Weekly Update & Summary: February 22nd, 2014

The market remained relatively flat for the week with the Dow Jones losing -51 points (-0.32%) while the Nasdaq gained 19 points (+0.46) Structurally, the market did very well, closing all the gaps during the span of the week. There is still a gap left around 15,500 on the Dow, but it will be closed during the subsequent bear market leg.

Fundamental & Market Analysis:

Over the last couple of years I have argued, sometimes passionately, that the Federal Reserve doesn’t really know what is going on within our own economy and our financial markets. Not only that, but I have also argued that they are a bunch of idiots and fools who believe that they can somehow control our financial markets.

If recently released transcripts, generated during the 2008 meltdown don’t prove my point of view without a shadow of a doubt, I don’t know what will. Here are just a few quick points from the said transcripts.

- They didn’t even realize recession was happening until the 4th quarter of 2008. By that point the stock market has completed 80% of its down move. In fact, for most of 2008 they thought the recession “could be avoided”.

—-Hello???? Was anyone home??? Recession started in Q4 of 2007.

- Bernanke talked about pent-up demand for housing as late as January 2008.

- Bernanke was worried about inflation as late as January 2008.

- Throughout Q1 of 2008 they have held a generally rosy view of the world and the US Economy

Here are the links to two great articles about the transcripts if you would like to learn more. Click Here and/or Click Here

The lesson here is twofold.

First, anyone who believes that the FED can either control, anticipate or predict financial markets and/or the economy is even a bigger fool. Neither Bernanke nor Yellen can predict the economy even if it hit them in the face with a brick. All they can do is look at past data and say “Oh, look, according to this data recession started in Q4 of 2007”. What a waste of time and money.

Second, they will always be behind the ball. They will always be a reactionary force as opposed to market makers. Take today’s environment for example. They are cutting QE and talking about raising the interest rates at exactly the wrong time. The damage from their crazy liquidity party has already been done. The worst thing they can do now is cut it. The faster they do it the faster the markets will collapse.

Why is any of this important?

Well, if you rely on FED to make money in the stock market and/or run your own business it becomes incredibly important. As such, no one should rely on any action by the FED as an investment indicator. It is as simple as that.

This brings us to financial markets and my premise that financial markets behave exactly as they should. Many people would argue that it was the FED’s actions that put the bottom in at the March of 2009 juncture, ensuring a subsequent and massive stock market rally.

WRONG.

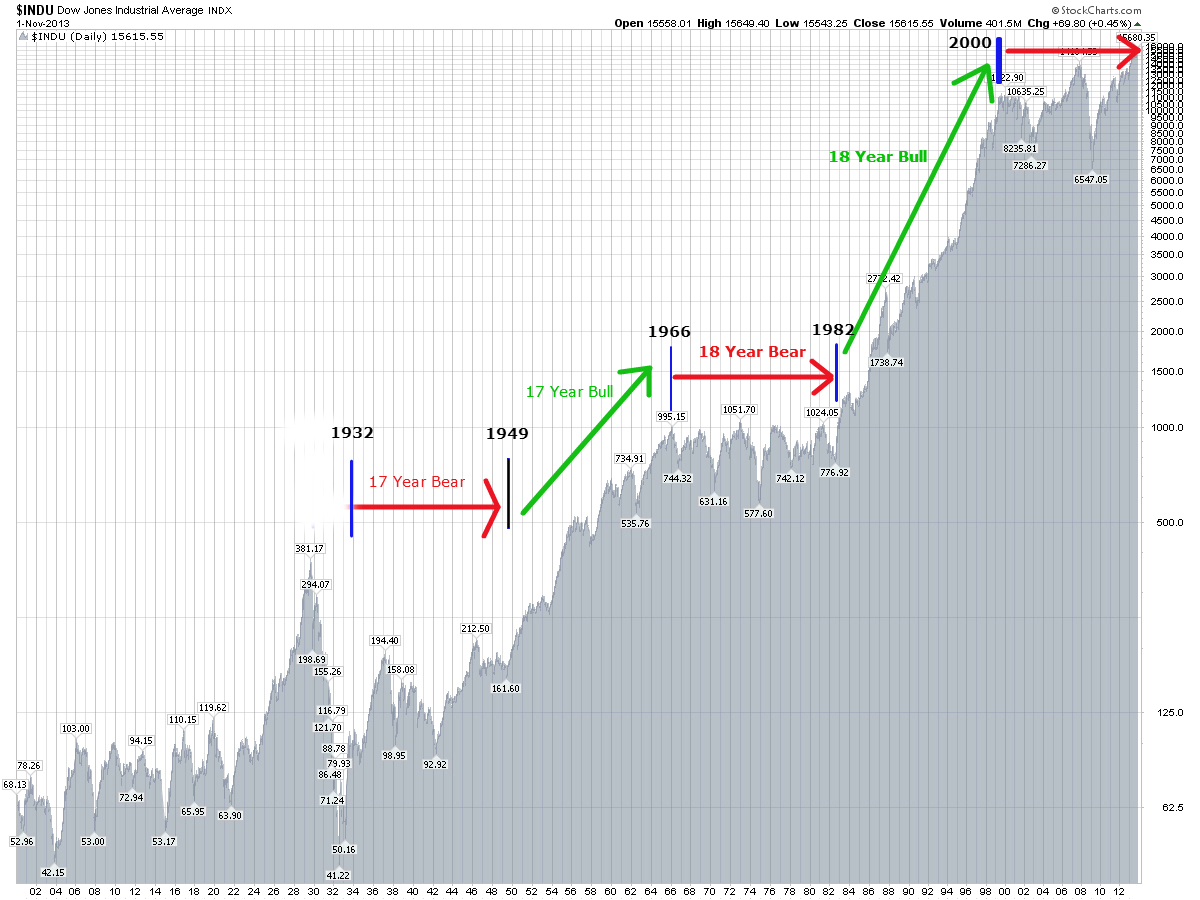

Don’t confuse cause and effect. It was the market that made the FED’s look good and not the other way around. The market was structured to bottom on March 6th, 2009 at 6,469 and then have a subsequent 5-year market rally. It was the mid-cycle bottom (half point of bear market) and I predicted it as early as January of that year. I was 1 day and 100 points away. Close enough. I know I have shown this chart before, but let’s take another look.

If you perform the type of 3-dimensional analysis that I do you would know that the move between 2003 bottom and 2009 bottom would be IDENTICAL to the move between 1994 bottom and 2002 bottom. And so it was, exhibiting a variance of 22 3-dimensional units (equivalent to a few trading days or 100 points).

Any analyst working with this information would know that as soon as 2007 top was confirmed that the next move down would be exactly 8,130 3-dimensional units. Once the market developed further, the same analyst would be able to pin point the exact bottom with amazing precision and that is what I want you to understand without a shadow of a doubt. The stock market is not volatile or random, it is exact and precise.

Same thing applies to today’s market. In last week’s forecast I identified a turning point in February. While I am not yet at liberty to discuss this turning point (available to premium subscribers only), it clearly explains the market action we have witnessed over the last couple of days. By concentrating on mathematics and 3-dimensional analysis one can pick out turning points with a precision of a surgeon.

Macroeconomic Analysis:

In a nutshell, Ukraine, Venezuela, Argentina and China. Argentina is on a verge of another default and I wrote about it before. Ukraine and Venezuela are both in the midst of violent revolutionary uprisings. While Venezuela will not have that much impact either way, Ukraine’s situation will have vast repercussions across the globe. Maybe not in economic terms, but certainly in geopolitical risk. All because of Russia. Having been born in Russia, let me tell you something. Russia is pissed off….big time.

They are pissed at a blatant American and EU interference into Russia’s business. Yes, Ukraine is Russia’s business. Always was and always will be. Just to give you a reference point, there would be a similar type of a reaction from the US if Russia was interfering in governance of Kentucky. Now, let’s take the “Ukranian people deserve freedom too and the US will go to any length necessary to see it happen” bullshit off the table. If you believe this crap, I have a $20 million bridge to sell you (give me a call).

What you see happening is the beginning of the next Cold War where both the US and Russia keep tearing into each other. With the only winners being the politicians and the military industrial complex. This is a negative development that should be watched carefully going forward.

China’s shadow lending system continues to expand at breakneck speeds. No-one really knows for sure how big a problem China’s economy will eventually face due to the massive credit and money supply growth over the last few years. Since 2008 financial meltdown in particular. While no one has the real numbers, some of the estimates coming out of China are truly mindboggling. For instance, that China’s banking sector is now roughly the size of the US banking sector. With one primary difference. It took the US over 100 years of trial and error to get to that size, it took China roughly 5 years. Thus far China has been able to keep trouble at bay, but this is unlikely to continue much longer. Some sort of a blow up in China is imminent.

Technical Analysis:

While the overall technical picture continues to remain murky, the resolution should be just around the corner.

Long-Term: The trend is still up. Market action in January-February could be viewed as a simple correction in an ongoing bull market.

Intermediary-Term: Since February 5th, intermediary term picture shifted from negative to positive. Giving us a technical indication that both the intermediary term and the long term trends are up. Yet, that in itself can be misleading as per our timing analysis discussion below.

Short-Term: Is somewhat bearish. Please view our mathematical and timing analysis below for further understanding and explanation.

Mathematical & Timing Analysis:

(*** Please Note: About 75% of the information contained within this section has been deliberately removed. Particularly, exact dates and prices of the upcoming turning points. As well as trading forecasts associated with them. I deem such information to be too valuable to be released onto the general public. As such, this information is only available to my premium subscribers. If you are a premium subscriber please Click Here to log in. If you would be interested in becoming a subscriber and gaining access to the most accurate forecasting service available anywhere, a forecasting service that gives you exact turning points in both price and time, please Click Here to learn more.Don’t forget, we have a risk free 14-day trial).

Last week we concentrated on February XXXX, as a turning point. Here is the forecast that was provided.

Date: XXXX

Price: XXXX

Thus far, the vertical rally that started on February 5th ran into a brick wall. To be exact, the Dow topped out 1 hour into trading on February 19th at 16,225 and then proceeded to collapse 200 points. Recovering thereafter and subsequently oscillating without going anywhere.

So, what is going on? Have we hit our turning point?

XXXX

Hence, I suggest the following positioning over the next few days/weeks to minimize the risk while positioning yourself for a forecasted market action.

If You Are A Trader: XXXX

If No Position: XXXX

If Long: XXXX

If Short: XXXX.

CONCLUSION:

We have an existing couple of weeks coming up. The week of February 24-28th should finally confirm February XXXX as a turning point. In March, we should see a number of big and very important turning points. I will start talking about them once the current stock market action resolves itself. Those anticipating the moves and those who can time them properly will be rewarded appropriately. Once the moves described above play out in full, the market will be set free to continue its next cyclical bear market leg.

Please Note: XXXX is available to our premium subscribers in our + Subscriber Section. It’s FREE to start.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Idiots At The Gate. Plus, Weekly Stock Market Update & Forecast Google