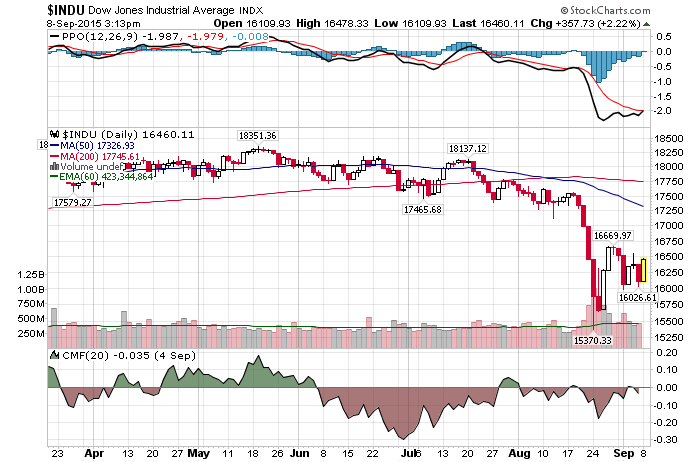

9/8/2015 – A big up day with the Dow Jones up 391 points (+2.43%) and the Nasdaq is up128 points (+2.73%)

While this will upset quite a few of Mr.Buffett’s disciples, I no longer believe that Warren is following his own advice. Advice such as, “Be greedy when others are fearful, fearful when others are greedy, buy $1 bills for .50 cents, etc…” Here is why….

Warren Buffett plans to invest $32 billion, soon

Warren Buffett said Tuesday the U.S. economy is growing at about 2 percent, and he’s planning to invest $32 billion in the next four to five months.The previous time the Oracle of Omaha spoke with CNBC in early August, he discussed the conglomerate’s $37.2 billion acquisition of Precision Castparts (NYSE: PCP), an aircraft equipment maker, saying “This a very high multiple for us to pay.”

There you go, even Mr.Buffett thinks he is paying a “A Very HIGH Multiple”.

My question is……..why?

As my previous posts here clearly illustrate, I believe we are in an overvaluation bubble of epic proportions. In the past, Mr. Buffett didn’t have a problem with sitting on the sideline while waiting for the market to crater. Then picking up wonderful investment opportunities at give away prices. That is how he has made his fortune.

It is unclear why Berkshire Hathaway is trying to get rid of its cash by investing right in the middle of this overvaluation bubble. Could it be due to the fact that Warren Buffett has fallen into a trap frequented by most other investors. Particularly today. A cult like believe in the FED and their ability to backstop any market decline? A believe that we are in the early stages of a 16-18 year bull run? A believe that our economy will improve and not slide back into a recession?

Sure, the investments he is making today will pay off over the next 15-20 years. Short-term, I believe this to be a very dumb decision. Something Mr. Buffett will surely write about in his 2017 Annual Letter To Shareholders. Mark my words.

This conclusion is further supported by my mathematical and timing work. It clearly shows a severe bear market between 2015-2017. In fact, when it starts it will very quickly retrace most of the gains accrued over the last few years. If you would be interested in learning when the bear market of 2015-2017 will start (to the day) and its internal composition, please CLICK HERE.

(***Please Note: A bear market might have started already, I am simply not disclosing this information. Due to my obligations to my Subscribers I am unable to provide you with more exact forecasts. In fact, I am being “Wishy Washy” at best with my FREE daily updates here. If you would be interested in exact forecasts, dates, times and precise daily coverage, please Click Here). Daily Stock Market Update. September 8th, 2015 InvestWithAlex.com

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!