I am simply amazed by the amount of stupidity out there and by the speed with which our society is deteriorating.

To illustrate, let me ask you a simple question. What did our President comment on today? The fact that the US has officially withdrawn from the INF treaty, bringing us all a GIANT step closer to a nuclear war with Russia (just as my forecast suggests). Or, did he spent time talking about some D list rapper thug. Any guesses?

I rest my case.

This week was all about the FED and their interest rate decision. Here is what told my premium subscribers……

A lot of interesting developments in the market today. Let’s concentrate on just two.

First, the FED doesn’t really know what to do. As I have said before, they are simply following the short end of the yield curve. For instance, the 6 month treasury has dropped from 2.5% at the beginning of the year to about 2.05 today. Hence, the cut we saw today.

The biggest problem for Powell and the FED, regardless of Trump’s tantrums, is that he doesn’t know what short-term yields will do next. Sure, they can go back to zero, but they can very well blow up again and head towards 5%. Forcing the FED to hike again. That’s the real reason why the FED was “non-committal” today. Just as everyone else, they have no clue.

Now, the mighty US Dollar blew through an important resistance level today. If you recall, we went long the US Dollar right at the bottom around 89 in early 2018. We got out around 97 some time ago because the US Dollar was hitting an important resistance line at that time. After wrestling with this line for close to a year, today’s market action points towards a breakout. If true, sky is the limit for the USD at this point. At the very least it will re-test prior highs.

Throw in the stock market and most traders, understandably, are ripping their hair out. Trying, in vain, to figure out what in the world is going on.

In terms of the stock market……..

After voting for the guy in 2016, here is what really upsets me about Trump and the whole situation.

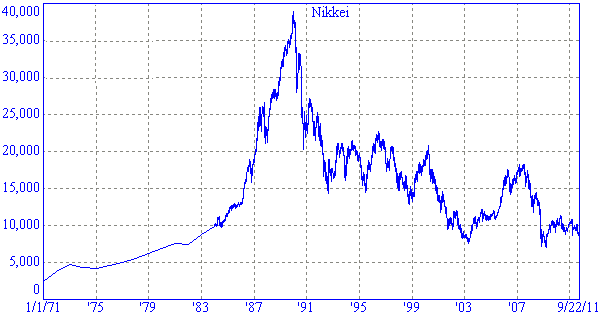

In early 2016 candidate Trump correctly identified a number of important economic/financial issues. To be more precise, he faulted the FED with keeping the interest rates too low for far too long and blowing up massive real estate and stock market bubbles.

Now that he is the President the exact opposite is true. Apparently the guy wants zero interest rates for even a bigger “Everything Bubble”.

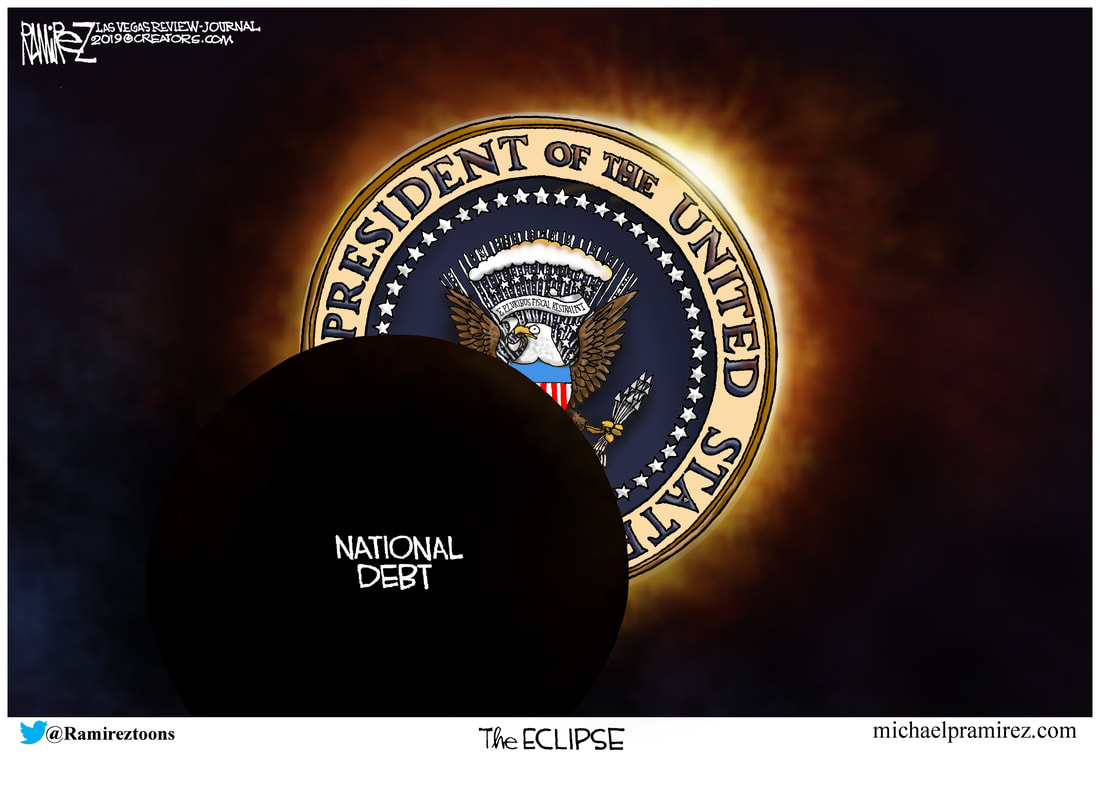

The following upsets me the most.

The guy knows or understands very clearly what he is doing or attempting to do.

He is trying to keep the party going a bit longer, no matter the cost or circumstances for the entire country. But the party always ends, and given today’s imbalances, it will get very, very ugly when it does end. So ugly, in fact, that it will devastate the entire country on multiple levels.

Finally, you don’t have to guess what the stock market will do next under today’s extreme conditions. If you would like to find out exactly what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here.

Please Note: Our latest call was a direct hit. While everyone was panicking our work projected an important bottom on December 27th (+/- 1 trading day) on the Dow at 21,725 (+/- 50 points). An actual bottom was put in place on December 26th at 21,713.