Bloomberg Writes: Value Fund Managers Go on a Buyer’s Strike

Wally Weitz beat 90 percent of his rivals in the past five years by buying stocks he deemed cheap. Now he says bargains are so scarce that he’s letting his cash pile up. “It’s more fun to be finding great new ideas,” says Weitz, whose $1.1 billion Weitz Value Fund (WVALX) had 29 percent of its assets in cash and Treasury bills as of Sept. 30. “But we take what the market gives us, and right now it is not giving us anything.”

“We are having a more difficult time finding bargains,” Yacktman wrote in an e-mail.

Romick, managing partner of First Pacific Advisors, took a similar stance in his second-quarter letter to shareholders of the $14.1 billion FPA Crescent Fund. “We find it difficult to invest in an environment that seems manipulated to engineer higher asset prices regardless of business fundamentals,” he wrote.

Read The Rest Of The Article Here

I have mentioned this a number of times before, but we are now getting confirmations from some of the top money managers in the world.

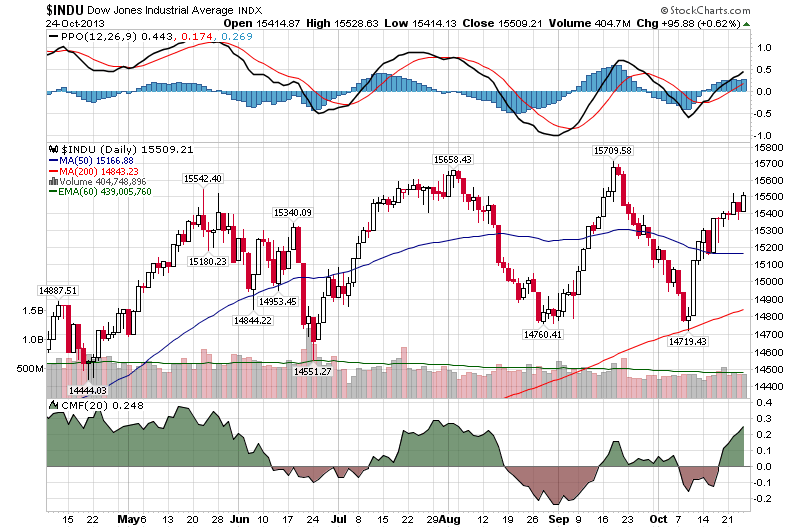

Given current market environment, there isn’t that much to buy out there. Most stocks and markets are overpriced. Bullish sentiment is approaching all time highs and the situation is starting to get dangerous. Why dangerous? Well, this market is artificially maintained by massive infusions of cheap credit (QE) and speculation. Basically, there is no fundamental reason for most asset classes to be where they are today. It is all artificial. All assets are grossly mispriced to the upside and that will have to be corrected, sooner rather than later.

While I do not provide financial advice directly, I would suggest that people might want to look at the situation from the following vantage point. The market is providing you with an excellent opportunity to start selling and building your cash reserve for the next round of the bull/bear swing.

Can the market go even higher here? Sure, but the probability of a severe bear move in the near future is very high. Well, certain as per my mathematical work.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!