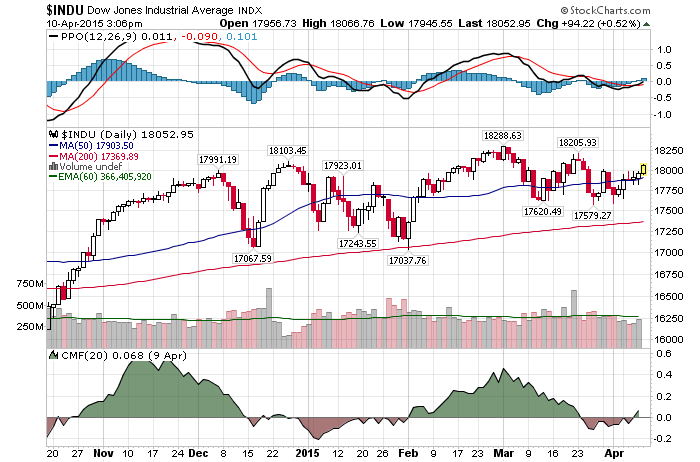

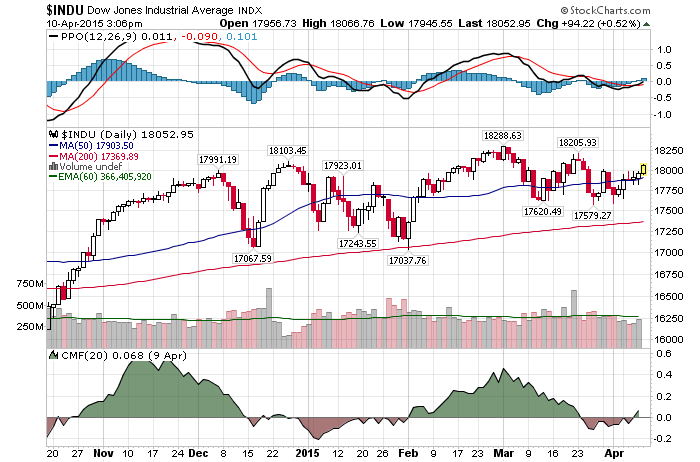

4/10/2015 – Another positive day with the Dow Jones up 99 points (+0.55%) and the Nasdaq up 21 points (+0.43%).

The market continues to behave as forecasted. If you would like to find out what happens next, please Click Here. A lot of stuff to to cover this Friday.

First, here is a question……for the same amount of money, would you buy a 9 Br Castle in France or a 1 Br crappy apartment with no balcony in Sydney?

Don’t for a second think that I have forgotten about our persisting Real Estate bubble. Nothing new on that front. The dead cat bounce off of 2010-2011 bottom is now over, the market is rolling over and it will accelerate down over the next 5 years. Most likely in conjunction with the upcoming recession and a bear market in equities. Our friend MISH has a jaw dropping post on 10 French Castles that are Cheaper than Sydney Units. Check it out.

Second, Einhorn Says Too Much Easy Money Is Holding Back U.S. Economy

Greenlight Capital’s Einhorn makes his point by discussing the pros and cons of jelly donuts. “My point is that you can have too much of a good thing and overdoses are destructive. Chairman Bernanke is presently force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn’t giving us energy or making us feel better. Instead of a robust recovery, the economy continues to be sluggish. Last year, when asked why his measures weren’t working, he suggested it was “bad luck.”

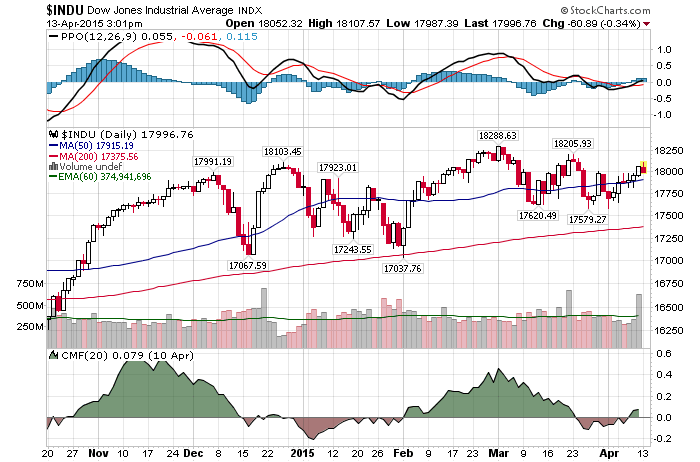

The problem is, the damage has already been done and it is now impossible to avoid the consequences. In this case, the consequences being a severe bear market in equities and a deep recession within the US Economy. Current weakness and collapsing economic variables, despite zero interest rates and a massive liquidity infusion, is a clear evidence of that.

Both Dimon and Summers believe there might be a liquidity problem in the bond market. An issue that concerns both of them very much. I am beginning to hear anecdotal evidence that is the case within the stock market as well. While my positions are not large enough to trigger liquidity concerns, some of the bigger guys out there are starting to have problems liquidating their postions.

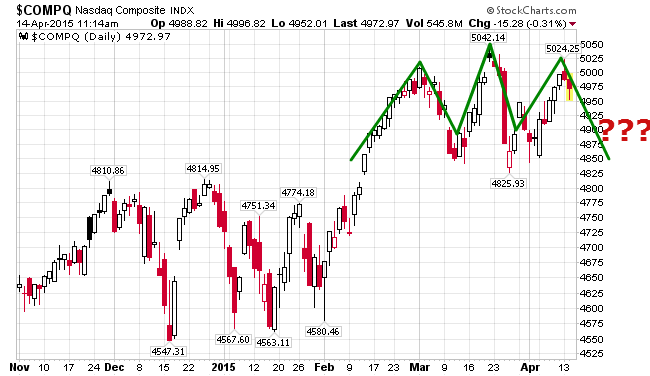

Or so I hear. In terms of press, Crispin Odey of Odey Asset Management talks about just that in The Secret Behind This Hedge Fund Manager’s Market Collapse Prediction. That is to say, should the market start a significant decline, we might see liquidity vanish overnight. We saw a little bit of that in October of 2014. Point being, if/when things get ugly, they will get ugly fast.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2014/15-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2014/15-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. April 10th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Shocking: The Same Price Buys You Either A 9 Bedroom Castle Or 1 Bedroom Apartment Google

In an attempt to gain complete control of our financial system the FED needs an additional tool. The ability to set negative interest rates in order to tax the currency. We might as well be a stone throws away from someone at the FED actually proposing this notion as CITI’s own economist believe it’s a splendid idea.

In an attempt to gain complete control of our financial system the FED needs an additional tool. The ability to set negative interest rates in order to tax the currency. We might as well be a stone throws away from someone at the FED actually proposing this notion as CITI’s own economist believe it’s a splendid idea.

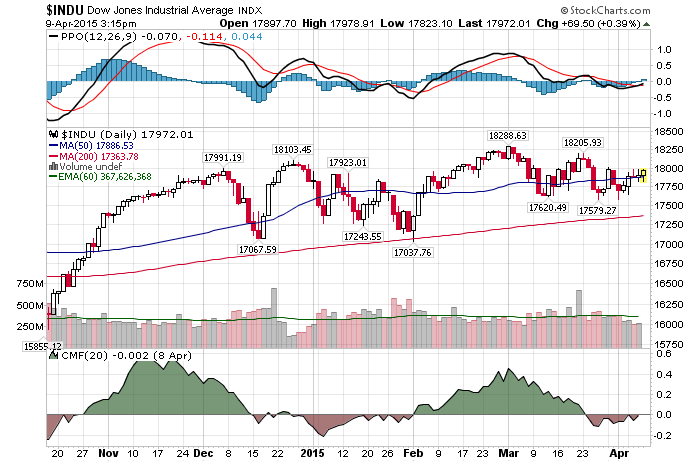

4/09/2015 – A positive day with the Dow Jones up 56 points (+0.31%) and the Nasdaq up 24 points (+0.48%).

4/09/2015 – A positive day with the Dow Jones up 56 points (+0.31%) and the Nasdaq up 24 points (+0.48%).

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.

As yours truly, David Stockman and Mohamed El-Erian continue to warn their followers that a big stock market decline and a severe recession are coming down the pipeline.