Quick Update: May of 2015: Over the last few months quite a few people told me that my timing is off. Questioning my work and suggesting that this war will start much sooner than 2029. Well, it’s NOT going to happen. My cycle work is exact. What I talk about below represents approximately 5% of my work. I left quite a bit of stuff out. Every single war, including smaller wars, can be predicted with these cycles. Either through the primary 84 year war cycle or its smaller counterparts.

Let me give you another quick example that I didn’t mention in the book/report below. The US entered World War 1 in April of 1917. Exactly 84 years from that date brings us into April of 2001. Just 5 months shy of September 11th, 2001 and the start of Iraq/Afghanistan/Terror wars. In other words, scary accurate. I rest my case.

|

A Few Excerpts From The Book

If you want to see the rest of the information, please get the book. In addition to the excerpts below the book offers mathematical proof and the steps you need to take in order to save your family and yourself.

WARNING LABEL

Yes, this book should come with its own warning label. The subject matter discussed here is beyond hard to swallow. For most people. Try telling parents that their kids only have 15-20 years to enjoy life before their world is turned into a literal hell and you will get a death stare of a thousand knifes. Try telling Christians that there will be no Rapture before the gates of hell open up and they will curse your soul to ten thousand years of fiery hell. Try telling religious leaders and scholars that the final war will NOT originate in or around Israel and they will laugh at you. Finally, try telling the rest of the populous that the war is coming and they will immediately dismiss you as one of those “The End Is Near” crazy sign holders with a free WI-FI connection.

Nevertheless, it is a book that I had to write in order to save the very few who will pay attention. For others, I have a quick message. If you are closed minded enough to dismiss the message in this book purely on religious grounds or from a vantage point of sheer terror, I demand that you put this book down and move on. There is no point in reading it. It will bring nothing but frustration and anger into your life. Then email me at alex@investwithalex.com with a proof of purchase and I will gladly refund the entire amount (direct purchases only, not Amazon).

In essence, I have no desire to argue with people about the validity of my forecasts. My work speaks for itself and I hope you will see that throughout the book. Finally, before you assume that I am sort of a doomsayer seeking to build some sort of a cult following, understand something very important. I am a very well to do and generally very happy. I do not have any interest in doom and gloom, I am simply reporting what my work indicates. As such, please don’t contact me or seek further guidance in regards to this report. Simply be aware that this is coming down the pipeline and decide what plan of action is best for your entire family.

“The Future”

I AM, and you are not, most likely my brothers and sisters

Soon, the Earth shall shake and roar in my honor

Shaking the dead weight and dirt of its surface

Draining the blood of the wicked and greedy

Purifying the oceans and the human spirit

Remain in your sleep you no longer my brothers and sisters

Open thy eyes and bask in my light

Open thy ears and hear my thunder

Open thy mouth and taste bitter ashes

Rejoice as the night is now over and the new morning is here

Join with my spirit and prosper forever

No One Can Stop Me

– Universal Consciousness

II thought long and hard whether or not I should publish this report and information. After careful consideration I have figured that if this information saves just one life and/or one family, it’s worth it.

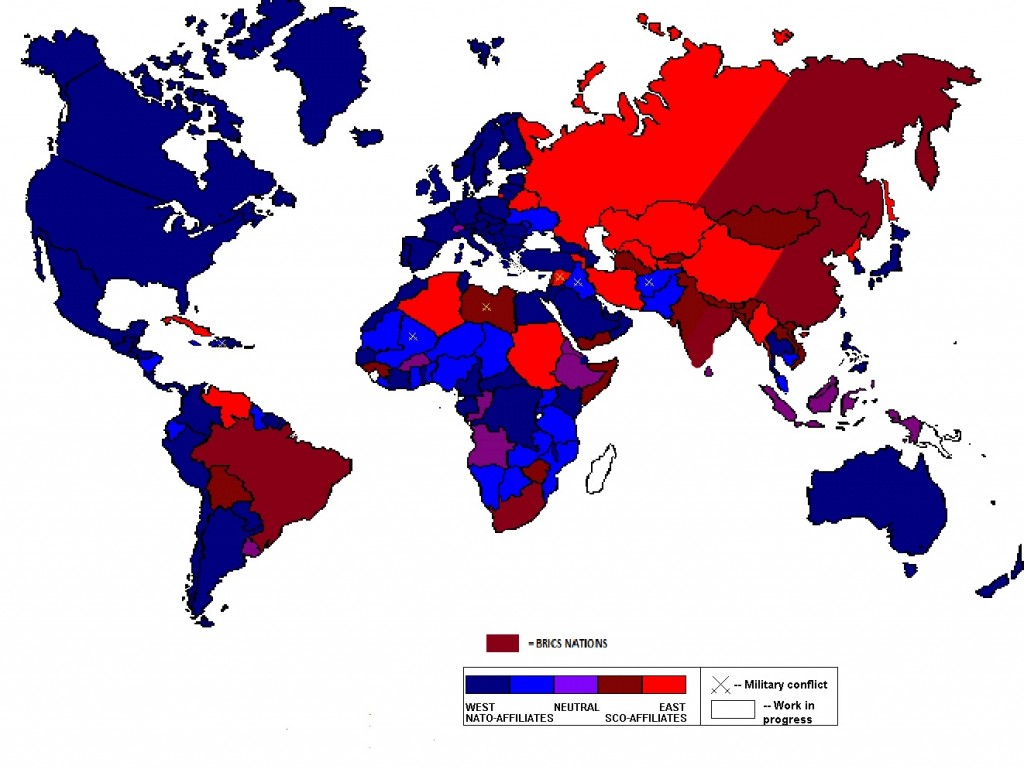

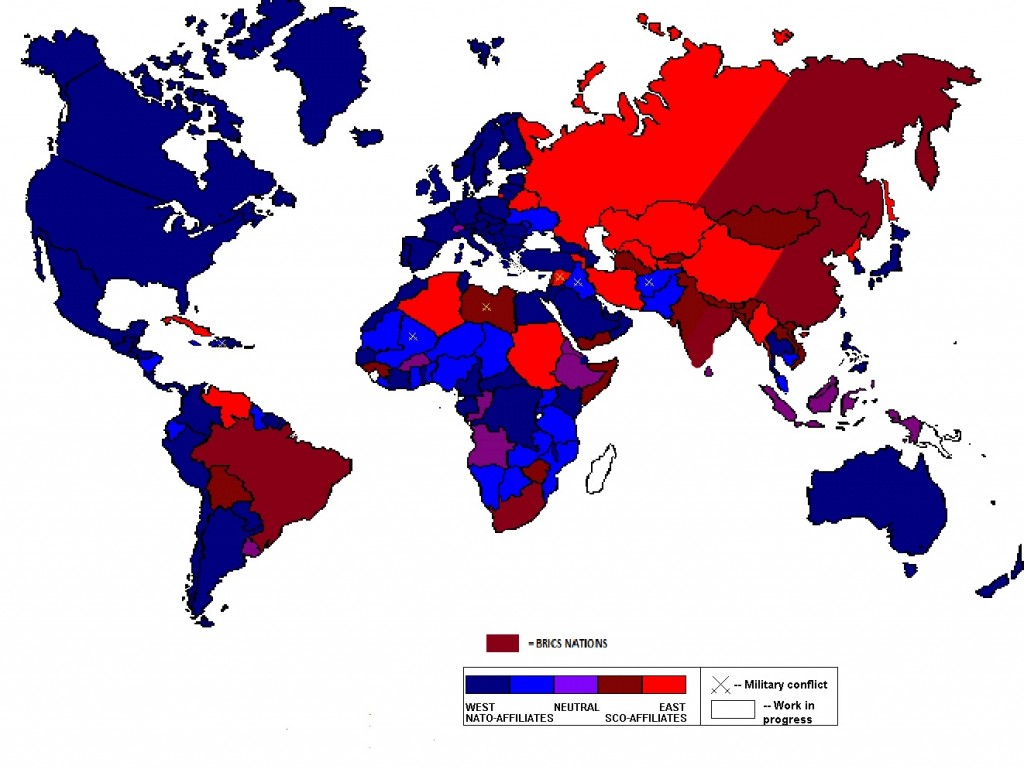

Report Summary: I plan to spend the 2029-2040 time frame at my beach house on one of the Islands somewhere in the South Pacific as the

- Coalition of NATO Members and

- Russia/China Alliance

…..NUKE each other back to the stone age.

|

Now, before you assume that I am sort of a doomsdayer seeking to build some sort of a cult following, understand something very important. I am a very well to do and generally very happy. I do not have any interest in doom and gloom, I am simply reporting what my work indicates.

I have learned a long time ago that I cannot change violent human nature NOR future. As such, please don’t contact me or seek guidance in regards to this report. Simply be aware that this is coming down the pipeline and decide what plan of action is best for your family and yourself.

The Bible calls this period Armageddon, graphically describing its aftermath in the Book of Revelation. Fortunately or unfortunately, I was able to figure out the exact time frame of this occurrence. By accident I might add. This report is to show you exactly why, how and when things will unfold.

I first became aware of the subject matter at hand during my research and analysis of future stock market cycles. After years of work with cycles and getting a fairly good understanding of the stock market composition (giving me the ability to predict the stock market with incredible accuracy) I came across something that puzzled me. When I got into the early 2030’s something crazy happened.

After a strong run up (due to inflation, not fundamentals) the stock market proceeded to collapse to the tune of 90-95% within a 2 weeks time frame. At first, I thought that I got some of my calculations wrong, but after some verification my original work was confirmed. Which brought out an incredibly important question.

What can collapse the Dow Jones 90-95% within a two week period of time?

I knew that it had to be something big. Such drops are unprecedented in the history of the stock market. As a matter of fact, it had never happened before. Even the 1929-32 collapse of 90% took 3 years to play out. So, what the hell could cause such a meltdown?

Sure, a natural catastrophe, an earthquake, giant tidal wave, meteor strikes, etc….are all a possibility. However, we are not talking about a specific region. We are talking about the entire stock market which represents every corner of Americana as a whole. Some sort of a war is always a possibility, but for the market to collapse to such an extent so rapidly, it would have to be a nuclear war.

Is that even possible in today’s world?

I had to find an answer and so began my research into the subject matter. Using the same cyclical analysis I use for the stock market work, it wasn’t long before I found my answers. What I found shocked me to the core. The nuclear war is indeed coming. It will be fought between 2029-2032 and it will literally destroy the world and impact every human being on the face of the Earth, one way or another. What I find fascinating, is that today’s macroeconomic and geopolitical developments are already lining up for what is to come.

This report is to show you exactly what will transpire over the next 20 years and what you can do to in order protect yourself.

WHEN?

Every significant* American war has been fought exactly 84 years apart. Based on my work this is not a coincidence. Let’s take a look.

(*Significant can mean many things. In this case, it’s the % of casualties based on total population).

Revolutionary War: Started in 1776. Total American Casualties (killed and wounded) 50,000. 1.25% of population. Total US Population at the time…. 4 Million (including 700K slaves).

EXACTLY 84 YEARS LATER—————-

Civil War: Started in 1860. Total American Casualties (killed and wounded) 1.1 Million 3.2% of population. Total US Population at the time…31 Million (12.7% are slaves).

EXACTLY 84 YEARS LATER————————

World War II: For the US the war technically started on December 7th, 1941 with the attack on Pearl Harbor, but the US suffered the highest % of casualties in 1944. Exactly 84 years from the previous cycle. Total American Casualties (killed and wounded) 1.05 Million. 0.7% of population. Total US Population at the time 132 Million.

EXACTLY 84 YEARS LATER (NATO Vs. Russia/China)——————-

World War III. 2029-2032. Nuclear War. The war will be fought between NATO Members and Russia/China Coalition. Massive casualties. Most major cities or population centers with +1 Million people throughout the world will be Nuked.

(***Please note, I am very well aware that there were many wars in between the wars described above. World War I, Vietnam War, Korean War, Iraq/Afghanistan, etc… They do not count because they were not major wars. Even though tens of thousands of people have died, as per % of population such losses were small. For example, the total number of casualties in Vietnam (killed and wounded) were 200,000 or 0.01% of US Population at the time. Now, compare that to massive losses as per % of population in the wars described above. )

Why Do I Believe This Will Be A Nuclear War?

My study shows that the weapon that were “brand new” at the preceding 84 cycle war are used on a massive scale during the next war. For instance, machine guns (Gatling Gun) were first introduced during the Civil War in 1861. Subsequently, they were used during the World War II on a massive scale, inflicting a devastating casualty count.

As you know, the first Atomic Bomb (Little Boy) was used by the US on Hiroshima on August 6, 1945. Followed by Nagasaki on August 9th. If we take 84 years from those dates, it will bring us into the summer of 2029. Whether or not that’s the exact date…….I refuse to say. A date of 2029-2032 is sufficient enough for our purpose.

Please note, there will be a multitude of signs right before the nuclear war starts. These sort of things do not happen in the vacuum and/or out of the blue. There will be plenty of news during that period of time that will allow you to narrow down the time frame and hopefully to save your family and yourself.

PART II

WHY

All wars repeat in cycles. In Part I of this report, I have shown you the major war cycle associated with all of the MAJOR American Wars. Unfortunately, the war is coming and cannot be stopped. Based on my stock market work, future is predetermined and cannot be altered.

Fundamental Reasons:

Let’s take a look at North Atlantic Treaty Organization (NATO).

NATO is a military alliance organization that consists of 28 countries. You can see the full list HERE. It’s membership consists mostly of the EU countries and North America. Obviously, the US is the largest superpower, force multiplier and policy driver. More or less, the treaty works as follows. If any of the NATO members are attacked, all other members must provide military support, assistance and equipment. Basically, if any of the member states are attacked, the entire NATO goes to war. NATO was originally created to counterbalance Soviet Russia after WW II.

Political Reasons:

You don’t have to go very far to see the tension between Russia and the US -OR- China and the US. Just turn the TV on. As I write this today, the relationship between Russia and the US has cooled to the point we haven’t seen since the 1980’s, before the Soviet Union broke up. All because of Ukraine. Whether or not the situation in Ukraine has been caused by the US or Russia is outside the scope of this discussion.

The major point I want you to understand here is this. Russia is fed up with the US due to NATO’s expansion right up to its borders. Plus, the US keeps lecturing Russia on what to do and how to do it. Since no one likes being lectured, Putin is not only fed up with the US foreign policy, he is furious with it. His speech on March 18th, 2014 proves that without a shadow of a doubt.

With that said, we can anticipate Putin to be in power in Russia for as long as he wants. For as long as the US continues with it’s policy against Russia (and I don’t see it changing anytime soon) our relationship with Russia will continue to deteriorate.

China finds itself in a very similar situation. If you have ever been to China, you very well know that Chinese are very proud people. Just as Americans are. Yet, America cannot help itself but to shove it’s god given “Righteousness”, democracy and politics down Chinese throats. I can tell you this. This infuriates the Chinese to no end. Plus, China is trying to build a military superpower in the region only to be constantly undermined by the US with the help of Japan, Taiwan and the Philippines. Again, who is right or wrong here is outside the scope of this discussion.

The bottom line is this, both Russia and China are fed up with the US at this point in time. Further, given today’s geopolitical and macroeconomic situation I see no reason for the situation to improve. Quite the opposite. I see the US relationship with both countries deteriorating further as all 3 superpowers fight for their own interests.

If you didn’t know, China and Russia are both “communist” countries that go way back. In fact, until China started selling crap to the US, it was always expected that China and Russia would stand together. Vietnam War, North Korea, Communism Ideology, etc…. In fact, it wouldn’t be wrong to describe China and Russia as having a “brotherly” relationship. You see the evidence of that at the United Nations, where Russia and China tend to support each other on important international issues.

In Summary: Both China and Russia are fed up with the US. On multiple levels. As the US and China/Russia relationship continues to deteriorate over the next 10-15 years, Russia and China will, once again, be forced to form an alliance. With the US/NATO flexing its military muscles, the alliance between Russia and China will eventually become a military alliance similar to NATO.

Economic Reasons:

Most wars are triggered by economics, not ideology. For example, Civil War was fought over cotton trade, not slavery…..Revolutionary War was fought over excessive taxes…not British rule and WWII was triggered by economic depression and war repatriations in Germany in the 1920s and the 1930s.

So, if you haven’t noticed the US owes China $1.3 Trillion. With the US National Debt at over $17 Trillion, the US is one recession away from not being able to cover its interest payments. In a nutshell, we don’t have the money to repay the Chinese. The only way out of this mess is for the US is to inflate its currency away. The FEDs have been trying to do just that over the last 10 years. Thus far, without too much success, due to a number of deflationary forces within the economy.

Based on my timing and mathematical work, that is about to change. The FED will be successful in getting inflation going after 2017. Slow at first, much faster after 2022. Basically, they will be able to inflate away the Chinese $1.3 Trillion or more.

This might not be a problem if China didn’t face a massive economic slowdown over the next decade. It’s own bear market so to speak. Chinese leaders will need someone to blame in front of their population and since the US will inflate its $1.3 Trillion away, China will point its finger where it belongs. Rightfully so. Of course, this will cause massive friction with China. In fact, I see this economic issue as the major trigger point that will eventually set this war off.

That is why I view macroeconomic and geopolitical issues between China/Russia and the USA/NATO as a major trigger point. You will see most of the issues I talk about come into light over the next few years. They will not get better. They will continue to deteriorate further from this point on.

HOW

This section will be a pure speculation, but we have a good reference point.

Looking at the Cuban Missile Crisis in the 1960 provides us with a perfect example. If you study the incident, Soviet Union and the US literally came a few minutes away from blowing each other up. The bombers were already in the air and both nations had their finger on the proverbial red button. The scary part was, if one sailor or one pilot or one soldier would have made a simple mistake at that juncture….as simple as accidentally firing their gun…..we would have had a nuclear war in the 1960. And that’s the most important thing to remember.

It is difficult to predict exactly what will happen and how things will unfold, but we will eventually end up with some sort of a standoff between Russia/China Vs. USA/NATO. During that standoff a number of small skirmishes might eventually turn into an all out war and shortly thereafter, into a nuclear war. A trigger might be as simple as a short firefight between a Chinese and an American soldier.

At the end of the day, it doesn’t really matter what actually triggers it, the point is, the war will be triggered one way or another.

WHO WILL WIN?

No one will win. If the above scenario comes to fruition, as my stock market work indicates, billions (not millions) of people will die. No one wins in a situation like that. Most population centers throughout the world (particularly in China, Russia and the US) will be radioactive wastelands. Who cares who wins. Humanity as a whole will lose. Big time.

WHAT YOU SHOULD DO

You have a number of options.

1. You can dismiss me as a crazy person and that is totally fine by me. I will have a beer for you while sitting on a beautiful beach somewhere in the South Pacific as the War starts.

2. You can save this report and start watching macroeconomic and geopolitical developments over the next 10 years. What you will find is that this report was right on the money. You will see the US relationship with Russia/China deteriorate significantly over the next 10-15 years. You will also see China and Russia coming together and forming a military alliance. At that stage you will have two options.

- Do nothing. You will eventually get vaporized or otherwise killed during the war.

- Get away from major population centers and become self sufficient. Same applies to your family. Make sure you can protect yourself as well as sustain your family over a 10 year period of time.

Good luck everyone. We will need it.