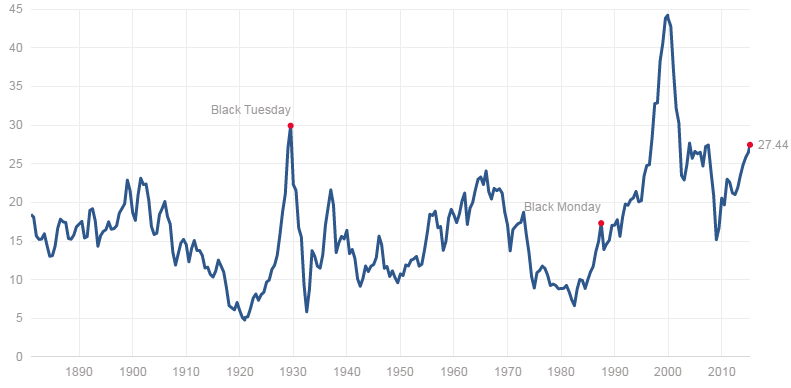

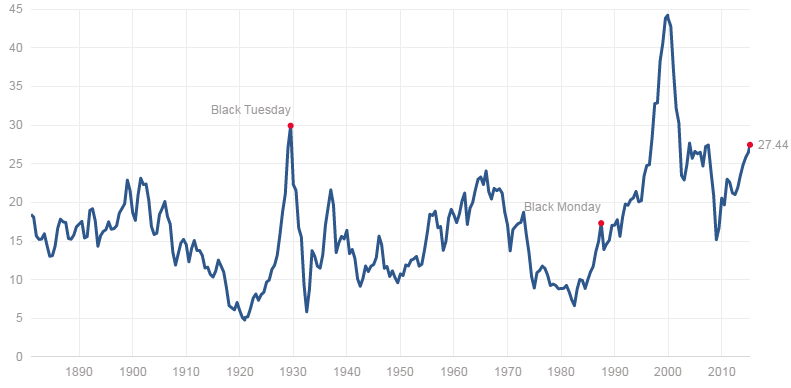

Earth to Bullard: We are already in a massive bubble. It is already too late. And you don’t need a fancy Harvard Ph.D. nor do you have to look further than the chart below to fully realize that. Take a look.

The market is now more expensive than at 1907,1937, 1966,1972 and 1987 tops. Just as expensive as at 1929 and 2007 tops. Only 2000 top stands above (due to the tech bubble and the lack of earnings at that time – arguably that number can be dismissed). And the charlatans at the FED have the audacity to claim that there is “No Bubble”? Despite QE, zero interest rates, stock buybacks, high margin debt, etc…. Seriously, WTF?

This leads me to stand by my earlier statement. The FED has no clue.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 15th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

The FED Expects An Economic Boom, WTF? Google

Long-term crash protection put option cost has doubled.

Long-term crash protection put option cost has doubled.