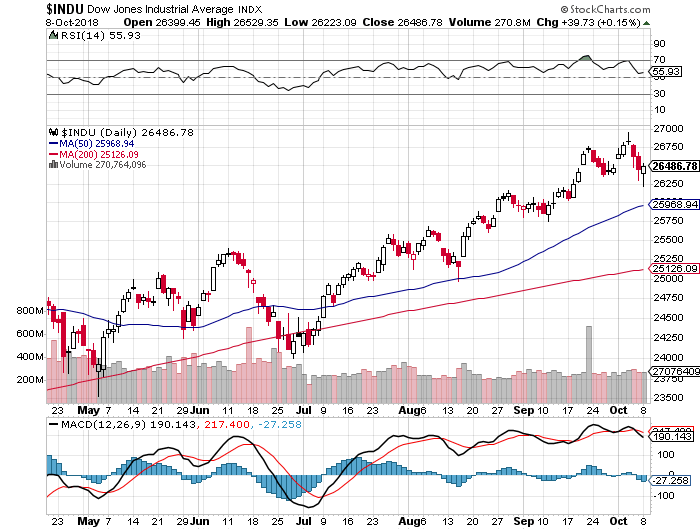

A negative week with the Dow Jones down 11 points (-0.04%) and the Nasdaq down 258 points (-3.20%)

The stock market finds itself at an incredibly important juncture. Things are about to move. If you would like to find out what happens next, based on our timing and mathematical work, in both price and time, please Click Here.

Back in July of 2016 we were able to identify the exact bottom on a 10-Year Note. Suggesting at the time that a 30+ years bull market in bonds was finally over. It has taken quite a while, over two years, but we now have our first longer-term confirmation point.

During a webcast last month, Gundlach said the effect that stimulus has on markets is akin to the effect that miracle grow can have on plants. Too much of it burns them out – which is why it’s not encouraging that deficits are widening this late in the cycle.

And if yields continue to rise, the selling rout in both bonds and equities – a twin rally that has been fueled by QE and rising US debt levels – will likely worsen. Indeed, the bond market is facing a crucial test.

During that webcast, Gundlach pointed out that the S&P 500 and US debt outstanding have climbed in tandem since the bull market began.

Gundlach finished his interview with another bold call. Namely, that stocks outside the US are already down significantly from the Jan. 26, 2018, synchronized high, “which will go down in history as the peak for the global stock market for this cycle.”

I find the above interesting for two reasons.

First, the yield curve has actually steepened over the last few days. And while some people will argue that is net bullish, I don’t see it that way. As I have argued in the past, the yield curve is already flat and doing massive damage. No inversion is necessary.

Plus, the above will give the FED more room to hike rates. Just as Power has indicated. What’s worse, at some point the yield will move down to its trendline (most likely) and that will invest the curve in a dramatic fashion.

Second, considering today’s massive imbalances and debt levels, higher interest rates will bring Trump’s Ponzi Economy to a screeching halt. Are the bond vigilantes back, has the FED lost control, and if so, just how high and how fast will the rates go?

Finally, will the setup above absolutely crash global stocks?

We might have an answer.

If you would like to find our exactly what the stock market will do next, based on our mathematical and timing work, in both price and time, please Click Here