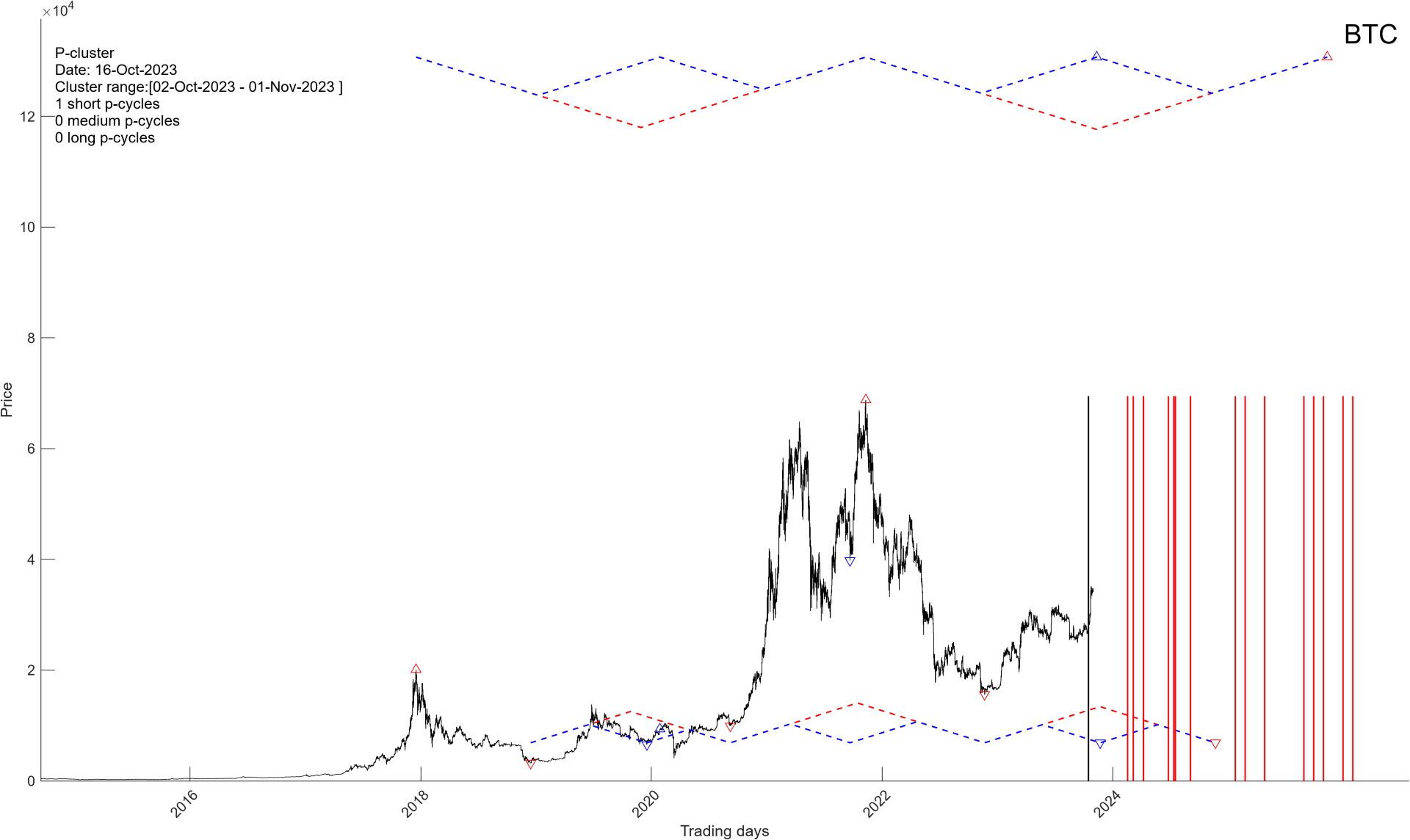

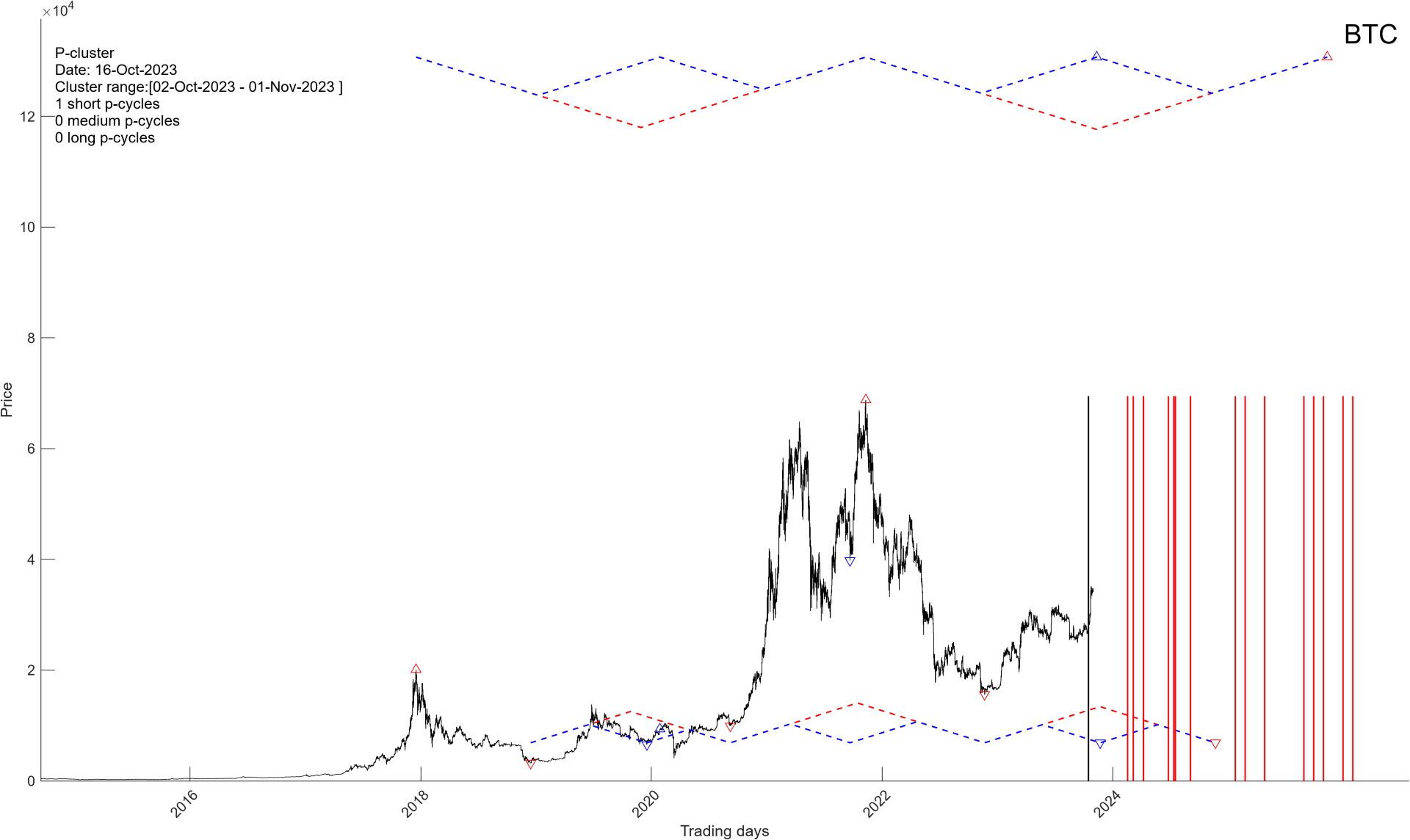

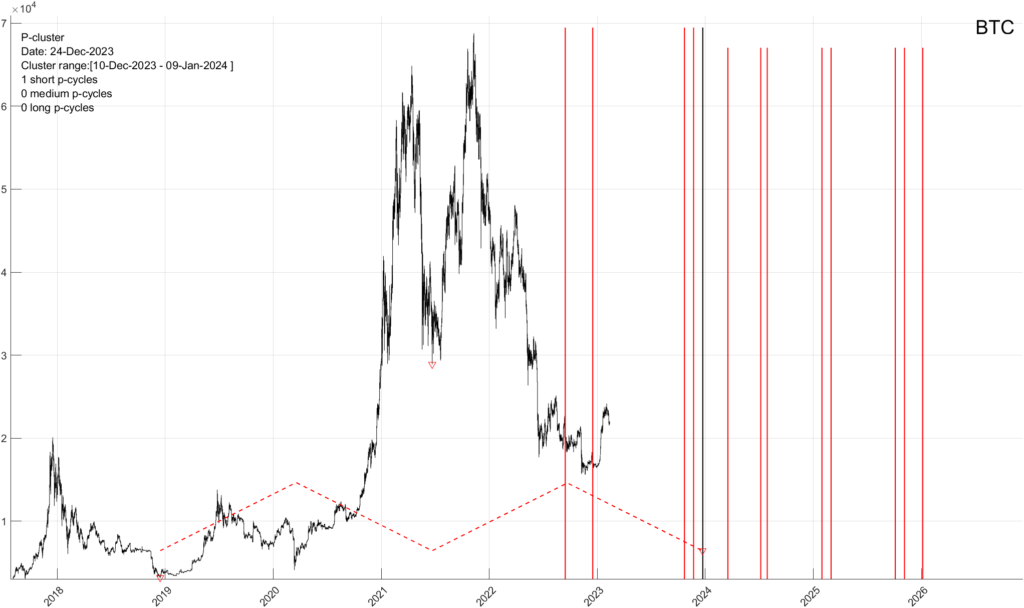

In early January of this year we confirmed Bitcoin’s November of 2022 bottom as a longer-term precise mathematical bottom and have suggested at the time that Bitcoin will run up to above $30K. No one believed us at the time – what else is new.

It appears now that the proverbial Bitcoin bulls are coming back from the dead, their outlandish predictions are once again gaining steam. Not so fast….here is our latest Bitcoin (BTC) update……

BITCOIN (BTC)

Date of Analysis: October 30th, 2023

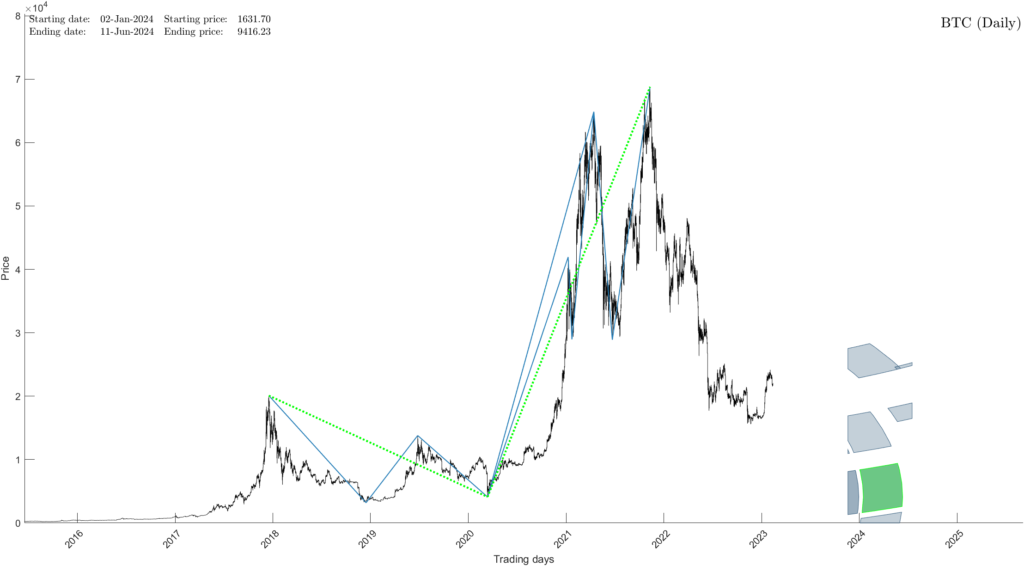

Our mathematical and timing analysis for Bitcoin shows the following…….

-

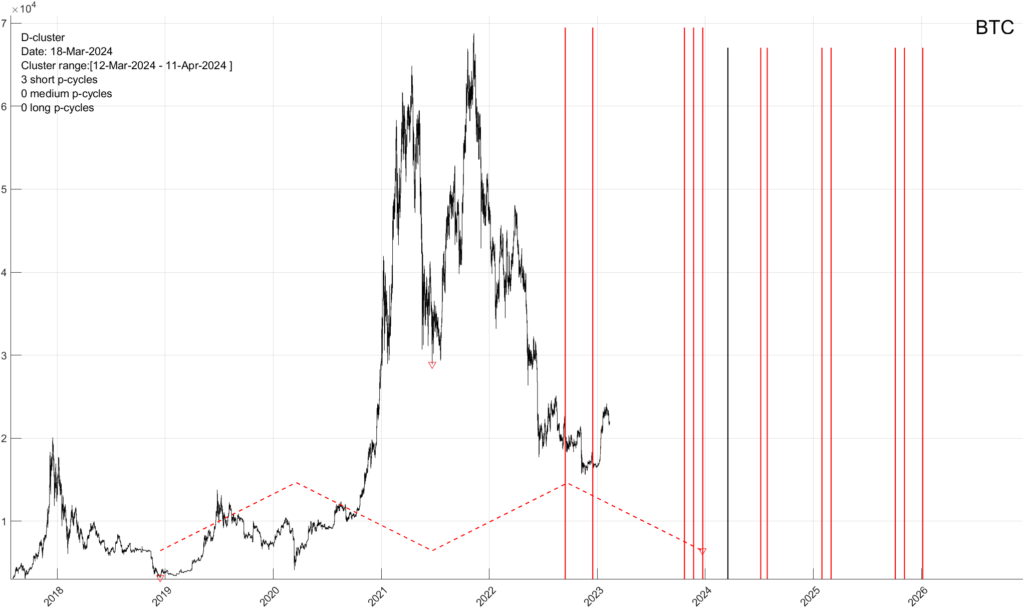

- Short-term Bitcoin should remain range bound as it seeks out a mid-term top. We currently do not have any good mid-term time/price projections for this completion point. It’s a bit of a mess.

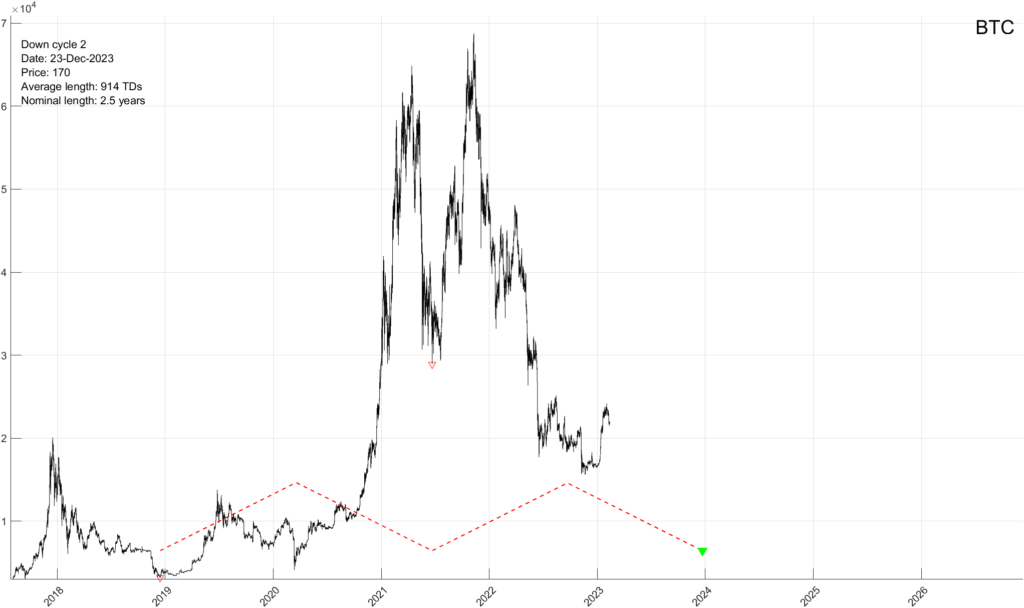

- Once the mid-term top arrives BTC will decline into a major bottom scheduled to arrive around XXXX of 20XX.

- We do have some bottom projection points, with the most likely bottom located at XXXX (+/- 100), but we would need a mid-term top point above to confirm this in full.

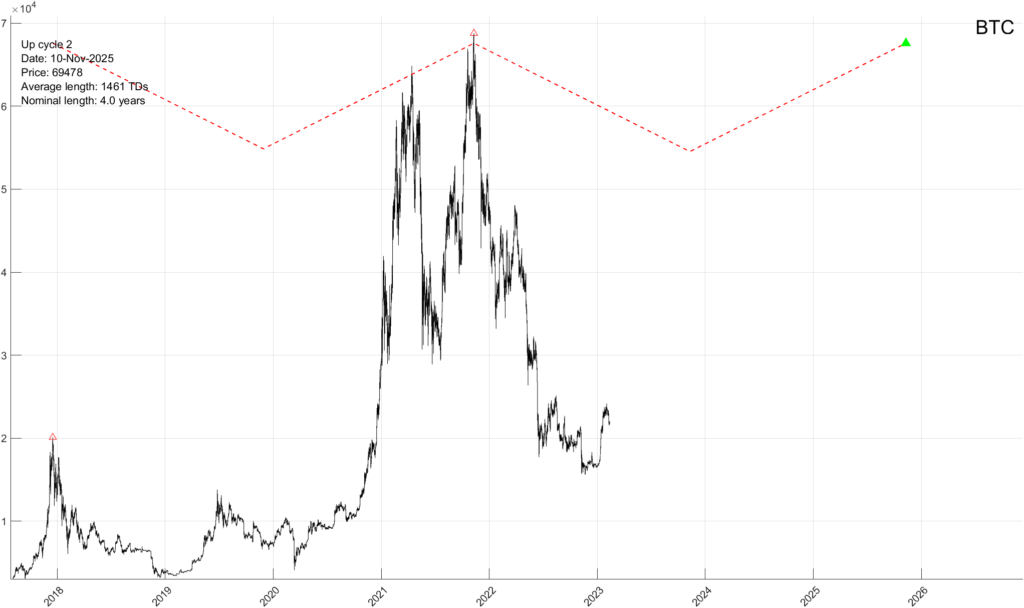

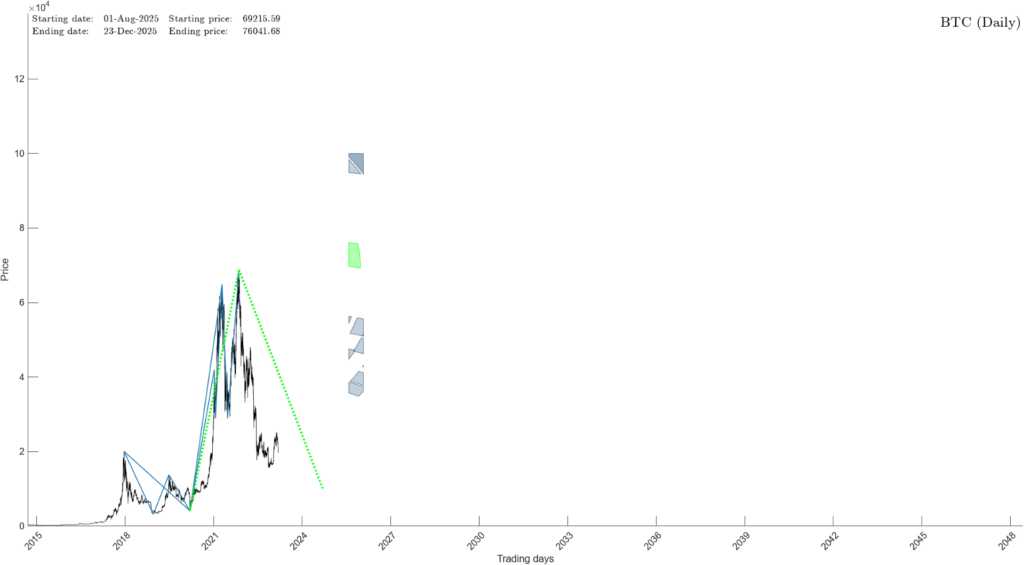

- Once the bottom arrives Bitcoin will turn into a fast mover and surge to a new all time high by about November of 20XX. This is the move to participate in.

In summary, expect a range bound Bitcoin until a major bottom arrives around XXXX of 20XX. Then a powerful move higher to a new all time high. A more exact targeting analysis will be available as we approach the junctures above.

If you would like to see our exact TIME & PRICE targets for Bitcoin’s (BTC) major bottom, as well as our precise turning point “targeting analysis” , please CLICK HERE

“I was convinced that I was totally incompetent in predicting market prices – but that others were generally incompetent also but did not know it, or did not know they were taking massive risks. Most traders were just “picking pennies in front of a steamroller,” exposing themselves to the high-impact rare event yet sleeping like babies, unaware of it.”

“I was convinced that I was totally incompetent in predicting market prices – but that others were generally incompetent also but did not know it, or did not know they were taking massive risks. Most traders were just “picking pennies in front of a steamroller,” exposing themselves to the high-impact rare event yet sleeping like babies, unaware of it.”