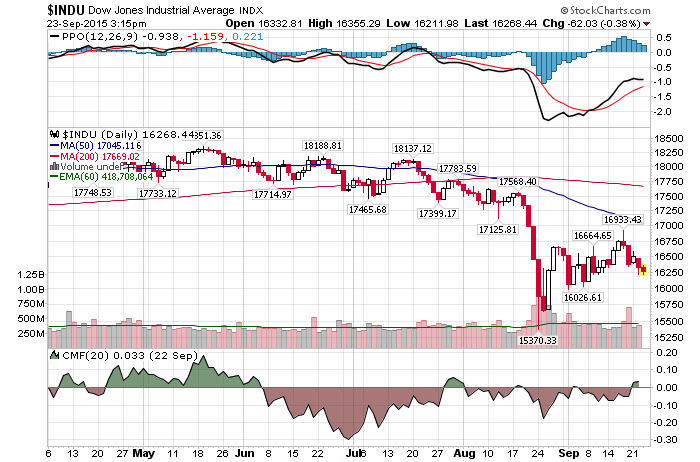

9/23/2015 – Another down day with the Dow Jones down 51 points (-0.31%) and the Nasdaq down 4 points (-0.08%)

The stock market is confused and so are most traders. From one vantage point, we are sitting on a buying opportunity of a lifetime. For instance, S&P 500: What’s on Tap for the Rest of 2015? 6 Reasons to Expect a Rally. From another, this apparent bear market is just starting. Stocks Will Slide Much More — Here’s How to Avoid the Pain of 2008

To complicate matters even more, most traders and Elliot Wave technicians I know expect the re-test of August’s lows before any sort of a rally materializes. Only if it was that easy.

Who is right?

Even if I knew I wouldn’t tell you, but let’s take a closer look at those 6 reasons to be bullish. My comments are in greed.

1. History: Panic declines, like in August, tend to be followed by a period of testing and another low or at least a test of the initial panic low.

That is absolutely correct. However, how is that bullish is lost on me.

2. Historical evidence: There have been 21 panic drops similar to the August one. 10 of them tested or broke the initial panic low before going higher. Five of them were a v-shaped recovery. Even three of the six instances that rolled over into a new bear market saw sizeable rallies after breaking the initial panic low.

Fair enough. We have rallied 1560 points on the Dow off of August 24th low or 10.2%. NDX was up 17.5%. Is that not sizeable enough? Just as a reference point, in 1929 the bounce was 12-13%. That was followed by a 50% drop. Again, I am failing to see how this is bullish.

3. Seasonality: Late September to early October is one of the worst times for the S&P 500 in terms of seasonality (view S&P 500 seasonality chart).

Actually, it is October-November. I am staring to think that this article is written by a bear.

4. Statistically: The S&P 500 ended August with a loss of more than 5%. This has happened 13 times since 1928. The September thereafter was positive only 4 out of 13 times.

OK, another worthless data point, but good to know.

5. Post-Triple-Witching weakness: Since 1991, there have been 33 Triple-Witching Friday’s that ended in the red (like last Friday). Some 24 were followed by a weekly loss.

OK, another worthless data point. This is not indicative of anything.

6. Elliott Wave Theory: According to Elliott Wave Theory, stocks move in segments of either three or five waves (this is a highly simplified explanation). Thus far, the S&P 500 has fallen in three waves. The current bounce looks like a wave 4 retracement, to be followed by another wave down (wave 5 — see labels on chart). Alternatively, the decline could only be three waves and lead to new all-time highs without prior new low.

Again, if it was this simple all Elliott Wave practitioners and/or followers would be billionaires by now. Plus, I am still confused about how this is bullish for stocks.

All of the above is just noise. In reality, one must look at the long-term structure and the fundamentals. The stock market is incredibly overpriced, by most traditional measures. I have beaten this point to death on this blog over the last few years. Technically, the market did a quite of a bit of damage on the downside in August. Suggesting that a bear market might have already started. And that should be your primary concern.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 23rd, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!

What Investors Ought To Know About Today’s Stock Market Google