BusinessWeek Writes: The U.S. Job Market Won’t Be Normal Until 2017, Says Goldman

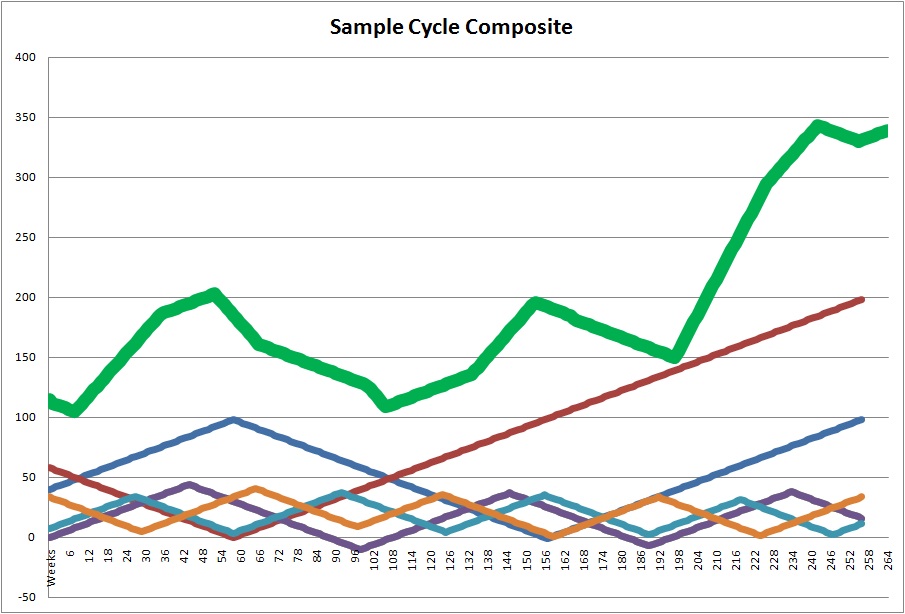

Two economists at the Federal Reserve Bank of Kansas City concluded recently that at the current rate of progress, the U.S. labor market won’t get back to normal until the summer of 2015. That’s bad enough. But Goldman Sachs (GS) economists, examining the same data, conclude in a report today that normal might not arrive until the beginning of 2017.

Either way it’s pretty depressing, considering that the recession began in December 2007. The financial markets are betting that the Federal Reserve’s rate-setting Federal Open Market Committee will start tapering purchases of long-term bonds sometime in early 2014. But the FOMC has said that the purchases will continue“until the outlook for the labor market has improved substantially in a context of price stability.” If the FOMC sticks to that commitment, bond purchases could continue longer than many people expect.

I really have no idea how they come up with these numbers. Maybe they have a supercomputer in their office churning out billions of calculations per second or maybe they just throw darts at the calendar. I think the latter is more plausible.

The problem with their analysis is they are discounting continual economic growth over the next 5 years. Well, let me ask you something. What if instead of economic growth our financial markets and our overall economy go through another severe contraction as I constantly argue? Are we going to normalize by 2017 or will the chart above take another dive? I think you know the answer to that.

The labor market in the US is facing strong headwinds. I think the situation we have today is the new norm and even that will continue to deteriorate. With our economy, financial markets, Obama care, outsourcing, robotics and higher productivity rates all putting negative pressures on full time employment, the labor market picture going forward is not pretty.

Did you enjoy this article? If so, please share our blog with your friends as we try to get traction. Gratitude!!!