2/22/2019 – A positive week with the Dow Jones up 148 points (+0.57%) and the Nasdaq up 55 points (+0.73%)

The stock market remains at an incredibly important juncture. Things are about to accelerate in an unexpected way. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Quite a bit of information to cover as we go into the weekend. I highly recommend the following…….

Stupidity Well-Anchored

The only thing that’s “well-anchored” is the stupidity of the belief that inflation expectations matter.

Asset Irony

People will rush to buy stocks in a bubble if they think prices will rise. They will hold off buying stocks if they expect prices will go down.

People will buy houses to rent or fix up if they think home prices will rise. They will hold off housing speculation if they expect prices will drop. The very things where expectations do matter are the very things the Fed and mainstream media ignore.

To rather quickly summarize all of the above…….Valuations remain at historically extreme levels (today’s P/E ratio is slightly above 1929 top) while underlying economic and earnings conditions continue to deteriorate at a fast pace.

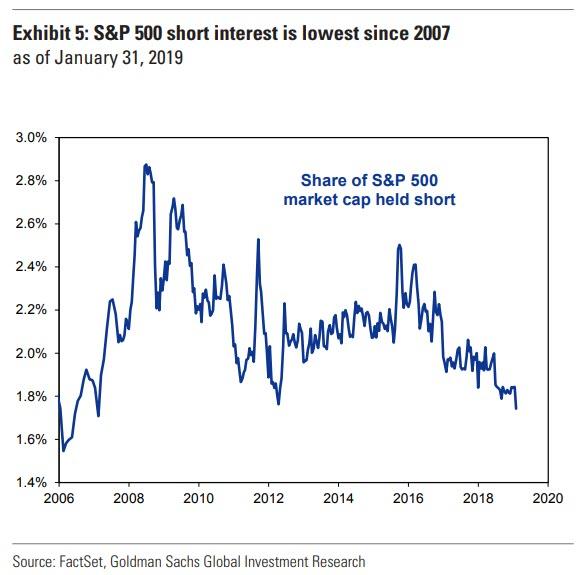

What’s more, short sellers have been decimated to 2007 top levels and various sentiment indicators are flashing extreme overbought levels. Not to mention that nearly everyone and their day trading grandma are “Long and Strong”.

No wonder Mr. Buffett is hard pressed to find anything to buy.

Luckily, you don’t have to guess what the stock market will do next under such extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.