AP Writes: State of the US economy: strongest since recession

WASHINGTON (AP) — The U.S. economy is showing more strength than at any time since the Great Recession began six years ago.

Employers are hiring. Home prices, sales and construction have surged. Corporate profits and stocks have hit records. And consumers have picked up their spending.

The economy has yet to fully recover from the most devastating crisis since the Great Depression. But it’s getting closer — a point President Barack Obama was expected to highlight in his State of the Union address Tuesday night.

The propaganda machine continues to hum along. Let me remind you that the so called “Great Recession” was caused by the insane economic policies of the US Government. Mind you, they continue the same policies today, yet on a much larger scale.

— JOBS

Job growth has been remarkably steady in an uneven recovery. Employers have added at least 2.1 million jobs in each of the past three years, creating momentum that could help the economy gain speed in 2014. Each new job puts more money in the hands of people to spend. That’s why consistent job growth can give more traction to the recovery. The unemployment rate has plunged from 7.9 percent to 6.7 percent over the past year. That’s down from a 10 percent peak in October 2009.

Still, the benefits of more hiring have been muted so far, in part because much of it has been concentrated in the low-wage industries of hotels, restaurants, retailers and temp workers. Also, millions of jobless Americans have stopped looking for work. Once people without jobs stop their searches, they’re no longer counted as unemployed. As a result, the unemployment rate can fall in a way that overstates the health of the economy.

WOW, really. I am not even sure where they are getting their numbers. While the government claims the unemployment is at 6.7%, in reality, that number is much higher. With people giving up on finding work and prolific “underemployment” the real rate is most likely to be around 15%. Hence, no pay growth.

— HOUSING

Real estate is rebounding. Home prices have climbed 13.7 percent over the past 12 months, according to a Standard & Poor’s index released Tuesday. Sales of existing homes totaled 5.09 million last year, the best such performance since 2006, the National Association of Realtors said last week. Home industry experts say the gains should continue this year, though at a slower pace because higher mortgage rates and home prices will make buying less affordable for some.

Sure, real estate has rebounded, but make no mistake. This has very little to do with an underlying economic health and everything to do with massive credit infusion and to a certain extent speculation in the sector. Once the bubble pops again, and it will, housing will decline below 2010-11 lows.

— CONSUMER SPENDING

The spending of consumers, which fuels about 70 percent of the economy, is starting to return to its pre-recession levels. The Conference Board said Tuesday that its consumer confidence index rose to 80.7 this month, well above last year’s average of 73.3. Retail sales bumped up 4.2 percent in 2013, the fourth straight annual increase. Roughly 15.6 million autos were bought last year, an 8 percent improvement and the highest total since 2007. Historically low inflation and interest rates have kept food and clothing affordable. And according to the Gallup Organization, average daily consumer spending rose $16 to $88 last year.

Fair enough, but consumer spending is a simple function of the economy. When the economy goes up, so does the consumer spending. Yet, keep the following in mind. Today’s economic recovery is driven primarily by credit infusion and speculation. As the result, consumer spending is being artificially levitated. When easy credit and speculation goes away, consumer spending will not only decline, but collapse.

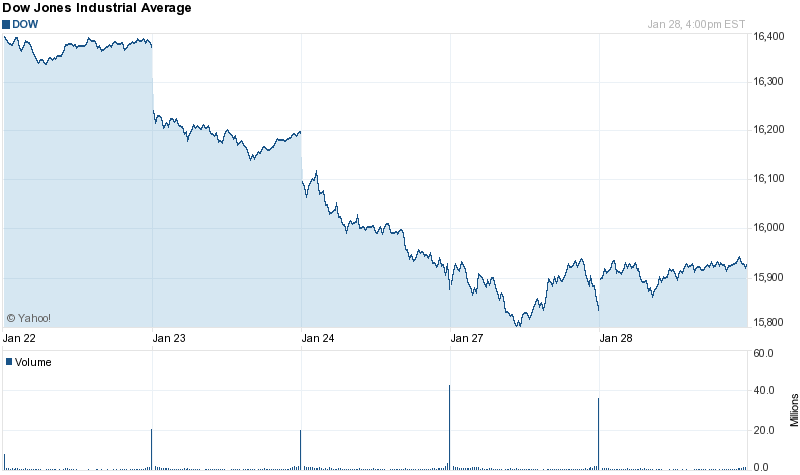

— STOCKS

The Dow Jones industrial average enjoyed a monster 2013, climbing 28 percent. Corporate profits are at their highest share of the economy in the 66 years of tracking by the government. Shares were bolstered by a Federal Reserve bond-buying program that is now being wound down. The eventual end of the program, paired with weak growth in China and troubles in Argentina and Turkey, help explain the 4.1 percent decline in the stock market since the start of this year.

Again, everything associated with the stock market has been goosed by the FED and their “unlimited” money supply. That includes corporate profits and emerging markets. It is similar to living a high life while maxing out your credit cards. Eventually the bills will come due and the cards will be maxed out. When that happens, there will be hell to pay in all financial markets. As I have stated so many times before, my mathematical work indicates that the bear market has already started and it will take us into the 2017 bottom.

It is prudent that you get yourself ready.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!