Peter Schiff certainly thinks so (video below), but we don’t buy it. We called the US Dollar bottom earlier the year and we still holding our long position. Can Trump’s Attack On The FED & The USD Keep This Bull Market Alive? That is to say, our target high hasn’t been reached, yet.

Investment Grin Of The Day

The $250 Trillion In Worldwide Debt: Forget Economic Collapse, War Is The Only Possible Outcome

Another mixed week with the Dow Jones up 356 points (+1.40%) and the Nasdaq down 23 points (-0.29%).

You can very much argue that recent oscillations in the stock market are driving both bulls and bears up the wall. What the market gives is then very quickly taken away. A flood of articles throughout the week were discussing which case was holding more water. Most were highly supportive of the bullish side, but it is not as easy as they make it out to be. On the contrary, the juncture we find ourselves at today is incredibly complicated.

If you would like to find out what the stock market will do next, both in price and time, based on our mathematical and timing work, please Click Here.

Just think for a second how staggering this number is, $250 Trillion in Global Debt. By comparison Global GDP is just north of $80 Trillion while the total global stock market capitalization is just about $100 Trillion. Let’s explore this further……

The Looming Economic Collapse: The $250 Trillion Dollar Worldwide Debt Crisis

As governments raise taxes to cope with their unending spending habits, people are increasingly being forced to supplement their own income with loans. And according to most financial experts, this debt problem is so big that it will usher in a global economic collapse of epic proportions.

According to the Institute of International Finance’s latest Global Debt Monitor, the amount of debt held in the world rose by the biggest amount in two years during the first quarter of 2018. It grew by $8 trillion to hit a new all-time high of $247 trillion, up from $238 trillion as of December 31, 2017. And that’s up by $30 trillion from the end of 2016.

Global debt is staggering to the point most of it will never be repaid and as governments continue their spending sprees and the debts keep mounting, the future of the economy looks bleak. There is more than enough economic data out there to show there could be an economic collapse and stock market crash in 2018. Bill Gross stated in 2017 that “our highly levered financial system is like a truckload of nitroglycerin on a bumpy road”. One wrong move and the whole thing could blow sky high, wrote the Epic Economist. Once this bubble pops, it will fling the globe into a financial crisis of epic proportions never before seen.

Here is what everyone is missing about this staggering amount. It can never be repaid, that is a mathematical certainty.

As result, world governments only have only a few options at their disposal. First, they can attempt to inflate away their currencies in a controlled fashion. That is what everyone is trying to do today, more or less unsuccessful, as everyone is playing the same game.

Second, they can default on the debt. Such drastic actions typically lead to economic collapse and subsequent depressions for the underlying countries. Very few would even consider such a step as very few countries can survive such a drastic measure. Although, Iceland did show us that it is possible.

The final option is some sort of a global debt or economic collapse/reset. The argument goes the Governments can’t control such an occurrence and the market will do it for them. As accurate as that description might be, such a collapse will lead to an all out global war.

We are already seeing early stages of this war developing. For instance, tariffs, Trump’s trade war, massive military budget, NATO, multiple proxy wars, etc….all point to the same conclusion.

Yes, the world has reached peak debt and there is no easy way out. Unfortunately, any sort of an economic collapse should be the least of your worries. An all out war, yes, nuclear war between the world superpowers will be the only possible outcome.

Luckily for you, we know exactly when this nuclear world war will start. If you would like to learn more, please Click Here.

MUST WATCH: David Stockman Explains Why Trump’s Trade War Will Implode The Market

Investment Wisdom of The Day To Celebrate Trump’s Massive Defense Budget

With Many Countries Dumping, Who The Hell Is Buying Mass Influx Of US Treasury Bonds?

8/16/2016 – A positive day with the Dow Jones up 396 points (+1.58%) and the Nasdaq up 32 points (+0.42%)

Today’s market action was ideal in terms of illustrating what a perfect short squeeze on the Dow looks like. Over the last few days we spoke about numerous large down gaps the market has left behind, suggesting it would close them before anything interesting happens. And so it was. If you would like to find out what the stock market will do next, based on our timing and mathematical work, in both price and time, please Click Here

Now, let’s talk about who the hell is buying the US Treasury Bonds currently flooding the market.

Who Bought the $1.36 Trillion of New US National Debt over the Past 12 Months?

“Official” foreign investors – this would be central banks, governments, etc. – and private-sector foreign investors held $6.21 trillion of US Treasury Securities at the end of June, up by $61 billion from a year earlier, according to the Treasury Department’s TIC data released Wednesday afternoon.

But over the same period, the US gross national debt, fired up by a stupendous spending binge, soared by a breath-taking $1.36 trillion. So who bought this $1.36 trillion in new debt?

The largest holder of marketable Treasury securities remains China, whose holdings in June fell by $4.4 billion from May to $1.18 trillion, within the same range since August 2017, despite escalating threats and counter-threats over trade.

No Seller – Not Even China – Can Disrupt US By Selling Treasurys…But The “Why” Ain’t Good

In short, Bernie Madoff would blush at the farce that is now the US Treasury market (further manipulating all downstream interest rate sensitive markets). A little lie or meddling led to more lying and more meddling…and suddenly the free market no longer exists. It should be clear that a buyer without profit motive is intervening in the Treasury market to maintain a bid and sustain continued low rates on US debt…all this because America has matured but those in control still want to synthetically maintain growth rates (hello China) via unrestrained debt issuance. Regardless how much debt the US issues and how few buyers remain, don’t look for interest rates to rise in kind.

We agree.

Having said that, it is a little beside the point of who is buying or selling US Treasury. As we have argued in the past, the Yield Curve itself is of much more importance here. FED Powell Confirms – Yield Curve Inversion Imminent

To very quickly summarize, the yield curve is already as flat as a pancake. The FED will continue to hike and the yield curve inversion is now imminent. Massive recession and debt implosion will come next and today’s short-term treasury buyers will look like absolute geniuses.

At least according to our work. If you would like to find out what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here

Is This The Blow Off Top Everyone Was Talking About?

8/15/2018 – A negative day with the Dow Jones down 137 points (-0.54%) and the Nasdaq down 97 points (-1.23%)

The stock market continues to follow our short-term and long-term forecasts. If you would like to read the rest of this forecast, based on our timing and mathematical work, please Click Here

So, is this the final blow off top everyone has been talking about? Well, it depends which index you are looking at, but one investor certainly thinks so.

‘This rally in stocks is a last hurrah!’ warns Guggenheim’s Minerd

However, Minerd, chief investment officer for Guggenheim and one of the world’s pre-eminent bond-fund managers, advised more than a dollop of caution should be employed by investors, who risk whistling through the proverbial graveyard. Via Twitter, the investment manager said: “Markets are crazy to ignore the risks and consequences of a #tradewar. This rally in #stocks is the last hurrah! Investors should sell now, speculators may do better in August”

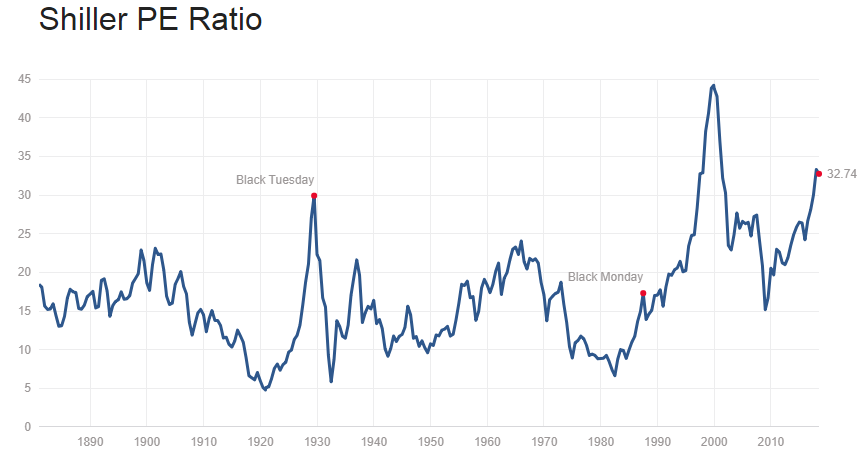

Let me put it this way. Over the weekend I raged about foolish investors (to put it mildly) buying small cap stocks at 100+ times earnings. Shiller’s Adjusted S&P P/E ratio is rather clear in that regard as well.

That is to say, the stock market is arguably selling at the highest valuation level in history. At the the very least, historically speaking, investors shouldn’t expect a return for decades to come.

Yet, we have to take something of significant importance into consideration here. The FED continues to hike, the yield curve is near inversion, Trump’s trade war just started and bullish animal spirits are running high.

Translation, the stock market finds itself in an explosive situation. And we would have to agree Mr. Minerd here. The explosion won’t be in the direction most investors believe. Luckily, our timing and mathematical work clearly shows what happens next. If you would like to find out, please Click Here

Investment Grin Of The Day

Bears Rejoice As The FED Refuses To Support The Market

8/14/2018 – A positive day with the Dow Jones up 112 points (+0.45%) and the Nasdaq up 51 points (+0.65%)

Not much new to add to our forecast. If you would like to find out what the stock market will do next, in both price and time, based on timing and mathematical work, please Click Here.

This might come as a shock to most bullish investors out there, but…..

Fed is no longer worried about every market hiccup, economist Lavorgna says

Perhaps lulled into a sense of complacency by a Federal Reserve that previously had seemed to attend to the market’s every hiccup, investors seem unprepared for a central bank that now thinks more hawkish medicine is in order, a veteran Fed watcher said Tuesday.

“People don’t seem to realize the Fed does not have investors’ backs,” said Joe Lavorgna, chief economist for the Americas for French investment firm Natixis.

Lavorgna has spent 20 years following the Fed for Deutsche Bank Securities and other Wall Street firms after starting his career at the New York Fed.

The biggest issue today is that most investors haven’t figured this out yet, let alone priced it into the market. Some bullish sentiment indicator are hitting historic highs and very few investors, if any, think the FED will spoil the party.

Yet, the time to worry is now. Let’s assume the above is true and the FED won’t care if the market drops 10-20% sometime in the future. In other words, they won’t jawbone the market higher as Janet Yellen has done in the past. That, in addition to tightening and taking liquidity out of the market can spark a real crisis of confidence.

Throw in the following chart and we possibly have an explosive situation on our hands.

In other words, if the FED refuses to support the market, even verbally, a 10-20% loss in the market can very quickly turn into a 60-40% loss. What’s worse, such a bloodbath will only take us back to the mean in terms of historic valuations levels. Bears rejoice?

Our work is clear in terms of identifying what the stock market will do next. If you would like to find out what the future holds, in both price and time, please Click Here

Melt Up Alert: Only Two Possibilities Remain And They Both Point To A Surge

8/13/2018 – A negative day with the Dow Jones down 125 points (-0.50%) and the Nasdaq down 19 points (-0.25%)

Short-term, the stock market continues to follow our exact trajectory. The next larger scale move should be….. If you would like to find out what the stock market will do next, in both price and time, based on our timing and mathematical work, please Click Here

Here is a sure bet ladies and gentlemen, if I have ever seen one……

Two possibilities for the S&P 500’s melt-up phase

Due to the higher move early last week, I have to now consider the more bullish pattern to 3,225 more seriously. I have labeled that pattern in blue, and it is an alternative pattern at this time. This pattern has a leading diagonal for wave (i) completed off the early April lows, and has us now setting up for the heart of a 3rd wave, ultimately pointing us over 3,100 on the SPX for wave (iii). However, in order to prove this is the operative count for wave (5), we will need to see a strong break out through 2,890 in the coming week or two. Should this occur, then we will likely see a pullback to the 2,870 level, and as long as we hold the 2,840 region on that pullback, it will be pointing us up toward 3,100 in quick fashion to complete wave (iii) of wave (5).

There you go, just load up on call options and ride this train to the promise land of milk and honey of massive capital gains.

RIGHT?

Wrong. Over the last few weeks we have been discussing an important divergence between the Nasdaq/Russell/Wilshire and the Dow/S&P/NYA. It is important to note that while the former is sitting at or near its respective all time highs, the latter is nowhere close.

How do we reconcile that?

Once again, that was the exact topic of discussion in our weekly update. In order to answer that question properly Timing, Cyclical and Mathematical analysis has to be thrown into the mix. Only then can one answer an all important question of what the stock market will do next.

If you would like to find out how this divergence will resolve itself, in both price and time, please Click Here. One thing is certain, it won’t be as simple as a one directional “melt-up”