If you haven’t noticed, both the bond market and the stock market have been rallying as of late. An unusual situation. The real question is……which market has got it right and/or which of these markets will break first?

Will the bond yields begin to rise in tandem with the stock market as the US Economy accelerates growth -OR- will the stock market break down, pulling both the US Economy and the bond market down?

Typically, the bond market is considered to be the “more intelligent” market and I would have to agree with that classification in this particular case. With the US stock market being severely overvalued (in bubble territory) and with the FED tightening in full force, it is just a matter of time before the bond market comes out on top.

This is further confirmed by our mathematical and timing work. Again, our work shows a severe bear market between 2014-2017. When it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning exactly when the bear market will start (to the day) and its subsequent internal composition, please CLICK HERE

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

Click here to subscribe to my mailing list

Google

Talking Numbers: How long can stocks and bonds rally together?

Call it the ultimate game of chicken.

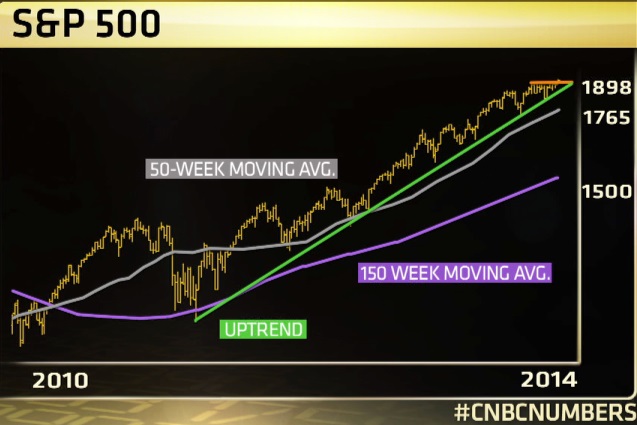

The Dow Jones Industrial Average closed at record highs on Friday. The S&P 500 index is just a few points shy of its all-time highs. And yet, year-to-date, as the S&P 500 continues to defy gravity, investors have been furiously buying up bonds as well.

So, which will break first: stocks or bonds?

Portfolio manager Chad Morganlander of Stifel Nicolaus’ Washington Crossing Advisors thinks bonds will crack first.

“I think interest rates are going to start going higher as the economy starts to improve and accelerate into the second quarter,” Morganlander said. “I think the [10-year Note] could go around 2.85 to 2.90 [percent].” Bond prices and rates move inversely to each other.

According to Morganlander, evidence of an accelerating economy will include nonfarm payrolls growing at a rate higher than 300,000 per month (it was 288,000 in April), higher household credit creation, and housing starts at an annual rate of 1.2 million (it was 946,000 in March).

But, while he sees the 10-year yield getting closer to 3 percent, he is optimistic on stocks as well. “We are quite bullish on the market,” Morganlander said. “We think that the equity markets are going to go higher by about 7 to 8 percent for the year.”

Mark Newton, chief technical analyst at Greywolf Execution Partners, doesn’t think rates will necessarily move up just yet.

“It’s still difficult to argue that the 10-year yield has to move straight up from here,” Newton said. “I know in the long run, that’s likely correct but in the short run, we’ve been very range-bound over the last few months.”

That range in the US Treasury 10-year yield is roughly between 2.56 and 2.82 percent, according to Newton. There is “very little sign, at least technically, that rates should move up right away. The chart overall is still quite bearish.”

Newton sees rates and stocks moving together, but this time to the downside.

“I think we’re going to see a move to 2.45 first,” said Newton about the 10-year yield. “That likely coincides with an equity correction probably between the months of July and September. That’s seasonal time when stocks usually pull back and we see that flight to safety in the Treasurys.

On the longer-term charts, Newton sees the 10-year yield moving down a well-defined trend channel since the mid-1980s. The upper end of that trend channel is currently around 3.75 percent.

“We almost need to get up above 3.75 to argue that a bigger move higher in rates is going to happen,” Newton said. “Rates over the long term are likely going to rise and it’s probably a poor risk/reward for investors. But, I think from a trading perspective, money should flow into Treasuries if the market starts to pull back more for safety reasons.”

“Over the next few months,” adds Newton, “I can still see rates pulling back here, getting back under 2.56 and down to 2.45.”

To see the full discussion on the US 10-Year Note, with Morganlander on the fundamentals and Newton on the technicals, watch the above video.