CNBC Writes: ‘No bubble troubles’ in stock market, declares Goldman Sachs

Goldman Sachs thinks talk of financial bubbles is misguided, and the firm is encouraging its wealthy clients to keep their money in relatively expensive sectors such as U.S. technology stocks and high-yield bonds.

“Stay fully invested—we don’t have bubble troubles yet,” Sharmin Mossavar-Rahmani, chief investment officer for the bank’s investment strategy group, said at a press briefing in New York last week.

The firm likes several relatively pricey sectors. One is U.S. technology stocks, based on strong corporate free cash flows and prospects for corporate earnings growth. The Dow Jones U.S. Technology Index has gained about 141 percent over the past five years.

Maybe Goldman Sachs clients are too rich for their own good and are in need of a good haircut. That is exactly what they are going to get if they listed to Sharmin Mossavar-Rahmani. Instead of being risk averse she wants them to pile into highly speculative Tech stocks? You can’t make this stuff up.

The article continues, “But she reiterated the four reasons Goldman believes equities are not in bubble territory, as outlined in a recent strategy report: Credit growth is not excessive; investors are just beginning to get back into U.S. stocks; views on the U.S. are not yet overly bullish; and stock valuations have not raced too far ahead”.

Let’s take a look at each point individually.

1. Credit Growth Is Not Excessive. Are you kidding me? Total market debt as a % of GDP stands at 370%. The highest in the history of mankind. As a reference point, 1929 this same indicator was at just 280% of GDP. We all know what happened thereafter. Plus, the FED is printing/monetizing $85 Billion per month to add liquidity to the market. There are credit bubbles everywhere (mortgage, student loans, credit cards, even car loans) and Goldman Sachs has the balls to claim that credit growth is not excessive? Unbelievable.

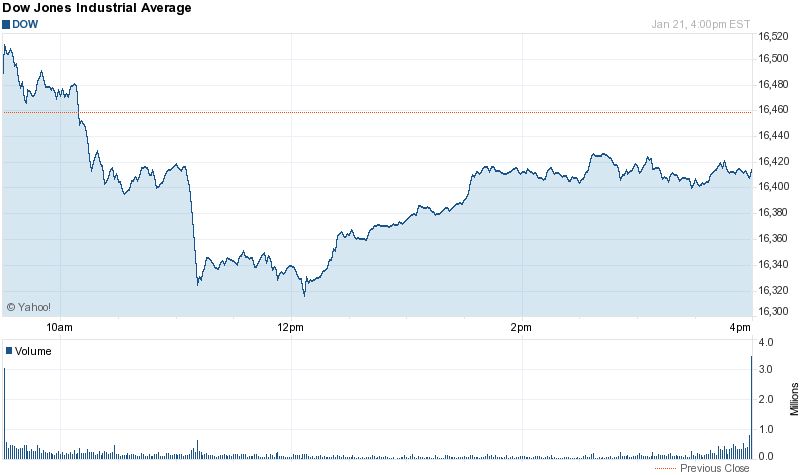

2. Investors are just beginning to get back into US stocks: I am not sure what “investors” she is talking about, but the market is up over 150% in 5 years. If they are getting back in “just now” they are dumb and this should be used as a contrary indicator.

3. Views on the US are not yet overly bullish: Once again, views by whom? If you take a look at the bullish sentiment indicator, it is sitting close to an all time high. That is above 2000 and 2007 levels. Plus, everyone (media, financial advisors, investors, etc…) are falling all over each other while predicting the market to go up in 2014. As far as I am concerned you can’t get more bullish than this.

4. Stock Valuations have not raced too far ahead: “Too Far” is the keyword. In a sense, Sharmin is admitting that valuations are indeed high. While this point is debatable based on your valuation metrics, personally, this market is incredibly expensive. At today’s prices I cannot find too many things (if anything) to invest in.

The bottom line is as follows. The arguments Goldman Sachs makes are nonsense and without merit. Investors must clearly understand that before making their investment decisions. As I have said so many times before, my timing/mathematical work indicates a contrary position. The bear market is about to start and it will wreck havoc on the financial markets over the next 3 years. AKA….its time to protect yourself instead of buying up tech stocks.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!